Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes March 15, 2024

The agency's multilingual efforts are a part of its Strategic Operating Plan, which has received additional funding since the enactment of the Inflation Reduction Act.

Taxes March 14, 2024

Money mules are people who, at someone else’s direction, receive and move money obtained from victims of fraud.

IRS March 14, 2024

Charles Rettig, who served as IRS chief from 2018 to 2022, has joined the law firm's tax controversy and litigation practice.

Taxes March 13, 2024

Dan Rotta, who is accused of dodging taxes for decades using accounts at UBS and Credit Suisse, was granted a $15 million bond.

Taxes March 13, 2024

Guy Ficco will oversee a worldwide staff of more than 3,200 Criminal Investigation (CI) employees, including 2,200 special agents who investigate crimes involving tax, money laundering, public corruption, human trafficking, drug trafficking, cybercrime and terrorism-financing.

Taxes March 12, 2024

The IRS moved the Direct File pilot out of the testing phase, allowing 19 million eligible taxpayers to use the free filing software.

Taxes March 12, 2024

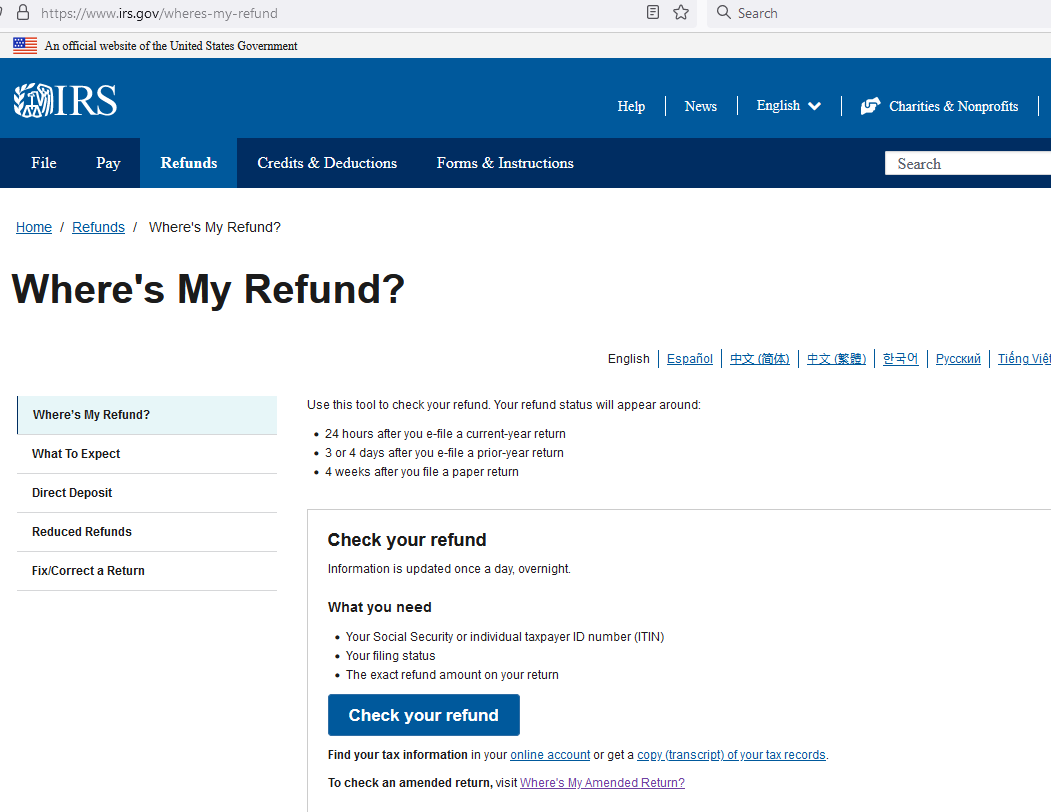

Compared with a similar point in the tax season the previous year, there have been nearly 6 million fewer refunds, according to the IRS.

IRS March 7, 2024

The projects included in the plan would be priorities for the Treasury and IRS to work on from July 1, 2024, through June 30, 2025.

Taxes March 7, 2024

Expenditures for general health and wellness aren't considered medical expenses, regardless of some claims to the contrary.

Taxes March 6, 2024

As of Feb. 24, 943,000 taxpayers had filed returns using Free File, up from last year's comparable period of 860,000 returns filed.

Taxes March 5, 2024

The refundable Recovery Rebate Credit is aimed at taxpayers who did not get one or more of their pandemic-era stimulus checks.

Taxes March 5, 2024

Americans hate taxes so much that they would entertain some bizarre options for a tax-free life, according to WalletHub.