Payroll

Latest News

INCPAS and NABA Launch Initiative to Strengthen Talent Pipeline in Indiana

Financial Cents Adds New Billing Feature For Accounting Firms

New Jersey Society of CPAs Announces 10 Winners of its CPA Exam Fee Lottery

CFPB Finalizes Rule on Federal Oversight of Popular Digital Payment Apps

Why a Minimum Wage Hike is a Bad Idea

The President of the United States, our champion of income equality, has once again called on Congress to raise the minimum wage from its present level of $7.25 per hour up to $10.10 per hour, a salary increase of just under 39 percent.

Healthcare Costs Top List of Small Business Concerns

How concerned are small businesses about the costs of implementing the new health care insurance laws? A new survey shows it's their top worry.

New Bill Ups the Stakes in Obamacare Showdown

It’s going to take time – perhaps more than initially anticipated – for the government to work through all the twists and turns in the Patient Protection and Affordable Care Act (the PPACA), the massive health care law known as “Obamacare.” Along the way, certain tweaks and modifications are likely to be required.

IRS Faces Customer Service Challenges Under Obamacare

A new report by the Treasury Inspector General (TIGTA) on the Patient Protection and Affordable Care Act (the PPACA) – the 2010 federal legislation also known as “Obamacare” – focuses on the “customer service” strategy promised by the IRS.

Paychex Offers Tax Season Tools for Accountants

With tax season in full swing, payroll and human resources provider Paychex, Inc. is highlighting resources to help accounting professionals stay on top of critical payroll, tax, and HR issues that could impact their small business clients.

Payroll Taxes for 2014: The Effects of the Demise of DOMA

The Supreme Court's rejection of the Defense of Marriage Act (DOMA) was big news in 2013. And in 2014, it has big payroll tax implications for employers who offer cafeteria benefits to same-sex spouses.

5 Tax Tips on March Madness Betting

5 NCAA Betting Tips from CPA and 19-year IRS veteran, Jim Buttonow

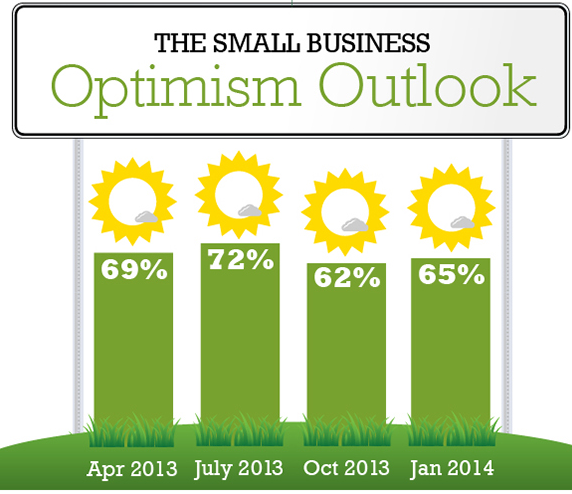

Small Business Owners Expect Profitable 2014

Although about 80 percent of small businesses expect to be profitable in 2014, less than half of them expect to create new jobs next year, according to a new survey.