Payroll

Latest News

IRS to Host Virtual Focus Groups on the Business Tax Account Online Tool

GASB Proposes Guidance on Subsequent Events

FASB Issues Post-Implementation Review Report for Its Revenue Recognition Standard

Newsom: California Will Offer EV Rebates if Trump Cuts Federal Tax Credit

Financial Planner Shares 3 Smart Tips for Retirement

With home ownership, job opportunity and retirement security in decline, an Allstate/National Journal Heartland Monitor poll shows that most Americans agree with what the experts have said. Seven in 10 think that tomorrow’s adults – today’s kids – will have less financial security than adults today.

Minimum Wage Increase in West Virginia Has Unexpected Consequences

The bill had some unintended consequences, as it struck language from the State Code that kept higher paid workers, as well as some municipal and county employees, from earning overtime.

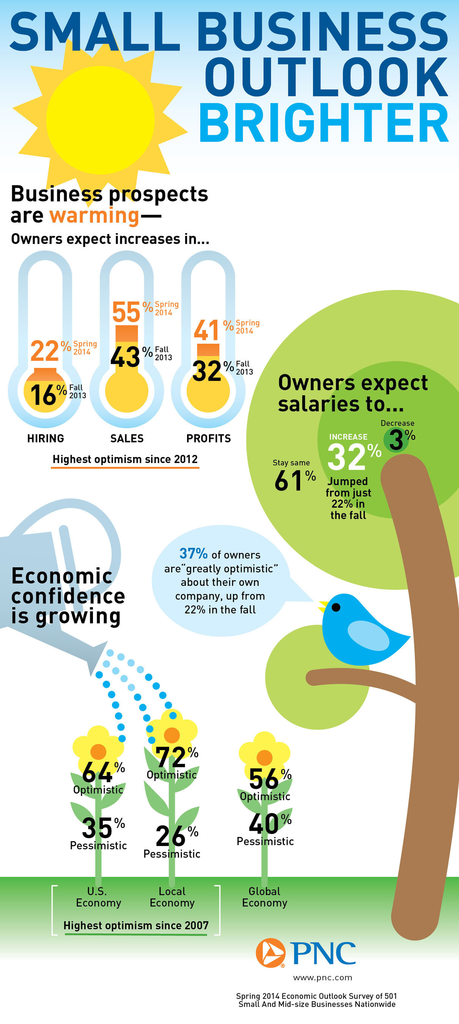

Small Businesses Hopeful on Growth, But Only 22% Expect to Hire

Following an unusually severe winter that stagnated much economic activity, small and mid-sized business owners in the U.S. are now forecasting sunnier days ahead, at least for the next six months.

Tennessee Halts Planned Raises for State Workers

Tennessee Governor Bill Haslam on Monday canceled proposed pay raises for state employees and teachers for the coming year as part of an administration plan for dealing with a revenue shortfall largely due to shrinking business tax collections.

New Pension Bill Nears Passage in Oklahoma

A bill designed to switch new state employees who participate in the Oklahoma Public Employees Retirement System from a defined benefit plan to a 401(k)-style defined contribution plan was approved Tuesday by the state Senate Pensions Committee.

Los Angeles Ranks Among Worst Job Markets

The starkly negative report on the economic health of the nation's largest county, with a population of 10 million, contrasted Los Angeles with nearby suburban counties and with other, more dynamic cities across the nation.

For Seniors: April 1 is Deadline to Take Required Retirement Plan Distributions

The Internal Revenue Service today reminded taxpayers who turned 70½ during 2013 that in most cases they must start receiving required minimum distributions (RMDs) from Individual Retirement Accounts (IRAs) and workplace retirement plans by Tuesday, April 1, 2014.

Not an April Fool’s Joke: Obamacare Mandate Delayed Again

Despite recent claims that the deadline for signing up for Obamacare would not be postponed beyond the initial March 31 deadline – the day before April Fool’s Day – the White House has finally caved into the pressure. According to a report in the Washington Post on March 25, the Obama administration is extending the open enrollment period for two to three weeks in three dozen states around the country.