Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes July 1, 2025

Beginning July 14 through July 25, the conference will take place at the Westin New York in Times Square, focusing on a range of topics, including international, partnership, state and local taxation, trusts and estates, and like-kind exchanges.

Taxes July 1, 2025

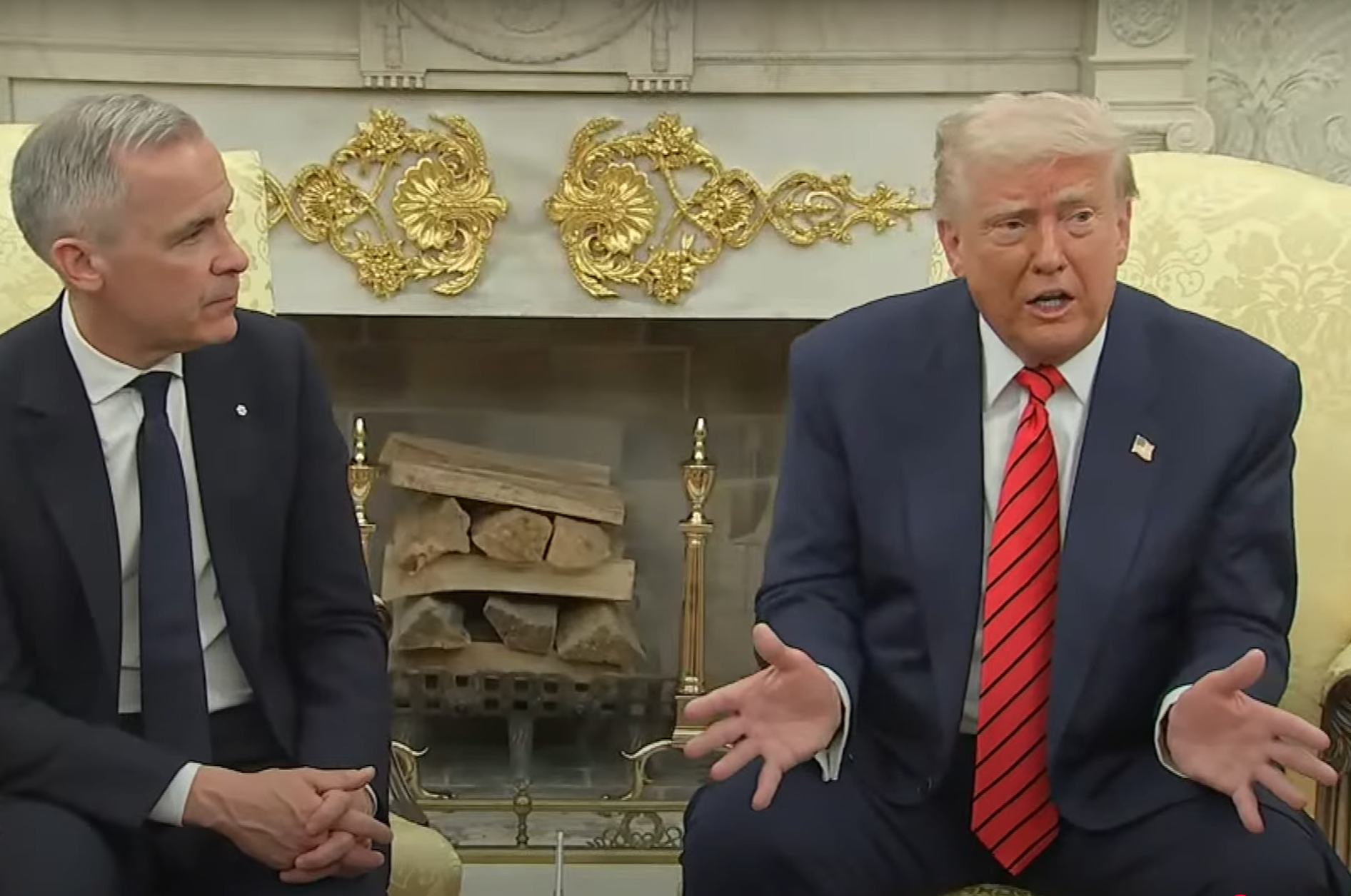

Canada has withdrawn its digital services tax on technology companies such as Meta Platforms Inc. and Alphabet Inc. in a move to restart trade talks with the U.S.

Taxes July 1, 2025

The Tesla CEO is once again threatening to ramp up his political spending, this time targeting nearly every sitting Republican in Congress who has signaled support for President Donald Trump’s multitrillion-dollar tax bill.

CAS June 30, 2025

The Sales Tax Sisters and Roundtable Labs partner to launch a supportive, educational space for accounting professionals struggling with sales tax.

Taxes June 30, 2025

Elon Musk slammed the Senate's latest version of President Donald Trump’s multitrillion-dollar tax bill warning that the cuts to EV and other clean energy credits would be “incredibly destructive” to the country.

Taxes June 30, 2025

As part of the deal, U.S. officials agreed to remove a provision from President Donald Trump’s tax cut bill, called the "revenge tax," that would have increased taxes on the U.S. income of non-U.S.-based businesses and individuals.

Taxes June 30, 2025

The plan had drawn opposition from members of both parties, and the Senate parliamentarian last week had ruled a more ambitious plan didn’t belong in the budget bill.

Small Business June 29, 2025

President Donald Trump said he doesn’t think he’ll need to extend the July 9 trade deadline he has imposed on countries to secure deals with the U.S. to avoid higher tariffs.

Taxes June 29, 2025

The bill’s cost has been a big problem for fiscal conservatives. It has faced several obstacles in the Senate as lawmakers have demanded conflicting changes.

Legislation June 29, 2025

The president and CEO of the American Institute of CPAs, Mark Koziel, CPA, CGMA, has released a statement following the release of the text of the U.S. Senate’s reconciliation bill.

Accounting June 28, 2025

The Innovation Awards highlight technologies that are shaping the profession and small businesses through increased collaboration and productivity.

Taxes June 27, 2025

“It’s not the end-all. It can go longer,” Trump told reporters at a White House press conference on June 27. “But we’d like to get it done by that time, if possible.”