Payroll

Latest News

Review of HubSync – The Accounting Technology Lab Podcast – Nov. 2024

FASB Issues Standard on Induced Conversions of Convertible Debt Instruments

IRS Announces National Tax Security Awareness Week Starts on Dec. 2

Deloitte Predicts Record-High Black Friday and Cyber Monday Spending

Review of XpressPayroll For Accountants – 2010

CompuPay – Xpress Payroll for Accountants877-729-6299 www.CompuPay.com From the Sept. 2010 Review of Professional Payroll Systems CompuPay has a variety of payroll systems designed primarily for direct use by small businesses that offer varying degrees of automated processing, reporting and compliance. The company also offers an Accountant Solutions division, which offers guidance to professionals […]

CheckMark Software — CheckMark Payroll

6156 www.CheckMark.com 800-444-9922 CheckMark Software offers its self-named CheckMark Payroll, a traditionally installed live payroll system designed for use by accountants or small businesses as a multi-employer payroll management system. The program can be run on Windows or Mac computers, providing support for all federal and state reporting requirements, and offering Direct Deposit and basic […]

Payroll Services for Your Clients: Which Model is Right for Your Firm?

6363 Over the past two decades, payroll processing has had an ebb and flow relationship with many professional practices. Small and mid-sized business owners or management either try to manage payroll themselves without assistance, or they instinctively turn to their public accountant. In the first case, most will inevitably face penalties for missing due dates […]

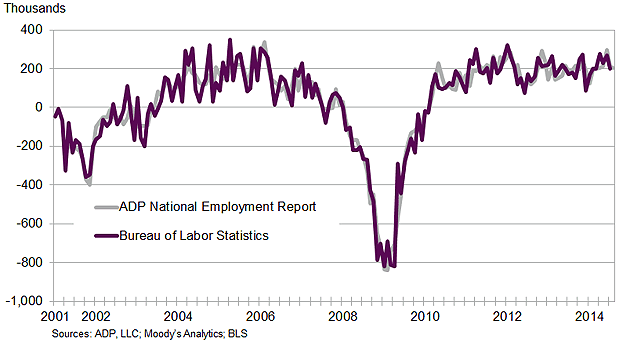

ADP Report Shows 204,000 Jobs Added in August, Led by Small Businesses

Private sector employment increased by 204,000 jobs from July to August, according tot he latest ADP National Employment Report, which is produced by ADP in collaboration with Moody's Analytics.

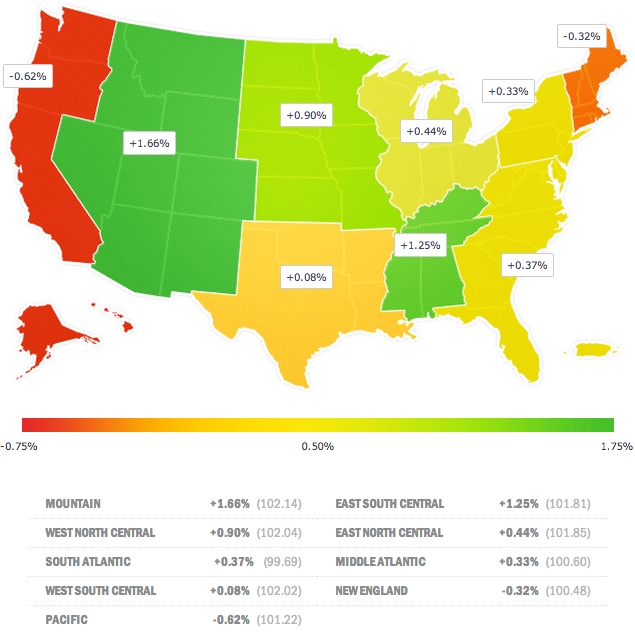

Small Business Hiring Up Across U.S. for First Time in 2014

Small businesses with primarily 1-10 employees, often referred to as micro businesses, saw a month-over-month increase in hiring (0.1 percent) for the first time in 2014, according to the August 2014 SurePayroll Small Business Scorecard. SurePayroll Inc., is a provider of online payroll services to small businesses.

ZenPayroll Announces Partnerships with Multiple Technology Companies

ZenPayroll, the maker of cloud-based payroll management systems, has announced partnerships with over a dozen SMB-focused technology companies. Through the partnerships, users will have integration options that will allow them to connect critical back office tools for small businesses, from payroll to benefits to human resources. ZenPayroll has already had partnerships with small business leaders like Intuit, Xero and FreshBooks.

How to Handle Payroll Overpayments and Repayments

Now is a great time to sort out any anomalies that could complicate year-end and W-2 processing. And two of the most common are overpayments and repayments.

Small Business Jobs Index Shows Mixed Results

Strong small business employment growth propelled the Mountain region into the lead among regions.