Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 5, 2026

February 2, 2026

Taxes March 9, 2023

The new deadline of Oct. 16 applies to California and federal individual and business tax returns and payments.

Taxes March 9, 2023

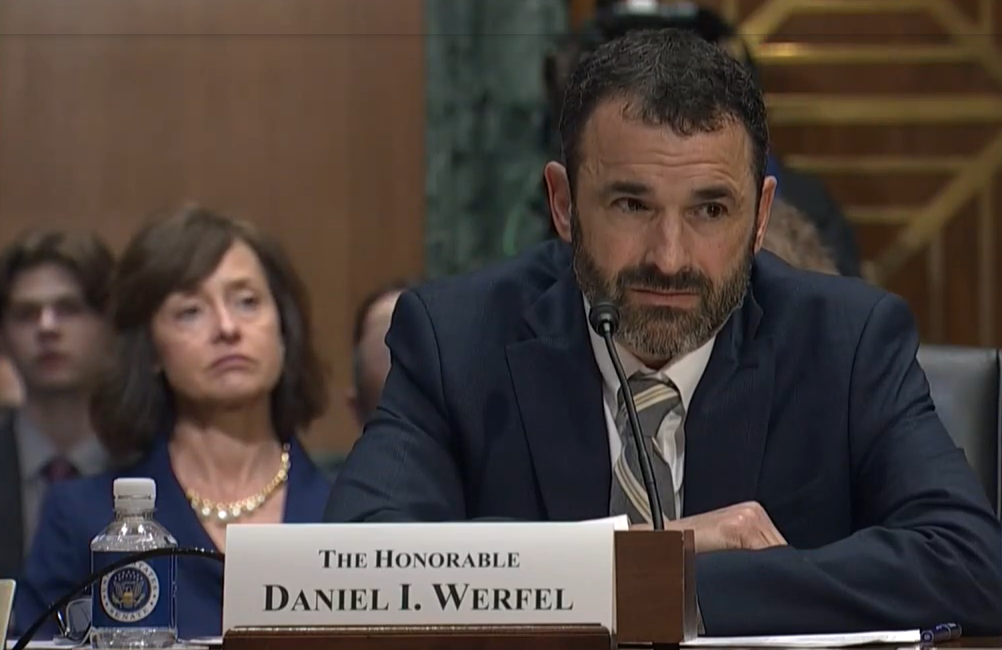

The Senate voted 54-42 to confirm Werfel, a former acting IRS commissioner under the Obama administration.

Taxes March 9, 2023

Joe Manchin called Daniel Werfel “supremely qualified” but has “zero faith” he would have autonomy in the post.

Taxes March 8, 2023

The Inflation Reduction Act reintroduces the corporate AMT, but with major changes, and it only applies to certain corporations, but a company only needs to pass the book income test once to be subject to AMT.

Taxes March 7, 2023

The IRS is working with payroll companies and large employers to verify W-2 information in light of these scams.

Taxes March 2, 2023

His nomination was approved by the committee on a 17-9 bipartisan vote. The full senate will now vote on his confirmation.

Taxes March 1, 2023

During National Consumer Protection Week, March 5-11, IRS-CI will share information on its social media about tax scams.

Taxes March 1, 2023

IRS statistics for the week ending Feb. 17 show the average refund is $3,140, down 11.2%, or $396, from last year.

Taxes March 1, 2023

Generally, small business owners who use their automobile for business driving are entitled to deduct expenses based on the vehicle’s use, but there are plenty of twists and turns along the way.

Taxes February 28, 2023

Just 49% of workers know about the credit, which can help them save for retirement and lower their taxes, a survey found.

Taxes February 28, 2023

Roughly 300 Iowans who had filed their 2022 federal tax returns did not receive the correct federal refund.

Taxes February 28, 2023

Disaster-area taxpayers in most of California and parts of Alabama and Georgia received tax filing and payment relief.