Sales Tax

Latest News

Professionals on the Move – Nov. 2024

Top Hyundai Exec Says EVs Are ‘the Future’ Even if Trump Kills Tax Credit

3 Reasons to Involve Your Children in Small Business Saturday

Review of Blue J – The Accounting Technology Lab Podcast – Nov. 2024

July SALT Checklist

What should you be doing in your state and local tax practice this month? Here's your SALT checklist for July.

10 Common Nexus-Creating Activities for Sales and Use Tax

As a part of CPA Practice Advisor's ongoing series, "A Year in the Life of a SALT Accountant," Dallas-based Peisner Johnson LLP offered some key advice to accountants and their small business clients when it comes to activities that can cause them to be exposed to unexpected sales and use taxes in jurisdictions where they may think they are not required to report.

Virginia Society of CPAs Partners with Avalara

Avalara and the Virginia Society of Certified Public Accountants have reached an agreement where VSCPA members will have unlimited access to up-to-date sales and use tax rules, rates, forms, and related reference resources, to better assist their clients, and/or their employers, in complying with a rapidly changing and complex regulatory environment.

2014 Review of Sales Tax Systems for Small Businesses

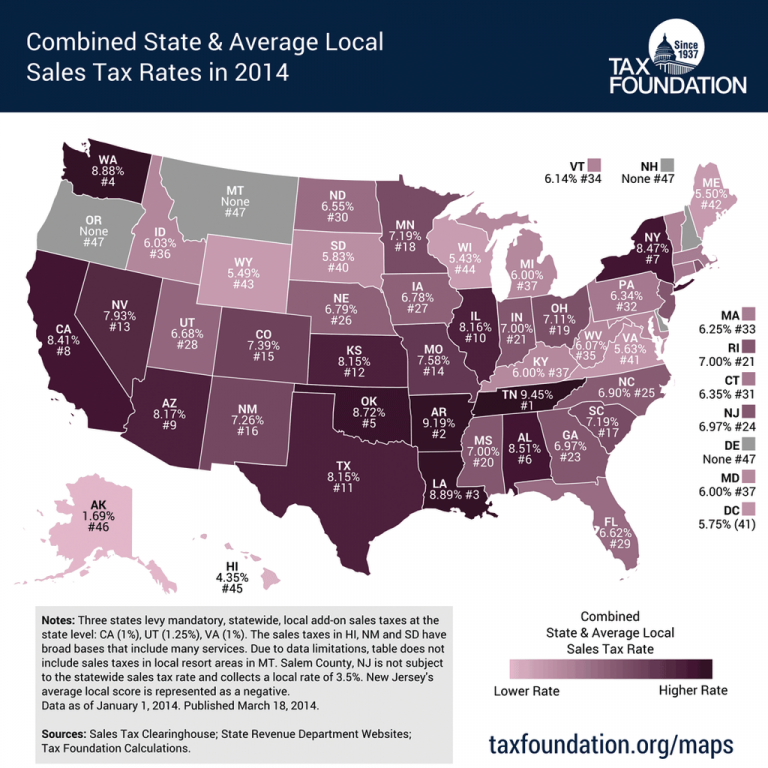

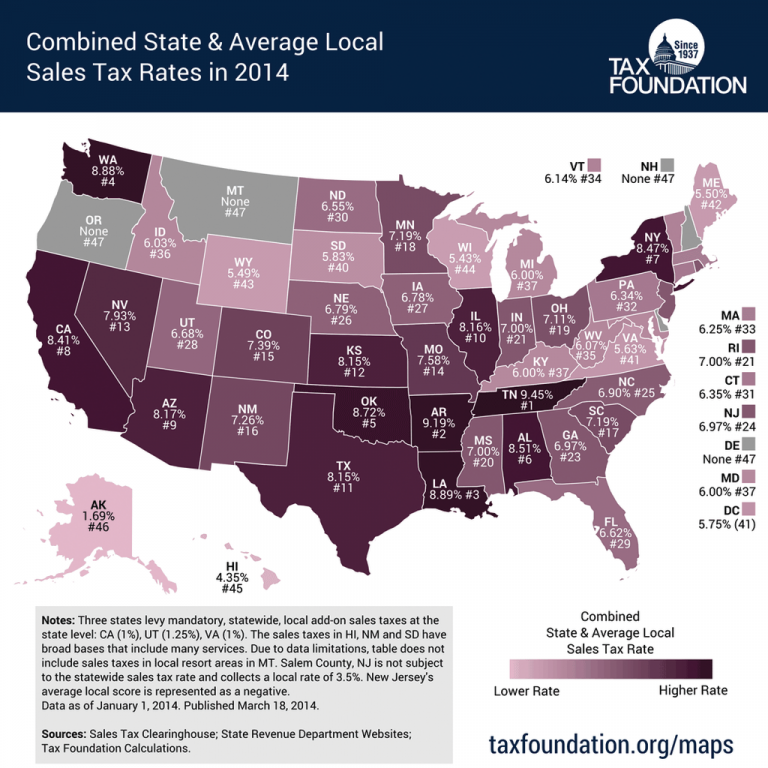

Sales and use tax is a key source of government funding in most states. Unlike property tax and state income tax, however, the legislators and regulators have adopted a patchwork of different rules which affect the taxability of the items. In addition to dealing with statewide tax rates in 45 states, 38 states levy sales taxes based on the borders of cities, counties, and special districts.

2014 Review of Bloomberg BNA Sales and Use Tax Forms and Rates

In addition to its publishing products, Bloomberg BNA offers two software tools which are designed to help companies and practitioners stay up to date on tax rates and prepare accurate forms.

2014 Review of CCH Sales Tax Returns Online and Sales Tax SaaS PLUS

CCH’s sales tax compliance applications are priced based on a range of factors, including the number of entities, the number of returns, and the features purchased. Specific pricing is available upon request.

Talking to Your Clients About SALT

The Year in the Life of a State and Local Tax (SALT) Accountant series is being created with the practitioner in mind. In cooperation with Avalara, each month we'll provide you with the latest news relating to state and local tax issues, updates on federal legislation, checklists and tips for building and improving your SALT practice, talking points and guidance for answering the questions posed by your clients, and more.

Sales Tax & Compliance

The Sales Tax & Compliance series is being created with the practitioner in mind. In cooperation with Avalara, each month we'll provide you with the latest news relating to state and local tax issues, updates on federal legislation, checklists and ...