Payroll

Latest News

Review of HubSync – The Accounting Technology Lab Podcast – Nov. 2024

FASB Issues Standard on Induced Conversions of Convertible Debt Instruments

IRS Announces National Tax Security Awareness Week Starts on Dec. 2

Deloitte Predicts Record-High Black Friday and Cyber Monday Spending

Paramount Software Solutions, Inc. — Crest Payroll

8245 888-400-1613 www.ParamountSofware.com With its Crest Payroll solution, Paramount Software offers a comprehensive system for professional accounting firms managing the payrolls for multiple client businesses, providing support for any number of entities and employees, with a web-based system that includes unlimited payroll runs, direct deposit, and online client and employee portals branded with the professional […]

AccountantsWorld — Payroll Relief AC

7820 888-999-1366 www.AccountantsWorld.com Payroll Relief is the professional web-based payroll system from AccountantsWorld, providing an accountant-centric model for payroll processing that includes client portal and data-entry access, support for any number of clients and employees, direct deposit, electronic payment, and reporting. The program is available in per-payroll and per-paycheck options, as well as an all-inclusive […]

Intuit — QuickBooks Enhanced Payroll for Accountants

Intuit, Inc. – QuickBooks Enhanced Payroll for Accountants800-365-9618www.accountant.intuit.com/payroll From the Sept. 2010 Review of Professional Payroll Systems Intuit offers several payroll processing systems and services, with some designed for direct use by small businesses and others designed with the accountant in mind. With QuickBooks Enhanced Payroll for Accountants, the vendor provides professional firms that […]

Advanced Micro Solutions — 1099-Etc A-T-F Payroll

6966 800-536-1099 www.1099-etc.com The 1099-Etc program and After-the-Fact/Live Payroll module from Advanced Micro Solutions (AMS) is, as its name implies, an after-the-fact payroll processing system designed for either professional accountants or business entities. The system also includes live payroll processing capabilities with direct deposit, but is generally geared toward managing in-house payrolls, multiple-payrolls for smaller […]

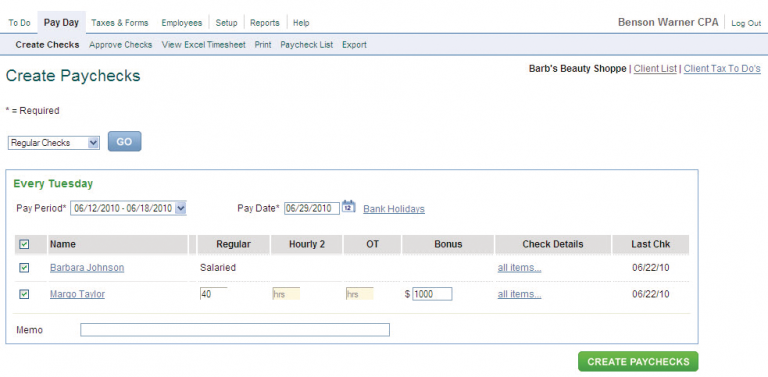

Sage — Sage Abra Suite

7348 800-424-9392 www.SageAbra.com Sage Software is well-known for its accounting and business management systems, with products ranging from the Peachtree small business bookkeeping system to applications and ERP systems for large enterprises. The Sage Abra Suite is the software vendor’s premier payroll and human resources management system, providing extensive payroll processing and management capabilities for […]

PenSoft — Payroll Accounting Edition

6926 888-736-7638 www.PenSoft.com PenSoft offers several payroll processing and employee management systems geared toward use directly by small and mid-sized businesses as well as a version tailored to the needs of professionals managing the payrolls of several employers. The Accounting Edition includes all of the features found in the vendor’s comprehensive payroll systems, including benefits […]

Intuit — Intuit Online Payroll

7588 800-365-9618 www.OnlinePayroll.Intuit.com The Intuit Online Payroll offering, formerly known as PayCycle, is one of several payroll products and services offered by Intuit. The completely web-based system includes versions for small businesses and for accounting professionals managing payroll activities and compliance for multiple employers, with automated compliance reporting, payments and due date alerts. The system […]

CCH Small Firm Services — ATX Payroll & TaxWise Payroll

7297 866-345-4171 www.cchsfs.com CCH Small Firm Services is the technology company behind the ATX and TaxWise professional tax compliance suites, which are popular with small and mid-sized practices. Under each of these brands, the vendor also offers collections of professional accounting and client service applications, including trial balance, write-up, asset management, client bookkeeping, and separate […]