Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes March 29, 2024

The agency further postponed until Aug. 7 various filing and payment deadlines for those affected by the Aug. 8, 2023, wildfires.

![divorce2_1_.58a1c88862581[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/04/divorce2_1_.58a1c88862581_1_.6078636acabd8.png)

Taxes March 28, 2024

Note that a QDRO may be used for qualified plans, like 401(k) or pension plans, but this option isn’t available for IRAs. IRAs are subject to other rules.

Taxes March 27, 2024

As of the week ending March 15, the IRS had issued just over 49 million tax refunds, close to 9% lower than at that point last year.

Taxes March 27, 2024

As taxpayers navigate the challenges of tax season, the AICPA wants individual filers to be aware of what’s new for this filing season.

IRS March 26, 2024

Ippei Mizuhara was implicated in a scandal involving illegal sports gambling and significant financial theft from the Dodgers superstar.

Taxes March 26, 2024

Nearly 940,000 Americans have unclaimed tax returns from 2020 and face a May 17 deadline if they want to get it back.

Taxes March 22, 2024

The IRS ordered an immediate moratorium on processing new ERC claims on Sept. 14, 2023, due to instances of widespread fraud.

Taxes March 22, 2024

The Internal Revenue Service has issued Notice 2024-30 that expands certain rules for determining what an energy community is for the production and investment tax credits.

Taxes March 21, 2024

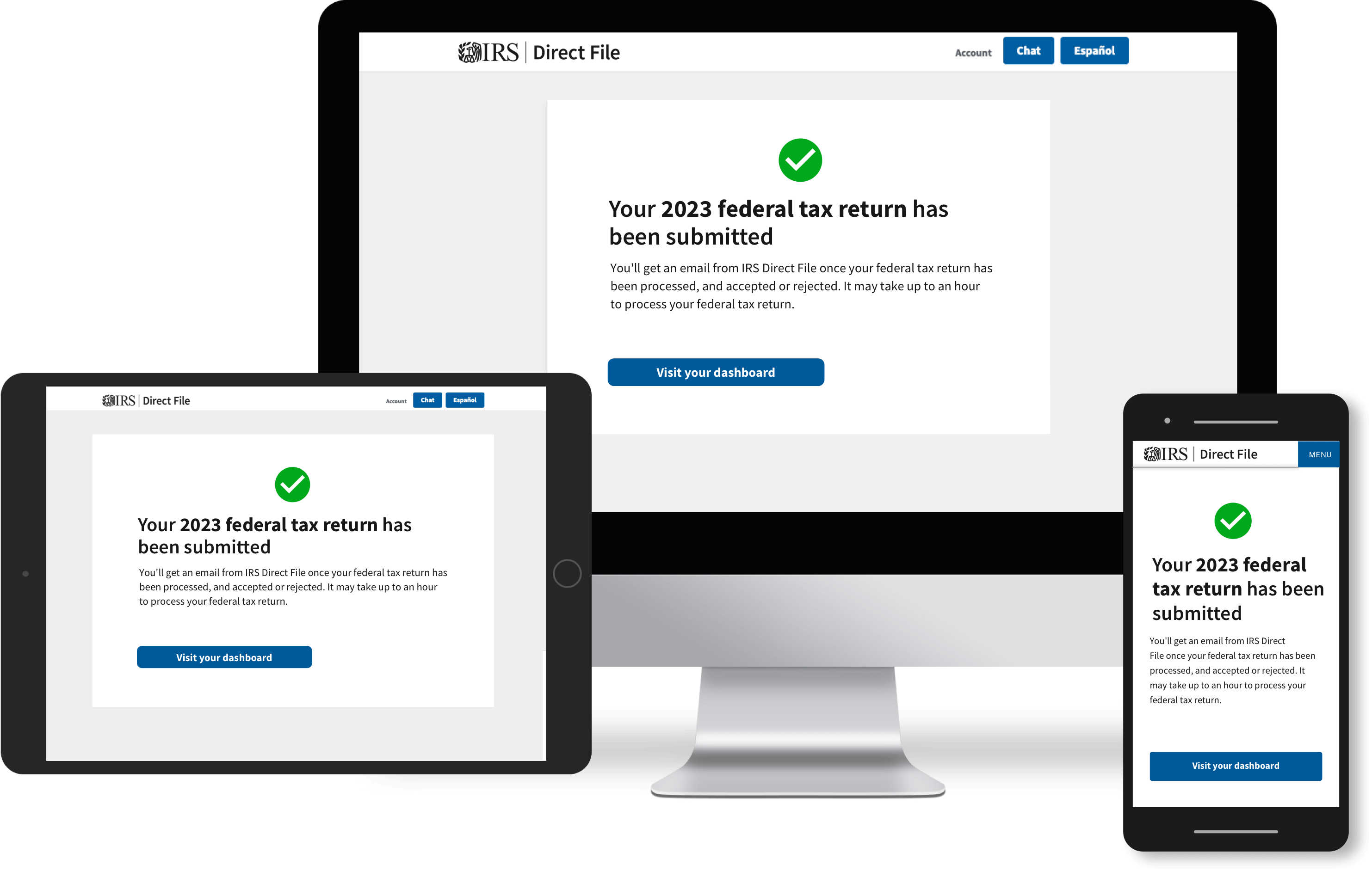

While the exact number was not available, the Treasury Department says Texas has the most filers on a per capita basis.

Taxes March 21, 2024

Ndeye Amy Thioub, 67, also taught college-level classes on accounting standards and ethics at Salem State University.

Taxes March 19, 2024

Stephen Jake McGonigle, 66, was ordered to pay the $1.2 million in restitution that he took from victims in the scheme.

Taxes March 18, 2024

The nation’s lawmakers may allow these provisions to expire as written into the TCJA, extend them indefinitely, for a period of time or even permanently, or otherwise modify them.