Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes November 21, 2025

A jury convicted Leon Haynes of 15 counts of aiding and assisting in the preparation and presentation of false tax returns, one count of mail fraud and two counts of tax evasion following a six-day trial.

IRS November 20, 2025

A possible merger of the IRS's Office of Professional Responsibility with the Return Preparer Office would bring negative consequences to the nation's tax system, the AICPA wrote in a letter to the agency last week.

Taxes November 20, 2025

The Donald J. Trump Presidential Library Foundation filed its request for tax-exempt status to the IRS on Oct. 10 and got an approval letter just 10 days later, according to tax records.

Taxes November 20, 2025

During a Nov. 19 event in Mobile, AL, U.S. Chamber of Commerce's Tom Wickham said the president's tariff policy amounts to a potential $600 billion “tax increase annually,” including about $202 billion on small businesses.

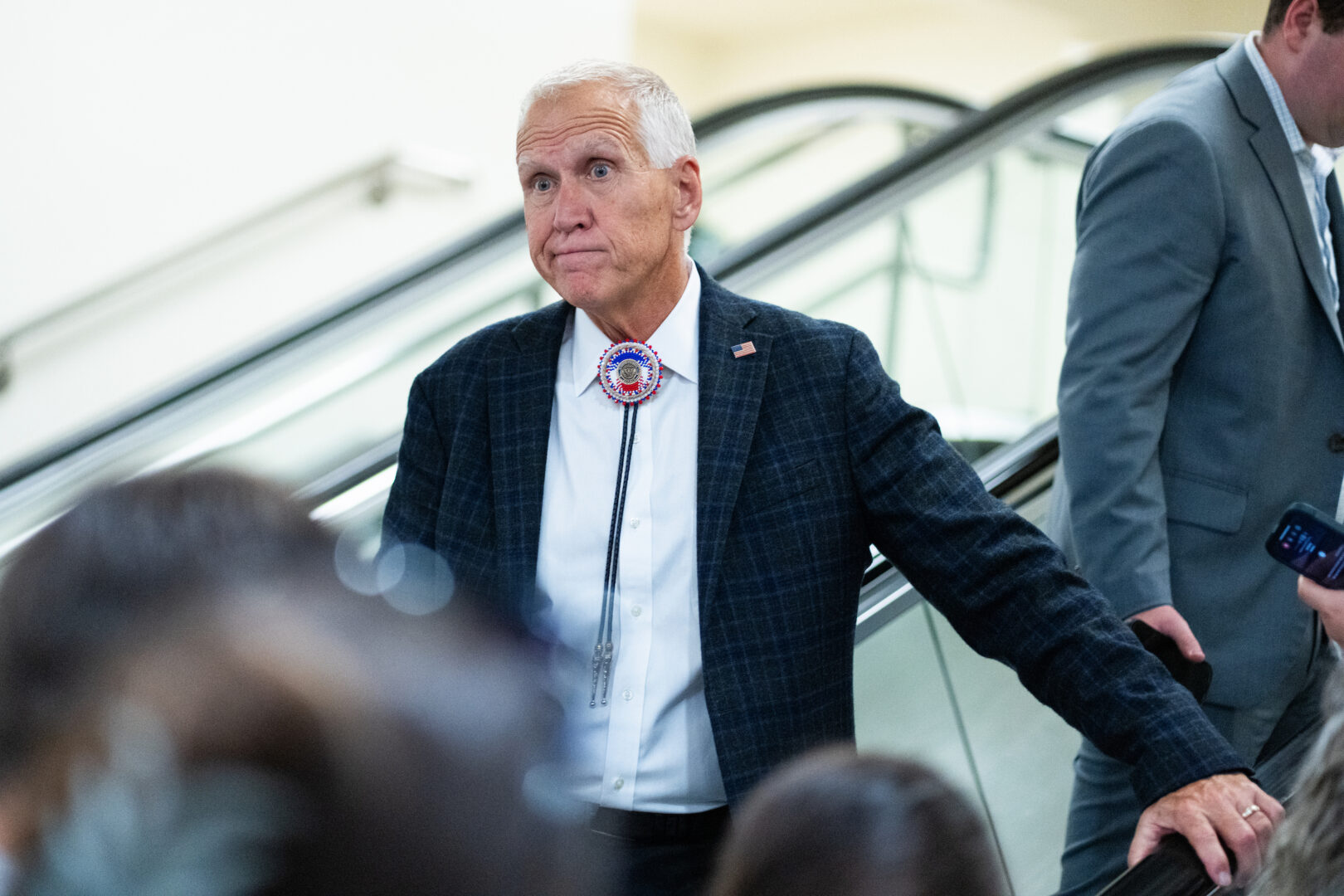

Taxes November 20, 2025

