Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes January 29, 2024

2024 Tax Refund Calendar: How to Estimate When You May Receive Your Refund.

Taxes January 26, 2024

Between 2015 and 2020, Coates claimed $228,788 in tax refunds on her individual federal income tax returns by falsely reporting that taxes had been withheld from her income and had been paid to the IRS.

Taxes January 26, 2024

The sessions held in February aim to ensure that tax professionals have the latest ERC information and understand ERC eligibility criteria.

Taxes January 24, 2024

The IRS has extended its April 15 filing deadline for impacted taxpayers until June 17 to submit returns and make tax payments.

Taxes January 24, 2024

EAs with a Social Security number ending in 7, 8, or 9 must renew their status by Jan. 31 before their current enrollment expires March 31.

Taxes January 23, 2024

The IRS noted on Monday that it has included a crypto question on four additional tax forms ahead of filing season.

Taxes January 23, 2024

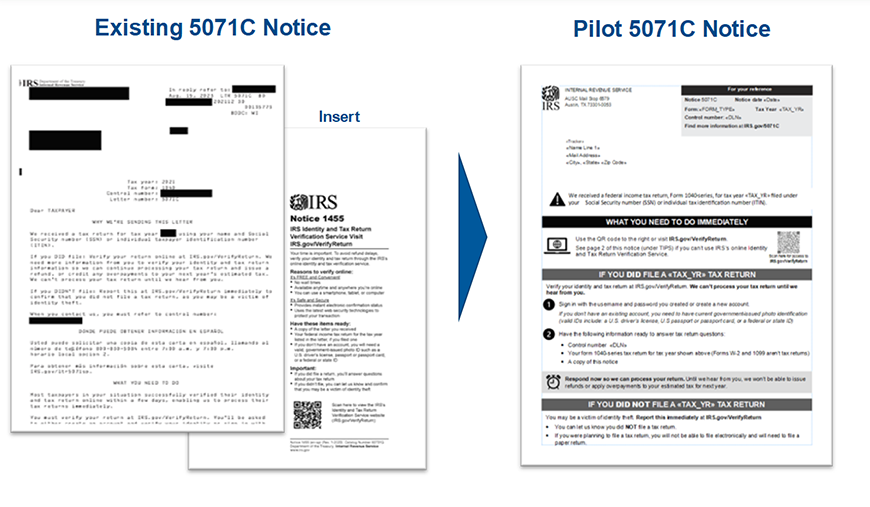

The Simple Notice Initiative will review and redesign hundreds of notices with an immediate focus on the most common notices that individual taxpayers receive.

Taxes January 23, 2024

The PIllar Two rules effectively create a global minimum tax rate of 15 percent and significantly impact financial processes and operating structures for large multinational organizations.

Small Business January 23, 2024

A new report shows continued changes to economic nexus and marketplace facilitator laws in the U.S. and the expansion of e-invoicing globally in 2024, both of which will lead to the likelihood of increase sales tax audits.

Taxes January 19, 2024

Ways and Means voted to approve a tax package that would revive a trio of business tax incentives and expand the child tax credit.

Taxes January 19, 2024

Charles Littlejohn, 38, pleaded guilty Oct. 12 to stealing Donald Trump’s tax data from the IRS and leaking it to The New York Times.

Taxes January 19, 2024

The Inflation Reduction Act amended the credit for qualified alternative fuel vehicle refueling property. The changes apply to qualified alternative fuel vehicle refueling property placed in service after Dec. 31, 2022 and before Jan. 1, 2033.