Payroll

Latest News

House Tax-Exempt Crackdown Bill Passes Despite Democrat Defections

Retailers Tell Senate Credit Card ‘Swipe’ Fees are ‘Adding Inflationary Pressure to the U.S. Economy’

The Top Toys and Gifts for the 2025 Christmas and Holiday Season

PCAOB Rule Change Creates Procedure to Revoke Delinquent Firms’ Registrations

BQE Software Releases BillQuick 2012

BillQuick 2012 offers new and improved features to promote faster business decisions, increase project performance and streamline the billing process.

Small Employers Can Benefit from Health Care Tax Credit

With business tax-filing deadlines fast approaching, the Internal Revenue Service today encouraged small employers that provide health insurance coverage to their employees to check out the small business health care tax credit and then claim it if they qualify.

myPay Solutions Now Available as a Mobile App

The Tax & Accounting business of Thomson Reuters released a mobile app for the myPay Solutions software. The mobile app grants mobile access to payroll information for employees of current myPay Solutions clients. With the app, employees can enter time for the current pay period and view time entered for previous pay periods right from […]

Ten Tax Benefits for Parents to Remember

How much is that little bundle of joy worth? Junior or your Princess may be priceless to you, but when it comes to taxes, there can be several very tangible monetary benefits.

Numbers Have Moved to the Cloud… The Benefits of Online Client Accounting

The Cloud has changed the world of accounting. This concept is not new—it actually dates back to the early 1990s—but the biggest growth by accounting firms starting to take advantage of this online technology has been within the last few years.

The Benefits of Adding Investment Planning to Your Practice

As a tax and accounting professional, your clients already trust you to provide professional tax advice that is in their best interest, so why do you keep referring your clients to another financial professional for investment services?

Building a Practice for the Future

Tax and accounting professionals who start their own firms from scratch face benefits and significant challenges. On the pro side, they have the opportunity to build the firm as they wish, from internal practices to staffing and management styles. Of course, there can be significant startup costs, and the firm starts with a client roster of zero, presenting the very pressing hurdle of income generation.

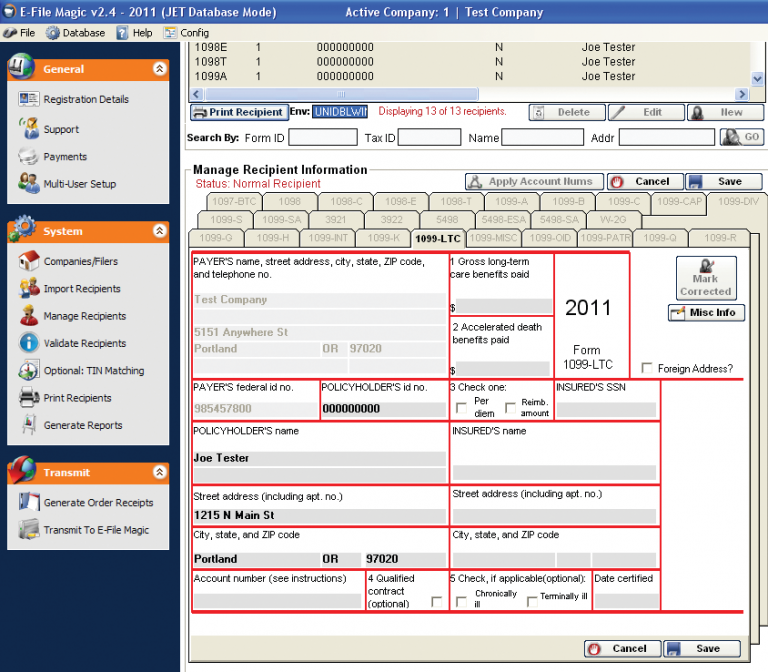

Form 1099-LTC Software – Long-Term Care and Accelerated Death Benefits

Using the E-File Magic 1099-LTC software you can print, mail, and e-File your 1099-LTC forms with ease. You pay only for e-File Services(required), and optionally print and mail services. This makes your year end reporting requirements even simpler than ever. Just import or manually enter your data into our software program, validate, and transmit your […]