Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes October 4, 2024

For the 2025 tax filing season, eligible taxpayers in 24 states will be able to use Direct File: 12 states that were part of the pilot last year, plus 12 new states where Direct File will be available in the upcoming filing season.

Taxes October 4, 2024

Firms must consider tax compliance when offshoring accounting staff. The IRS has issued several guidelines and regulations that affect the tax implications of offshoring accounting activities.

Taxes October 1, 2024

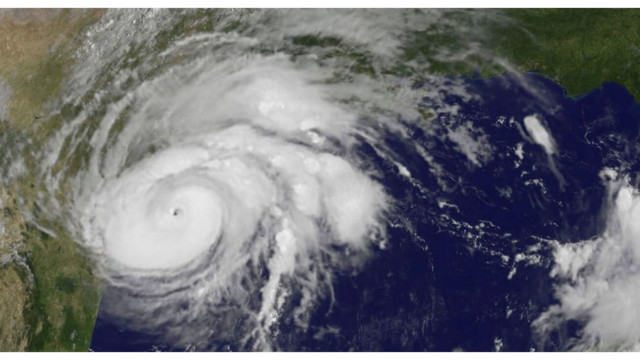

The entire states of Alabama, Georgia, and the Carolinas, as well as parts of Florida, Tennessee, and Virginia, qualify for tax relief.

Taxes October 1, 2024

The purpose of Form 7217, new for tax year 2024, is to report all distribution of property that a partner receives from a partnership.

Taxes October 1, 2024

The agency is piloting a program that would make contacting IRS Appeals easier for large businesses with multiple representatives.

IRS September 27, 2024

Third-party payers that filed prior ERC claims for multiple clients now have a way to "withdraw" those claims for clients that didn't qualify.

Taxes September 26, 2024

In his efforts to evade tax liability, this attorney from Missouri committed multiple fraudulent acts, for which he was found guilty.

IRS September 24, 2024

The agency updated a section in its fact sheet about the refundable credit, which helps some taxpayers afford health insurance premiums.

Taxes September 23, 2024

Come Oct. 1, the per diem rates will be $319 for business travel to high-cost locations and $225 for travel to low-cost areas.

Taxes September 19, 2024

The three people will share a $74 million payout for disclosing a tax evasion scheme that enabled the IRS to collect $263 million.

Taxes September 13, 2024

These taxpayers now have until Feb. 3, 2025, to file various federal individual and business tax returns and make tax payments.

Taxes September 12, 2024

The proposed regulations provide definitions and general rules for determining and identifying AFSI. They also include rules regarding various statutory and regulatory adjustments in determining AFSI.