Technology February 4, 2026

Pilot Rolls Out Fully Autonomous AI Accountant

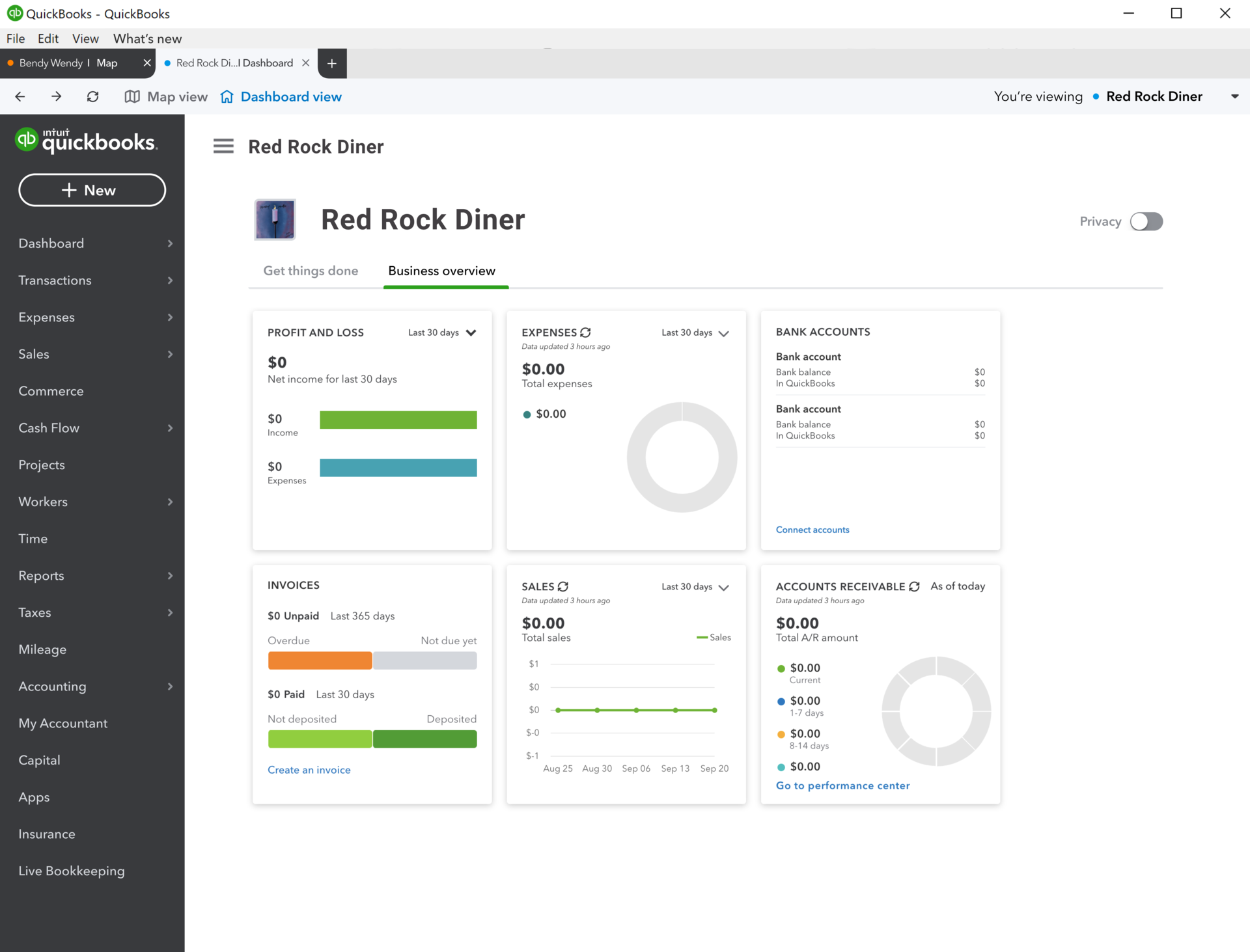

Pilot said Feb. 4 that its AI Accountant is a fully autonomous system that runs the entire bookkeeping process, from onboarding to monthly close, with zero human intervention.

![QuickBooks-Connect[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2021/11/QuickBooks_Connect_1_.617c0d6f79d9e.png)