Payroll

Latest News

IRS Will Phase in $600 Form 1099-K Reporting Threshold in 2026

Review of HubSync – The Accounting Technology Lab Podcast – Nov. 2024

FASB Issues Standard on Induced Conversions of Convertible Debt Instruments

IRS Announces National Tax Security Awareness Week Starts on Dec. 2

Small Business Jobs Index Shows Mixed Results

For the second consecutive month, the Paychex | IHS Small Business Jobs Index is showing a mixed story for small businesses employment growth.

CAMICO Partners with Underwriting Company to Expand Insurance for Accounting Firms

The program will further strengthen and expand CAMICO’s capacity for providing coverage and risk management services, especially to mid-sized and larger accounting firms of 15 or more professional staff.

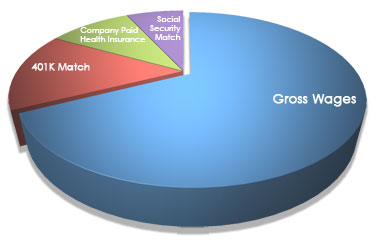

Study Shows Companies Falling Short on Employee Compensation

Companies are falling short on base pay and annual incentive programs, according to research from global professional services company Towers Watson.

Webinar to Explore Options and Benefits of the New myRA Retirement Plan

The “myRA” (“My Retirement Account”) is a new retirement savings account designed for employees who don't have access to an employer-sponsored 401(k) plan or who aren't eligible for their employer’s plan, but are looking for a simple, safe, and affordable

The Most and Least Happy States in America

The saying that "money can't buy happiness" may not be right. In fact, with some research proving that money can buy at least some happines, up to a certain dollar amount, the personal finance social network WalletHub conducted an in-depth analysis of 201

Sage to Acquire PayChoice

Accounting and business management software maker Sage North America has reached an agreement to acquire privately-held PayChoice, a provider of payroll solutions for small and medium-sized businesses. Sage says the acquisition will help it create ...

IRS Extends Deadline to Claim Retirement Loss Deductions

On September 18, the IRS released an advanced copy of Rev. Proc. 2014-54, which provides guidance on certain changes in method of accounting for dispositions of tangible depreciable property. One of the most notable changes in this 93-page document is tha

How to Enjoy the Tax Benefits of Business Convention Vacations

Suppose one of your clients receives a postcard or email heralding a business convention at a lush tropical paradise this winter. It’s hard to pass up and your client may jump at the opportunity. After the early presentations and round-table discussions,