Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes October 21, 2024

Charles Littlejohn pulled off what’s been described as the greatest heist in IRS history and was sentenced to five years in prison.

Taxes October 17, 2024

Deep ideological differences could make striking an agreement on expiring tax breaks difficult if there is divided government.

Taxes October 15, 2024

Scammers commonly set up fake charities to take advantage of peoples’ generosity during natural disasters and other tragic events.

Taxes October 14, 2024

Certain tax-exempt organizations that are making an elective payment election are getting a six-month extension to file Form 990-T.

Taxes October 11, 2024

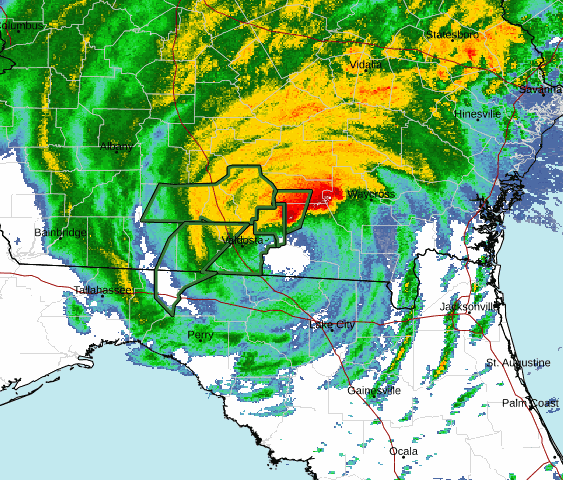

Because of hurricanes Debby, Helene, and Milton, affected taxpayers have until May 2025 to file returns and make tax payments.

Taxes October 11, 2024

The projected gross tax gap for 2022 is down $12 billion from a revised 2021 tax gap of $708 billion, the agency said Oct. 10.

Taxes October 9, 2024

The AICPA highlighted several areas of concern in the proposed regulations from the Treasury Department and the IRS.

IRS October 8, 2024

In addition, the Treasury Department and the IRS announced a delayed applicability date for related final 401(k) regulations.

Taxes October 8, 2024

Crucial tax relief opportunities may be available to those affected by recent natural disasters, such as Hurricane Helene.

Taxes October 8, 2024

During discussions with Treasury, tribes had requested rules on the federal tax classification of entities owned by tribes.

Taxes October 8, 2024

Known to benefit real estate developers, here’s how to redeploy these tax incentives to grow new businesses and boost employment.

Taxes October 7, 2024

Federal officials have announced tax relief for people and businesses in the Yakama Nation affected by wildfires that began June 22.