IRS

Latest News

Avalara Unveils Intelligent Tax Content Solution for Lodging and Hospitality

Survey: Over Half of Accounting Firms Plan to Increase Fees in 2025

Andersen Advances Global Valuation Practice in 10 Asia Pacific Countries

81% of Business Owners Have Some Optimism for 2025 Economic Outlook

National taxpayer Advocate focuses on tax reform, ID theft, IRS funding

The IRS's National Taxpayer Advocate Nina E. Olson released her 2012 annual report to Congress on Wednesday, identifying the need for tax reform as the overriding priority in tax administration.

Accountant explains why IRS delay will impact so many

We narrowly avoided going over the fiscal cliff earlier this month, but Congress' down-to-the-wire decision making has had an unsavory side effect.

Late start to tax season: IRS plans Jan. 30 opening day for 1040 returns, late Feb for more complex filers

Tax filing season to start Jan. 30, but late February for more complex returns

IRS expands eligibility for worker reclassification program

The IRS has announced a revision to its voluntary classification settlement program (VCSP) that provides partial relief from federal employment taxes for eligible taxpayers who agree to prospectively treat workers as employees.

What the 2013 Fiscal Cliff Means for Employers and Job Seekers – A Call to Action for Accountants

The "fiscal cliff" looms over the minds of business investors as Bush era tax cuts are scheduled to expire soon. Among other things, this could mean an increase of $2000 in income taxes for middle class families.

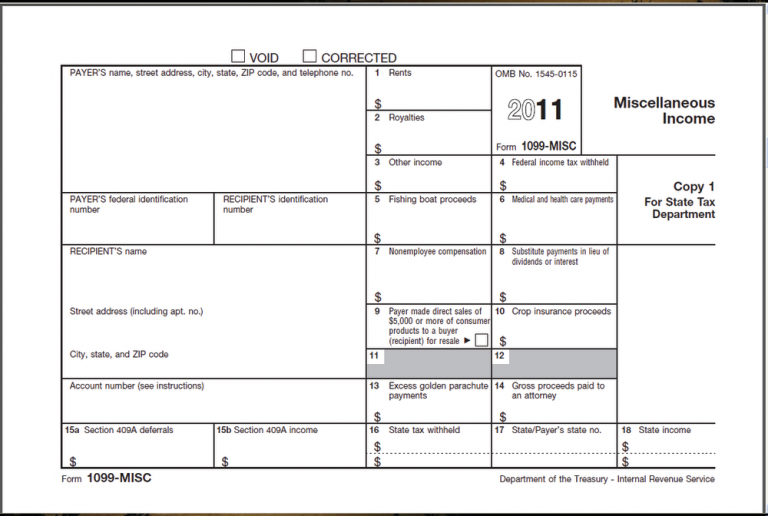

W-2 and 1099 Programs Make Year-End Reporting Easier

Every year, tax and accounting professionals and their clients are faced with the often daunting task of year-end wage and information reporting.

IRS Commissioner speaks to AICPA about his tenure

Doug Shulman, Commissioner of the IRS, will leave office Nov. 11, 2012, after five years in the office.

IRS to offer webinar about Registered Tax Return Preparer test

The Internal Revenue Service’s next IRS Live webinar, “Get Prepared: A to Z Details on the Registered Tax Return Preparer Test” is Wednesday, Oct. 31, at 2 p.m. Eastern Time.