Payroll

Latest News

IRS ‘Get Ready’ Campaign Helps Taxpayers Prepare for Filing Season

Trump Nominates Hedge Fund Exec Bessent to Lead Treasury Department

The Top Toys and Gifts for the 2025 Christmas and Holiday Season

Professionals on the Move – Nov. 2024

Indiana and Illinois See Jobs Growth

Small businesses are hiring, and employment at smaller firms grew in Illinois and Indiana last month.

Some Restaurants Dropping Automatic Tips For Large Groups

Like most other restaurants in Maine, DiMillo's On the Water in Portland says it will no longer charge automatic gratuities for most large groups now that a change in the federal income tax code has closed a long-standing loophole.

Which States Have the Most Millionaires?

Of the more than 119 million households in the U.S., about 6 million, or five percent, of them include a millionaire, according to a new report. But where do they live?

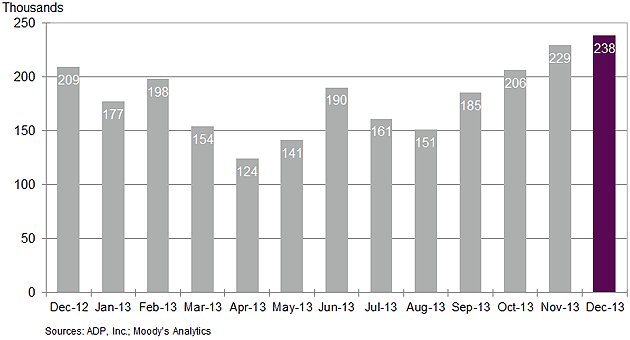

Report: December Was Strongest Jobs Growth Month in 2013

U.S. private-sector franchise jobs increased by 30,250 during the month of December 2013, according to the ADP National Franchise Report. BThe report measures monthly changes in franchise employment derived from ADP’s actual transactional payroll data.

A Billion Dollars for March Madness Bracket? Warren Buffet is Backing the Bet

Talk about March Madness! Office pools and online versions of pick-em games for the NCAA basketball tournament see a lot of money pass hands, but never like this.

Payroll: The Difference Between Exempt & Non-Exempt Employees

You probably know that non-exempt employees are covered under FLSA, which imposes requirements for overtime and other aspects of employment. Exempt employees, on the other hand, are not subject to FLSA.

Equality In Employer Health Insurance Plans Delayed

Unless you’ve been living under a rock the last few years, you’re well-aware that the massive health care legislation known informally as “Obamacare” by both its detractors and proponents remains the law of the land.

What Small Businesses Need to Know About Health Care Tax Credit

Starting this year, the credit goes up to 50 percent for for-profit entities, and 35 percent for tax-exempt ones.