Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes July 28, 2023

If you’re not careful, this often-misunderstood tax provision can result in a sizeable income tax liability for the family.

Sales Tax July 28, 2023

Businesses should be aware that as states become more fiscally creative, there will be more tax complexities and a bigger burden as the patchwork of regulations across the country get sorted out...

Taxes July 27, 2023

The AICPA believes that it is important that all taxpayers have convenient accessibility to an Appeals conference if they choose to do so.

Taxes July 24, 2023

Effective immediately, unannounced visits will end except in a few unique circumstances and will be replaced with mailed letters to schedule meetings.

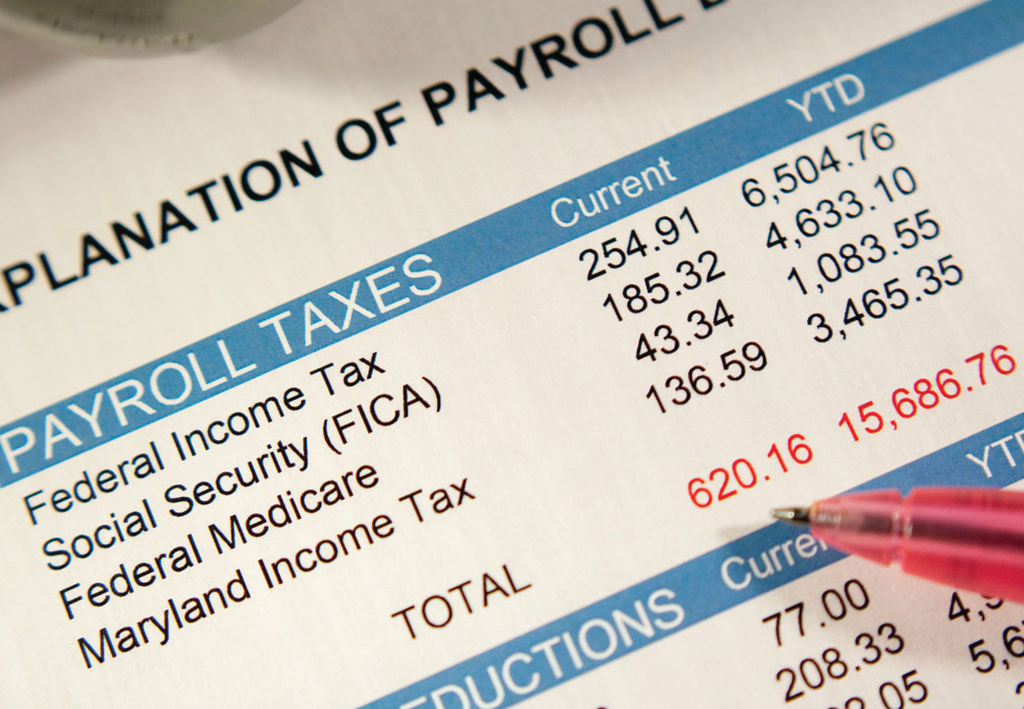

Payroll July 23, 2023

A Colorado man has been sentenced to 15 months in prison for evading the payment of more than $700,000 in employment taxes he owed to the IRS.

Taxes July 19, 2023

The Problem Solvers Caucus, a group of GOP and Democratic lawmakers, plans to work on issues associated with the credit.

Taxes July 19, 2023

What are the tax consequences regarding a home sale if you and your spouse split up or divorce?

Taxes July 17, 2023

A frivolous claim is one that is used to support an unreasonable entry on your returns or the failure to file a return. Numerous such claims have been shot down by the IRS, as well as the courts, in recent years.

Taxes July 13, 2023

This marks the eighth year that the Security Summit partners have worked to raise awareness about these issues through the "Protect Your Clients; Protect Yourself" campaign.

Taxes July 12, 2023

The Internal Revenue Code includes several tax strategies that may help your clients better prepare for the potential costs of long-term care—here are three to consider.

Taxes July 9, 2023

Qualified deductible expenses include the cost of books, tuition, food, clothing, transportation, medical and dental care, entertainment and other amounts actually spent for the student's well being.

July 6, 2023

Be aware, however, that this special tax treatment isn’t automatic. To qualify for Section 1244 treatment, the following four main requirements must be met.