Payroll

Latest News

IRS ‘Get Ready’ Campaign Helps Taxpayers Prepare for Filing Season

Trump Nominates Hedge Fund Exec Bessent to Lead Treasury Department

The Top Toys and Gifts for the 2025 Christmas and Holiday Season

Professionals on the Move – Nov. 2024

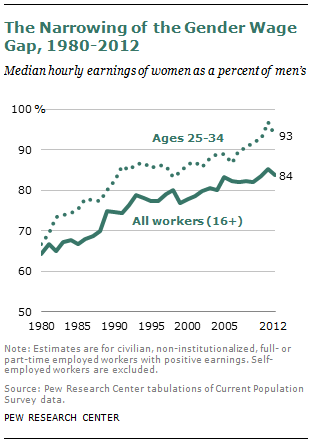

Pay Gap for Women in Workplace Narrows

Young women seem closer than ever to achieving gender equality in the workplace, at least when it comes to wages, a new report from the Pew Research Center suggests. But it remains to be seen whether motherhood will slow their strides, as it did for women before them.

U.S. Jobless Rate at Lowest Level in Five Years

Employers added a solid 203,000 jobs in November, driving down the unemployment rate three-tenths of a percentage point to 7 percent, the lowest it's been since November 2008, the Labor Department said Friday.

Greatland Enhances FileTaxes.com, Includes New W-2 & 1099 Features

Enhanced W-2 and 1099 Online Reporting Tool Offers New Form Retrieval Option, TIN Truncation Support and Additional New Features

New Online Payroll Solution Offers Full Integration With GL, Accounting

Online accounting software maker Xero has announced the integration of a full payroll processing and reporting system into its cloud-based accounting platform for small and mid-sized businesses. A multi-client management version is also available for payroll professionals and other business financial consultants.

Detroit Bankruptcy Ruling Could Affect Pensions Across Nation

For 34 years, Gwendolyn Beasley worked as a clerk at the Detroit Public Library and paid a portion of her salary into a fund that would someday help pay for her pension.

Report: IRS Needs to Strengthen Controls on ACA Health Care Tax Credits

The Internal Revenue Service (IRS) needs to strengthen systems development controls for the Premium Tax Credit (PTC) Project, the Treasury Inspector General for Tax Administration (TIGTA) concludes in a new report publicly released today.

Town To Pay Police Chief’s Salary in Bitcoins

The city commission in Vicco, Kentucky, has approved a measure on Monday to begin paying the city's police chief in a virtual currency, a move officials say is likely the first of its kind in the nation.

Latest Jobs Report Shows Strong Growth in November

U.S. companies added 215,000 jobs in November, according to the latest ADP National Employment report. ADP is a global provider of payroll, human resources and business services and solutions.