Missouri Gov. Mike Kehoe has offered no specifics about his plan but said it revolves around offsetting the $10 billion generated by the state’s 4.7% income tax rate, which represents about 63% of the state’s general revenue.

Taxes November 19, 2025

An investment portfolio where any one stock has appreciated dramatically over the original purchase is the perfect candidate for a contribution to a charitable organization or a DAF.

Taxes November 19, 2025

A centerpiece of the discussion was CCH Axcess Scan, an innovative solution powered by Expert AI and Azure AI services.

Taxes November 19, 2025

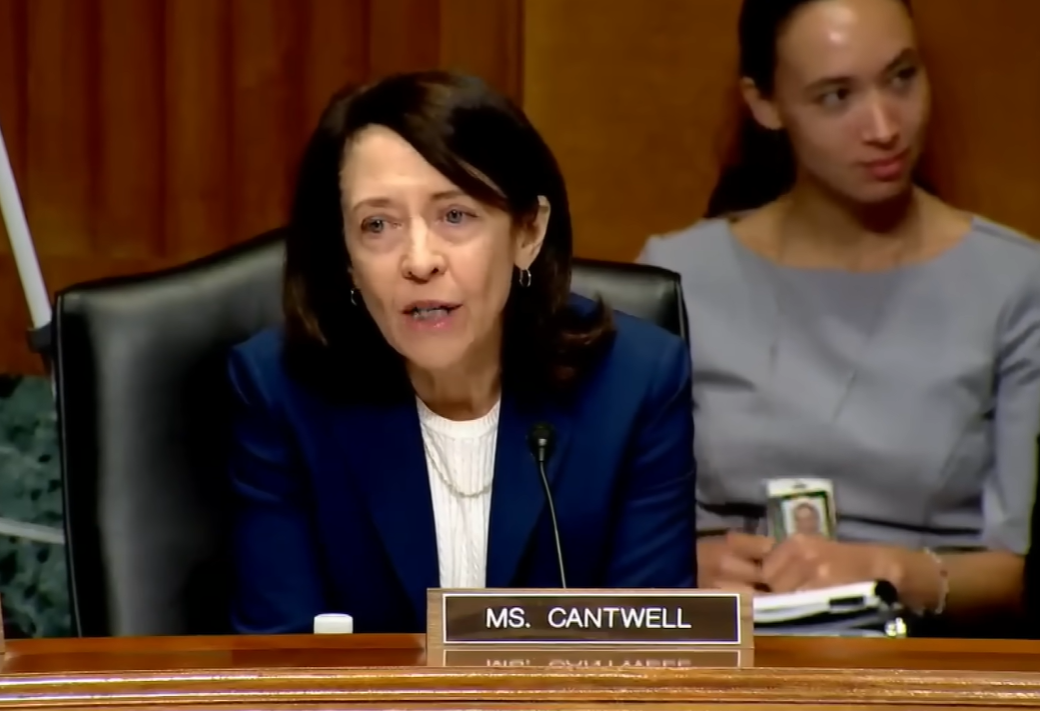

During a Senate Finance Committee hearing on health care affordability on Nov. 19, members found no middle ground on how to lower costs for those relying on expiring tax credits.

Taxes November 19, 2025

In a letter to the Joint Committee on Taxation, Sen. Maria Cantwell (D-WA) called for an analysis of the current landscape of college athletics centered around the policies that shield much of the industry from taxation.

Taxes November 19, 2025

As evidenced by a taxpayer in a new case, Besaw, TC Sum. Op. 2025-7, 7/21/25, just missing one or two of the key ingredients can spoil the deal.

