Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes September 5, 2025

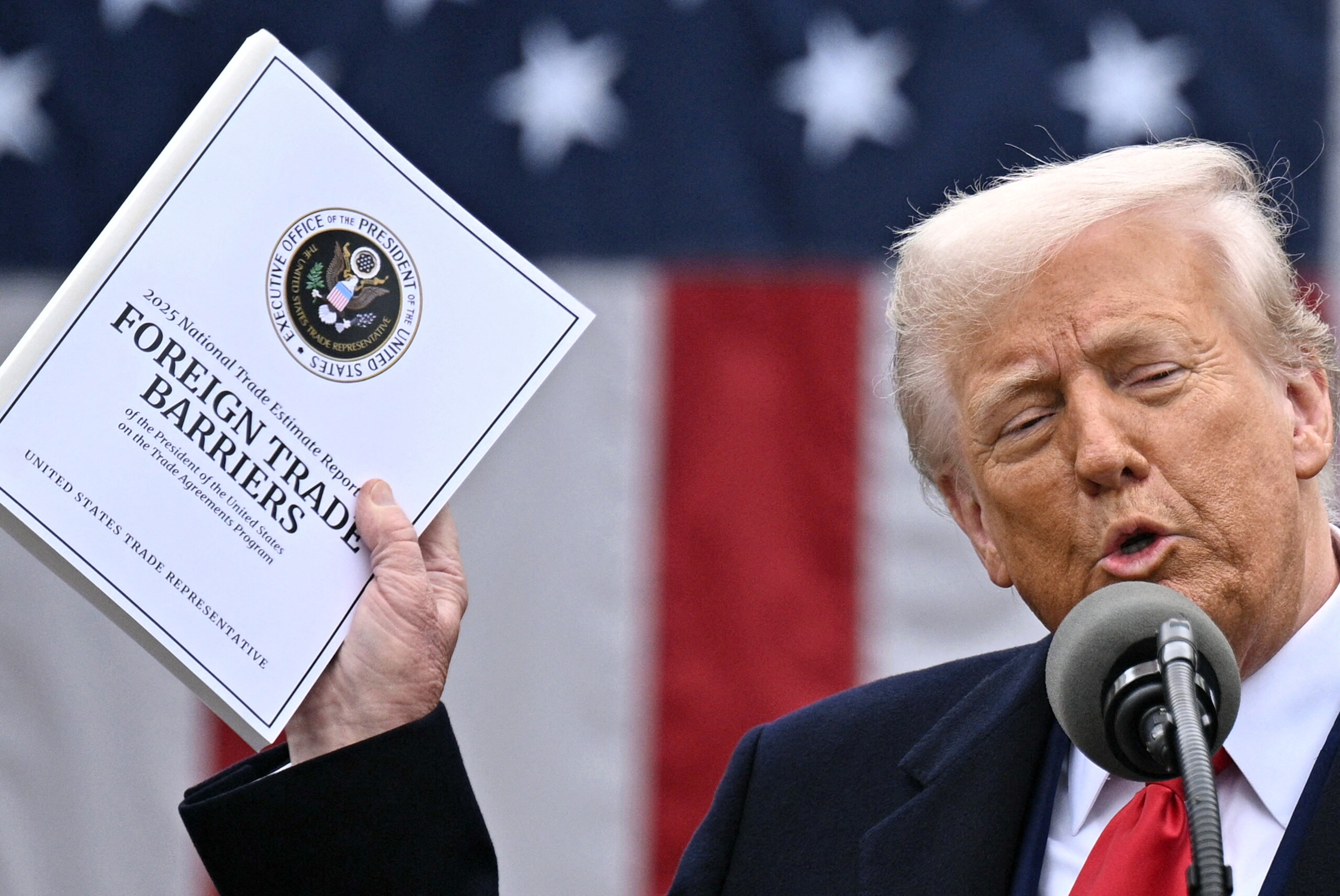

Donald Trump promised to slash red tape for business. His tariff regime has gotten American companies increasingly tangled up in it.

Taxes September 4, 2025

The IRS has already shared the residential addresses of more than 40,000 foreigners with immigration authorities, who are seeking to have the confidential information of at least 1 million more people incorporated directly into their database.

Accounting October 14, 2025 Sponsored

Retirement planning is not one-size-fits-all—it evolves through distinct stages of life and business ownership. This course explores key milestones and strategies to help individuals and small business owners prepare for a secure and efficient retirement.

Taxes September 3, 2025

The Treasury Department and the IRS issued a notice on Aug. 19 proposing to tweak rules that currently "may serve as an impediment to publicly traded foreign corporations redomiciling into the United States."

IRS September 3, 2025

In the first half of the year there were nearly 300 data breaches reported impacting as many as 250,000 clients.

Taxes September 3, 2025

The Treasury Department has provided a list of 68 jobs that will be covered by the “no tax on tips” provision in the One Big Beautiful Bill Act.

Taxes September 3, 2025

The Washington, D.C.-based nonprofit Rewiring America is offering free sessions with trained coaches who can help people navigate federal energy tax incentives before they expire.

Taxes September 3, 2025

The Trump administration will ask the Supreme Court for an expedited ruling in hopes of overturning a federal court decision that many tariffs were illegally imposed, arguing it is essential to keep the president's trade policy intact.

Taxes September 2, 2025

As the NFL season is set to begin on Thursday night and with the first official week of college football in the books, the IRS Criminal Investigation unit has a message for sports bettors: Bet safe. Bet legal.

Taxes September 2, 2025

According to the IRS, about 10,000 employers hadn't paid their deferral as of May 2025, and the tax agency had yet to manually adjust their account which would subject the unpaid amounts to standard collection processes, TIGTA said.

Taxes September 2, 2025

Under the OBBBA, only 90% of gambling losses will be deductible, beginning in 2026. The other 10% is gone forever. What’s more, the overall limit on gambling losses up to the amount of gambling winnings remains in place.

Taxes September 2, 2025

The IRS claimed the average wait time for a taxpayer when calling the agency for assistance was three minutes during the 2024 filing season, but that's not exactly correct, the Treasury Inspector General for Tax Administration said in a recent report.