Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

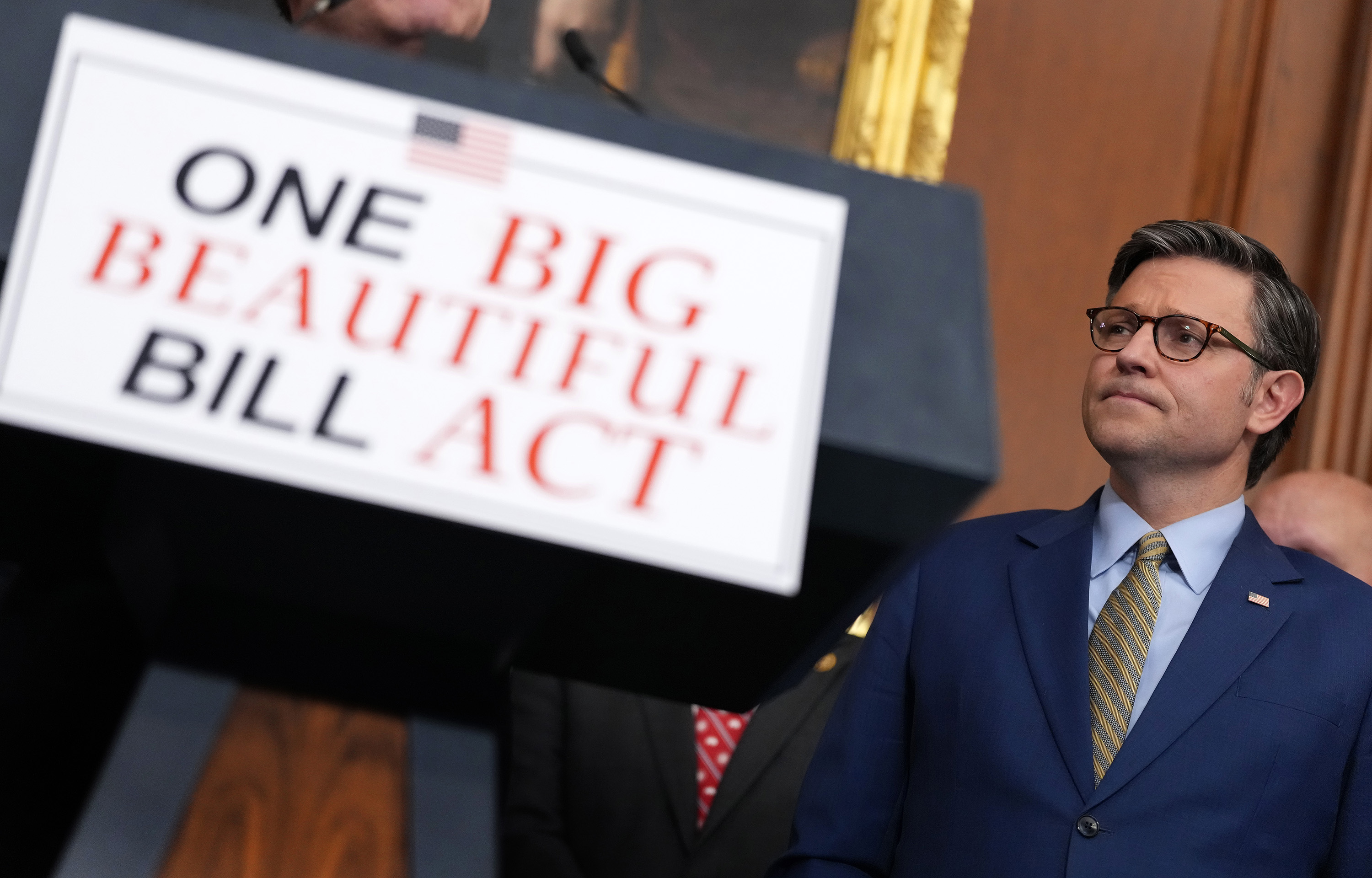

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes July 4, 2025

Business investors and wealthy Americans are among the biggest winners in President Donald Trump’s tax bill. Those hit the hardest include elite universities, which face new levies, and immigrants.

Taxes July 4, 2025

Sales are likely to dip below forecasts but not completely bottom out thanks to an array of new models and incentives from states and dealers.

Taxes July 3, 2025

While not perfect, the One Big Beautiful Bill Act contains many beneficial tax provisions that AICPA President and CEO Mark Koziel believes support the business community and will help grow the economy.

Taxes July 3, 2025

The House passed Republicans' sweeping tax-and-spending bill Thursday afternoon, a day earlier than the July 4 deadline President Donald Trump set to have it on his desk to sign.

Income Tax July 3, 2025

The adoption of an electronic system for federal disbursements and receipts would increase efficiency, reduce costs, and significantly diminish the occurrence of lost or stolen checks.

Taxes July 3, 2025

The House advanced President Donald Trump's sweeping tax-and-spending bill in a procedural vote overnight after nearly all of the Republican holdouts flipped their votes in support.

Taxes July 2, 2025

Republicans were scrambling Wednesday to salvage their “big, beautiful” reconciliation bill amid a revolt from conservatives over the measure’s growing price tag.

Taxes July 2, 2025

A Nevada lawmaker and a downtown Las Vegas casino owner are among those united in opposition to a provision in the proposed federal budget bill that would limit declarable losses for gamblers.

Taxes July 2, 2025

President Donald Trump’s multitrillion-dollar tax bill is running into Republican resistance in the House as ultraconservative and moderate GOP lawmakers threaten to defy the president and sink his domestic agenda.

Taxes July 2, 2025

Polling has found the "big, beautiful bill" is not especially popular with voters, prompting Democrats to see an opening to weaponize it in midterm contests.

AICPA July 1, 2025

The U.S. Senate passed its reconciliation bill earlier today, which removes the limit on pass-through businesses’ state and local tax (SALT) deductions entirely, generating optimism for those affected businesses.

Taxes July 1, 2025

The slim 51-50 vote margin sets up a frantic few days in the House, where Republicans have to figure out how to unite to get a bill to President Donald Trump’s desk before his self-imposed July 4 deadline.