Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes March 7, 2025

Even though the Tax Court is commonly thought of as the forum of last resort for appealing tax bills and other IRS issues, there is a way to appeal a Tax Court ruling. However, the chances of success of these appeals are often relatively low.

Financial Reporting March 6, 2025

The AICPA awaits the release of additional details later this month but believes that Treasury is headed in the right direction with this decision.

Taxes March 6, 2025

For individuals, the rate for overpayments and underpayments will be 7% per year, compounded daily, the IRS said on March 6.

IRS March 5, 2025

At the behest of the White House, the IRS is reportedly planning to cut its staff by as much as 50% as the Trump administration continues its mission to shrink the size of the federal workforce.

Payroll March 5, 2025

The National Association of Tax Professionals said it's trying to bridge the gap between recently displaced IRS workers and tax and accounting firms in need of skilled professionals.

Taxes March 4, 2025

The IRS said Feb. 27 that it's adding the two information return documents to its IRS Individual Online Account tool, which the agency said will consolidate important tax records into one digital location.

Taxes March 4, 2025

The IRS reports the average tax refund in 2025 is up $240 through the week ending Feb. 21, with more than 42 million returns processed so far.

Technology March 3, 2025

Wolters Kluwer has rolled out new enhancements that allow businesses to electronically file Form 5330 with the IRS from ftwilliam.com, Wolters Kluwer's employee benefit and pension software.

IRS March 3, 2025

Dismissal notices went out Saturday to about 85 employees of 18F, a federal agency that works on improving government technology—effectively shutting down an office hailed a decade ago as Uncle Sam’s new tech startup.

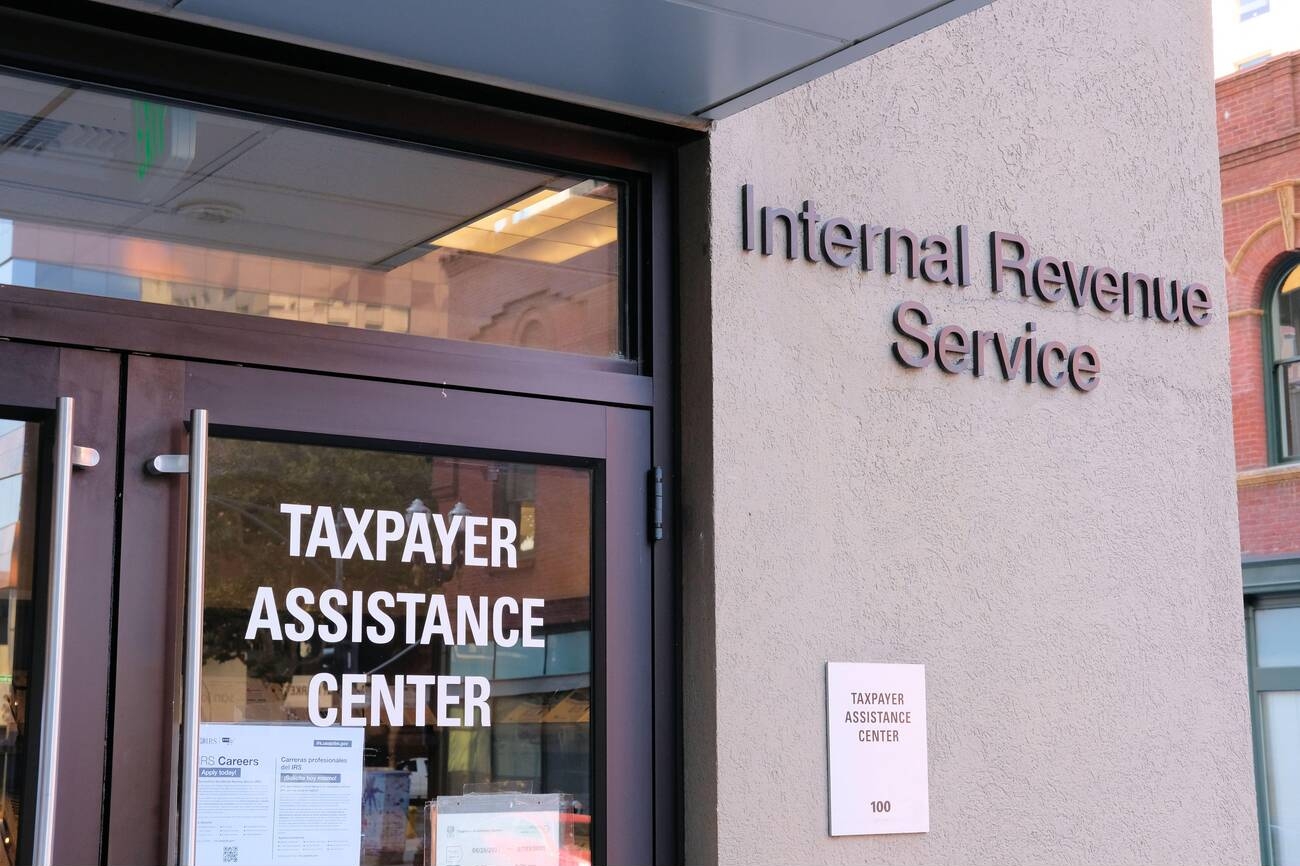

Taxes February 28, 2025

More than 100 IRS offices that host taxpayer assistance centers appear to be on the chopping block as the Trump administration continues efforts to cut waste from the federal government. But any closures likely won't take place until after tax season.

Taxes February 28, 2025

Each year, the Internal Revenue Service puts together a Dirty Dozen list warning taxpayers, businesses, and tax professionals of tax scams to watch out for, and common schemes that threaten their tax and financial information.

Taxes February 28, 2025

Most farmers and fishers who chose to forgo making estimated tax payments by January that they must generally file their 2024 federal income tax return and pay all taxes due by March 3, 2025.