Small Business

Latest News

IRS to Host Virtual Focus Groups on the Business Tax Account Online Tool

GASB Proposes Guidance on Subsequent Events

FASB Issues Post-Implementation Review Report for Its Revenue Recognition Standard

Newsom: California Will Offer EV Rebates if Trump Cuts Federal Tax Credit

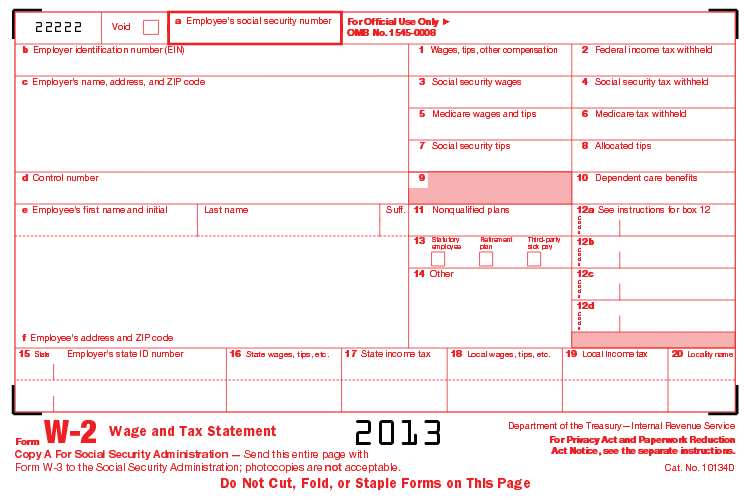

W-2 and 1099 Systems Help Accountants and Businesses Stay Compliant

2013 Overview of W-2/1099 Preparation Software

San Francisco Considers Soda Tax

San Francisco city supervisor Scott Wiener plans this week to introduce a ballot measure that would set a tax on sugary beverages. The proceeds would fund health, nutrition and activity programs for city youth.

Capturing Clients on LinkedIn? Yes…You…Can!

From the Nov. 2013 issue. The ongoing confusion within the profession about how social media effectively supports marketing and sales efforts is valid. While there is ample high-level educational content on the topic of social media, there are few strategies that are proven and tested. And even for those programs that do exist, it’s likely […]

Kim Hogan Joins Intuit Accountant & Advisor Program

Accounting marketing expert Kim Hogan has joined the Intuit Accountant and Advisor Group, effective immediately. She joins Ray Barlow and David Bergstein, CPA.CITP, who Intuit announced joined the team earlier this month.

US Sees Jump in Small Business Loans, SBA Program

Treasury officials said loans issued through its Small Business Lending Fund are up $10.4 billion over baseline levels and up $1.4 billion over last quarter, nationwide. More of those loans have been issued in the Southeast than elsewhere in the U.S. according to the report.

Cash Flow and Business Intelligence Top Priorities for Business Leaders

CFOs and financial executives are concerned about their organizations' ability to efficiently and effectively manage cash flow and working capital due to the growing need to address economic volatility with greater precision, speed and flexibility.

Liquor Stores in Washington State Struggling with New Taxes

A year and change after private liquor sales began in Washington, nearly two dozen mostly small retailers are in danger of losing their licenses for failing to pay the required taxes and fees.

Nurses Aides Guilty of Stealing Health Records, Filing Fake Tax Returns

Two former Sentara Healthcare employees pleaded guilty this month to accessing patients' electronic health records inappropriately in a scheme to file fraudulent tax returns.