IRS

Latest News

Avalara Unveils Intelligent Tax Content Solution for Lodging and Hospitality

Survey: Over Half of Accounting Firms Plan to Increase Fees in 2025

Andersen Advances Global Valuation Practice in 10 Asia Pacific Countries

81% of Business Owners Have Some Optimism for 2025 Economic Outlook

New River Innovation Releases Web-based IRS Research Application—Beyond415Guidance

From Darren’s CPA Practice Advisor blog: My Perspective. Just this week, a new cloud-based IRS “research center” application was released to the tax and accounting profession—Beyond415 Guidance. The stand-alone app from New River Innovation offers practical and up-to-date guidance for resolving issues after tax filing. Product features include searchable guidance that covers individual, business, and […]

IRS Selects CCH to Provide Sales Tax Data

The IRS has selected CCH to provide sales tax rates and taxability tables for the eighth consecutive year.

Eight Small Business IRS Audit Areas to Watch Through 2013

The IRS has announced emerging or significant areas that it will prioritize for the coming year. When it comes to compliance, the IRS has increasingly focused on small business underreporting, which is responsible for 84% of the $450 billion tax gap.

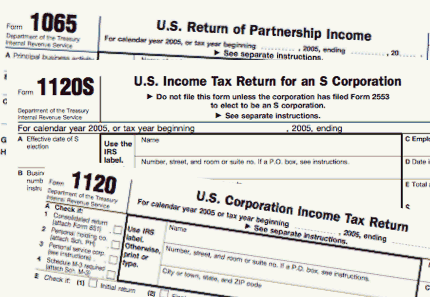

IRS announces a multi-year effort to increase audits in flow-through entities

As tax season approaches, practitioners can expect the IRS to quickly expand its audit focus to flow-through entities, according to an IRS official.

Supreme Court Health Care Ruling and the IRS?

IRS Inside Blog: Ruling leaves questions on the IRS' role in implementing the individual mandate "tax"

IRS Audit Compliance Initiative Projects for 2012 (Part 1)

The IRS regularly conducts national, regional, and local compliance initiative projects (CIPs) to study perceived areas of noncompliance.

Demystifying the IRS

Simplifying IRS representation services by partnering with the right technology. From the April 2012 Digital Issue. Lisa Richards has been in the tax and accounting game for many years, so she is more than aware of the time investment and frustration that can come with working with the IRS.“Handling IRS issues for clients has […]

IRS Gives Truckers Three-Month Extension; Highway Use Tax Return Due Nov. 30

The Internal Revenue Service today advised truckers and other owners of heavy highway vehicles that their next federal highway use tax return, usually due Aug. 31, will instead be due on Nov. 30, 2011