Payroll

Latest News

Trump Vows 25% Tariffs on Canada and Mexico, and 10% More on China on ‘Day One’

IRS to Host Virtual Focus Groups on the Business Tax Account Online Tool

GASB Proposes Guidance on Subsequent Events

FASB Issues Post-Implementation Review Report for Its Revenue Recognition Standard

Florida Job Growth Up 23,000 in June

Florida added 22,620 private sector jobs during the month of June, according to the latest ADP Regional Employment Report which is produced by payroll firm ADP, in collaboration with Moody's Analytics.

Small Business 401(k) Plans: Not a Nightmare Anymore, But No Fairytale Either

Once upon a time, an entrepreneur with just a handful of employees wouldn’t even think about starting up a 401(k) plan for the business. The administrative costs, as well as the complexity, could turn into a nightmare. But costs have come down in recent years and now the 401(k) is a viable vehicle for an employer of virtually any size.

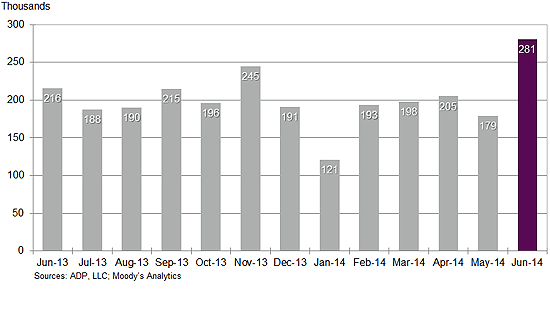

Report: 281,000 Jobs Added in June

U.S. private sector businesses added 281,000 jobs from in June according to the June National Employment Report, which is produced monthly by payroll and business services company ADP in collaboration with Moody’s Analytics.

Small Business Retirement Plans: SEPs Take the Easy Way Out

Most of your clients who are small business owners are consumed with their day-to-day operations. They usually don’t have the time, nor the inclination, to devote to administering a qualified retirement plan for employees, even though they also will benefit from it personally. For these harried entrepreneurs, a Simplified Employee Pension (SEP), also called a SEP-IRA, is often the optimal choice of plans.

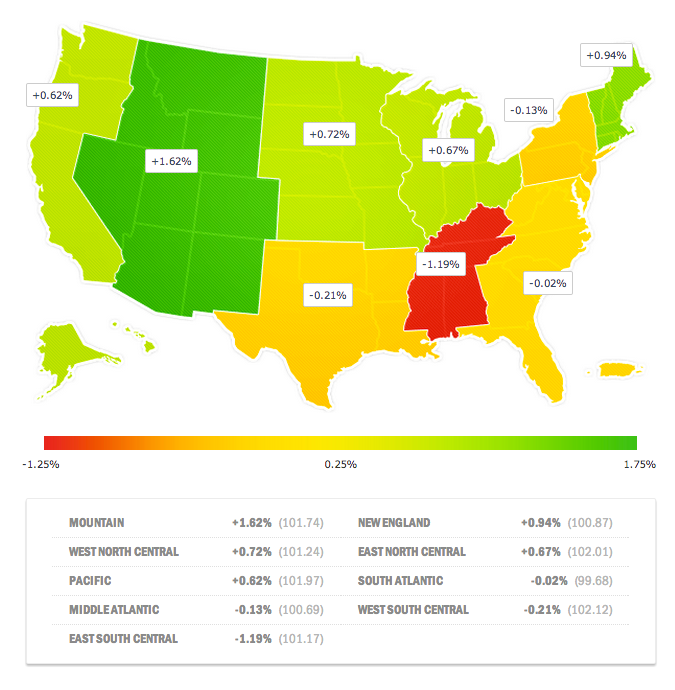

Small Business Job Growth Near Record High

Good news first: The Paychex / IHS national small business jobs growth index remains near record highs, as Washington state leads and Arizona shows strong improvement. Dallas ranked as June’s top performing metro area, surpassing San Francisco, Seattle, and Houston.

Starting a Qualified Plan for a Small Biz? It’s SIMPLE

SIMPLE. The name says it all. It stands for Savings Incentive Match Plan for Employees, a contrived moniker, but you get the picture. This type of qualified retirement plan, created back in 1996, is designed to provide an easy and convenient retirement plan option for small business operations.

Supreme Court Rules Businesses Don’t Have to Cover Contraception

In their 5-4 decision, the justices recognized for the first time that for-profit business such as East Earl, Pa.-based Conestoga Wood Specialties, owned by a Mennonite family, can hold religious views derived from their owners under federal law.

Report: Prices Rising Faster than Wages

Food prices are rising. And inflation, that word common in American conversation 25 years ago, is eating up wage gains.