Payroll

Latest News

IRS to Host Virtual Focus Groups on the Business Tax Account Online Tool

GASB Proposes Guidance on Subsequent Events

FASB Issues Post-Implementation Review Report for Its Revenue Recognition Standard

Newsom: California Will Offer EV Rebates if Trump Cuts Federal Tax Credit

Paycom IPO Opens On New York Stock Exchange

After reducing its initial public offering price to $15 per share, Paycom Software Inc. made its trading debut on the New York Stock Exchange on Tuesday, opening at $17.90 per share and closing at $15.35.

Oklahoma Governor Signs Bill Banning Cities from Raising Minimum Wage

Advocates of raising the minimum wage in Oklahoma City will continue collecting initiative petition signatures, Tim O'Connor, president of the Central Oklahoma Labor Federation, said Wednesday.

Accounting Firm’s Investment in Staff Pays Off

When it comes to investing in employees, CohnReznick LLP knows a thing or two. The accounting, tax and advisory firm was recently named one of the Best Places to Work for Career Development by Crain’s Chicago Business. CohnReznick’s Chicago office was ranked third among the honorees in the career development category.

7 Reasons People Haven’t Paid For Obamacare

The White House now says without equivocation that 7.1 million individuals signed up for Obamacare by March 31, the deadline for open enrollment in 2014. But how many of those people actually paid for health insurance coverage acquired through the marketplace? That’s where the “counting” gets a little trickier.

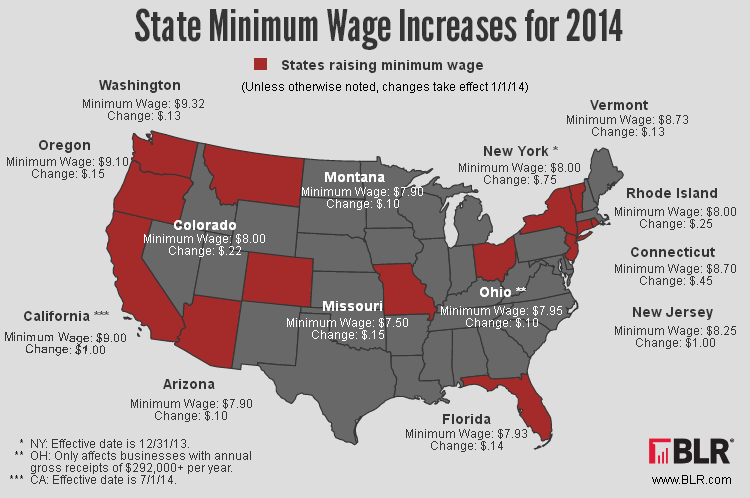

Is Your State’s Minimum Wage About to Change?

You've probably heard about President Obama's push to increase the federal minimum wage from $7.25 to $10.10 per hour. It's the latest of several attempts to increase the federal minimum wage. In addition, several states are following suit with minimum wage legislation of their own. With that in mind, I think now is a good time for a rundown of state legislation.

Healthcare Law May Cost Large Employers up to $5,900 Per Employee

According to a new study by the American Health Policy Institute (AHPI), it could cost some businesses almost $6,000 extra per employee. The report, “The Cost of the Affordable Care Act to Large Employers.” draws on internal cost data shared with AHPI by over 100 large employers (10,000 or more employees each) doing business in the United States.

IRS May Lack Resources to Enforce ObamaCare Insurance Mandate

The IRS has been struggling in its efforts to close an estimated $385 billion “tax gap” between the amount that taxpayers owe and the amount they’ve actually paid. Now, to add another crushing weight, it has to ramp up Obamacare activities despite recent budget cutbacks.

10 Ways to Still Beat the Obamacare Insurance Deadline

Despite reports of a formal extension circulating in the media, March 31 was the last day that individuals could sign up for health insurance coverage for 2014 under the Obamacare mandate without risking a hefty financial penalty. Or was it?