Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes August 22, 2024

Business tax account was launched last October as part of the agency's service improvement initiative under the Inflation Reduction Act.

Taxes August 22, 2024

Starting on Oct. 1, the rate for tax overpayments and underpayments for individuals will be 8% per year, compounded daily.

Taxes August 21, 2024

The Coalition Against Scam and Scheme Threats is comprised of the IRS, state tax agencies, tax software firms, associations, and others.

Taxes August 21, 2024

The process for obtaining these credits is unlike that of any previous program, and online resources have added to make it easier to navigate.

Taxes August 19, 2024

The SECURE 2.0 ACT permits employers to provide matching contributions for employees based on their payments on student loans.

Taxes August 19, 2024

The agency recommends that taxpayers submit the pre-filing registration at least 120 days before the planned filing date.

Taxes August 19, 2024

Taxpayers who operate large trucks and buses have until Sept. 3 to file Form 2290 for vehicles used in July 2024, the IRS said.

Taxes August 16, 2024

The application period for the 2025 Compliance Assurance Process program will be from Sept. 4 until Oct. 31, the agency said Thursday.

Taxes August 15, 2024

Businesses that apply for and are accepted into the program have to repay 85% of the credit back to the agency.

Taxes August 14, 2024

Over 3.4 million U.S. families claimed $8.4 billion in tax credits to lower the costs of their home energy upgrades, new data shows.

IRS August 14, 2024

The new Written Information Security Plan template was updated to help protect practitioners and their clients from identity thieves.

Taxes August 13, 2024

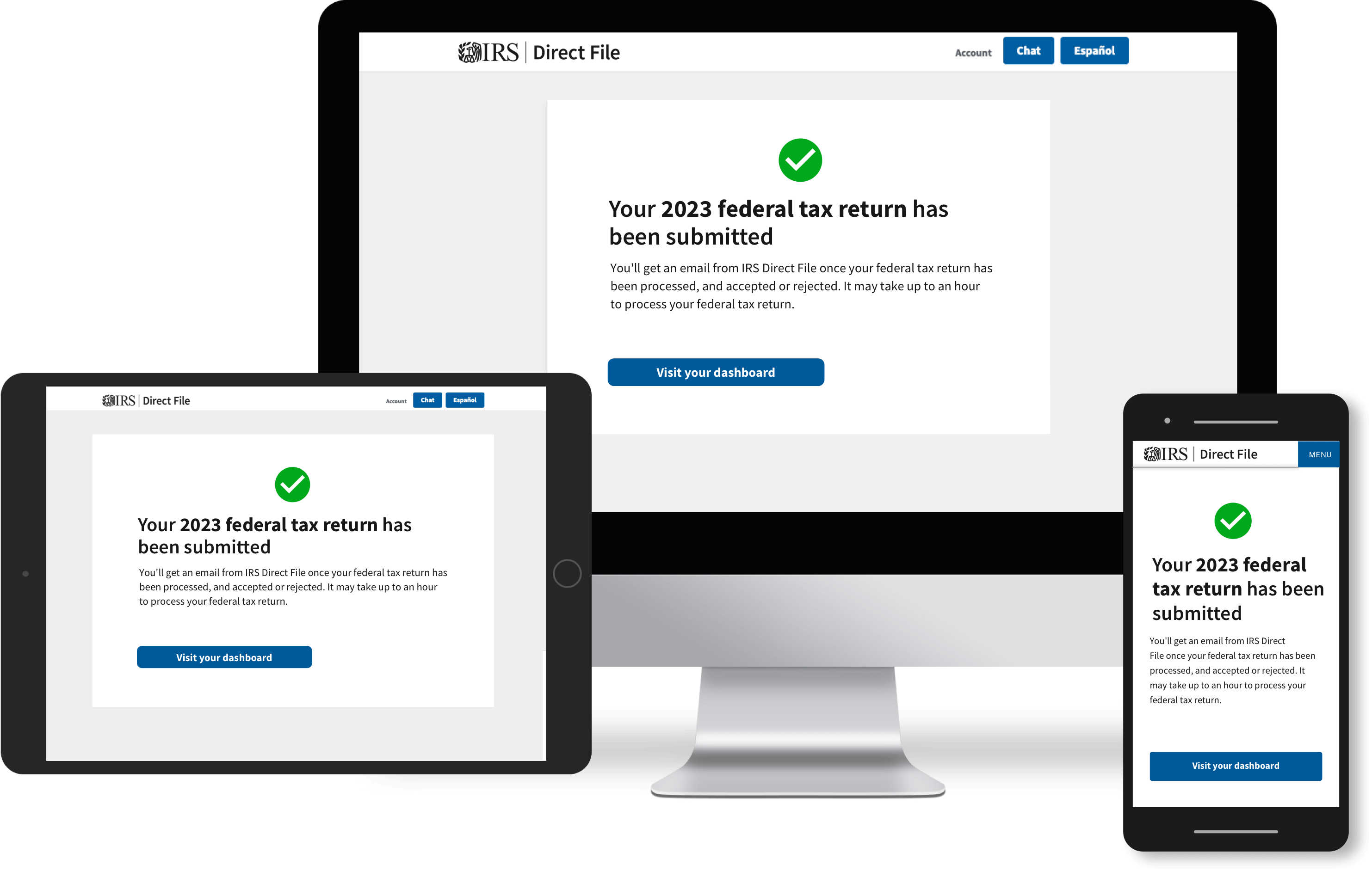

New Mexico became the fourth new state that can use the IRS's new system for filing federal taxes during the 2025 tax season.