Technology February 4, 2026

Pilot Rolls Out Fully Autonomous AI Accountant

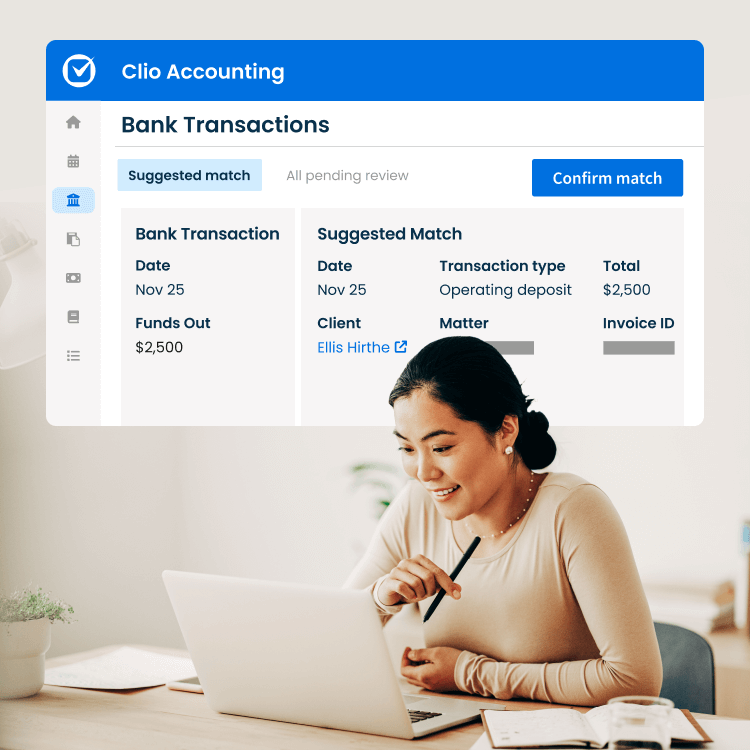

Pilot said Feb. 4 that its AI Accountant is a fully autonomous system that runs the entire bookkeeping process, from onboarding to monthly close, with zero human intervention.