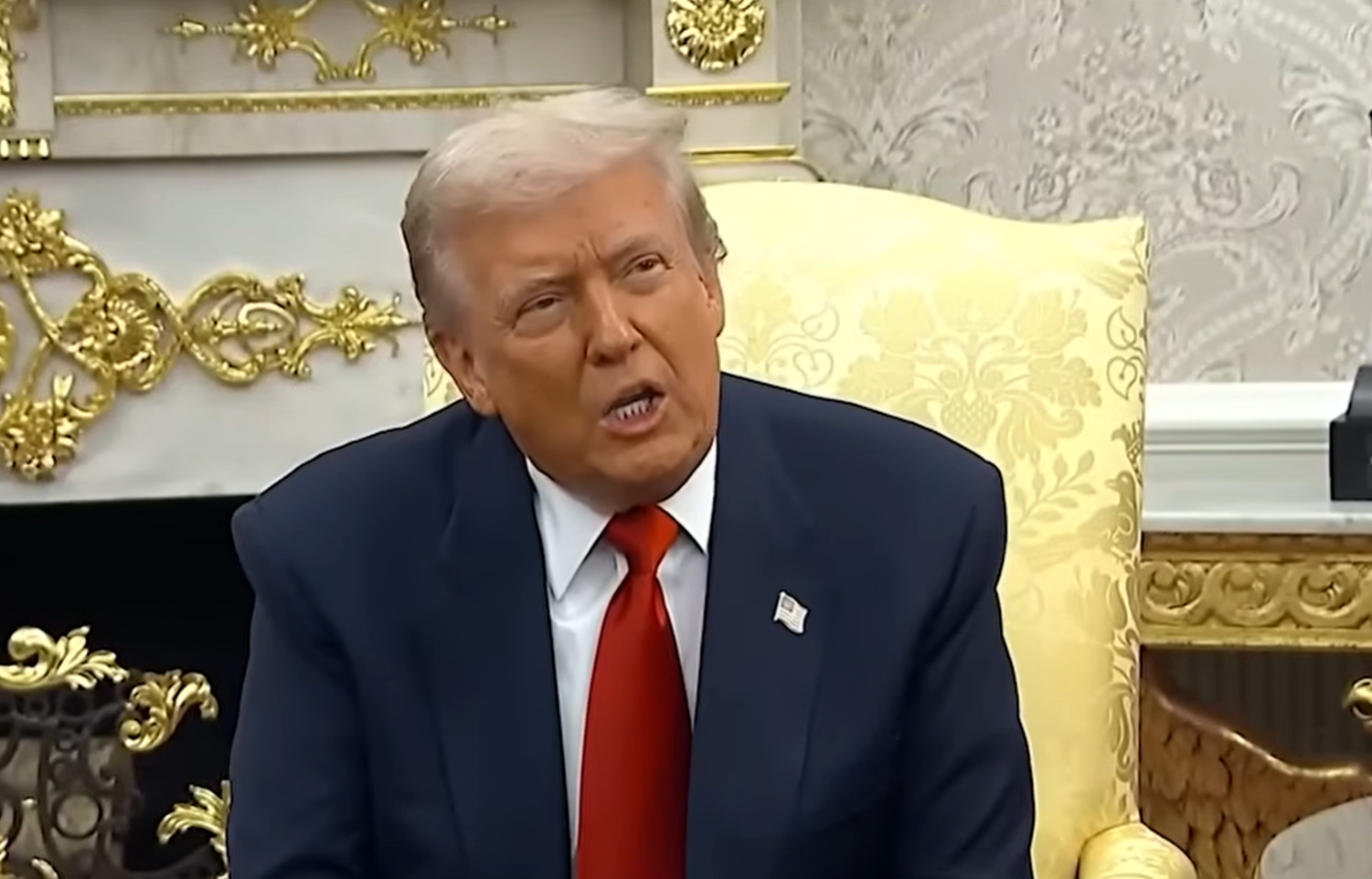

Taxes November 19, 2025

President Donald Trump on Tuesday gave his sharpest rebuke of congressional Democrats’ efforts to extend expiring Affordable Care Act enhanced tax credits, saying he would not support legislation to do so.

Taxes November 19, 2025

Donald Trump’s presidential library foundation plans to raise almost a billion dollars in tax-exempt contributions over the next two years to build and operate his high-rise legacy project in downtown Miami, according to new tax filings.