Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes June 27, 2025

President Donald Trump said he was ending all trade discussions with Canada after claiming the country moved to implement a digital services tax and threatened to impose a fresh tariff rate within the next week.

Taxes June 27, 2025

The Senate parliamentarian concluded that a section of the tax bill exempting a small number of religious schools, including the Christian liberal arts college in Hillsdale, MI, violated the chamber's procedural rules for the budget reconciliation process.

Taxes June 26, 2025

In an opinion column for Newsweek, the caucus members argued that the Senate would preserve “too much” of what President Donald Trump previously called a “scam.”

Payroll June 26, 2025

The personal finance website GoBankingRates analyzed state and federal data from the Tax Foundation for 2024 to assess what a $100,000 income looks like in each state.

Small Business June 26, 2025

Sales tax holidays typically delight consumers, but they can be hard on retailers. Keep reading to find out why and to learn which states will have sales tax holidays in 2025.

Firm Management June 26, 2025

Survey respondents predict AI will save professionals 5 hours weekly, translating to 240 hours annually per professional.

Taxes June 25, 2025

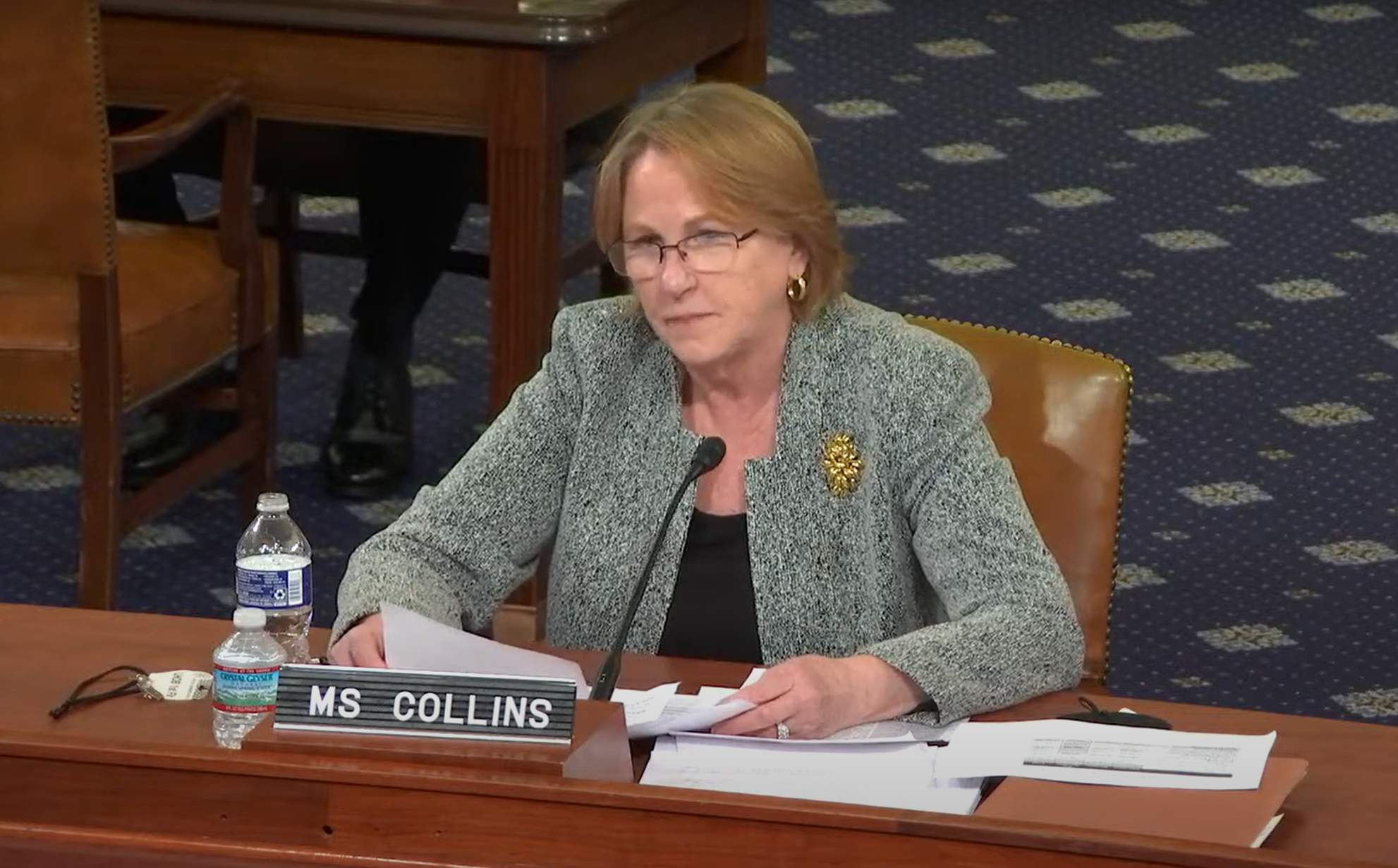

Despite calling this past tax filing season one of the most successful in recent memory, National Taxpayer Advocate Erin Collins warned there are potential risks heading into the 2026 tax season and that "it is critical that the IRS begin to take steps now to prepare."

Taxes June 25, 2025

The agency said it's aware of a delay in processing some electronic payments and that some taxpayers are receiving IRS notices indicating a balance due even though payments were made on time.

Taxes June 24, 2025

Republican leaders are stepping on the gas to get the giant budget package to President Donald Trump's desk before his July 4 deadline.

Technology June 24, 2025

The top five accounting firm said its new myRSM Tax ecosystem "demonstrates how cutting-edge AI is transforming client service, streamlining operations, and empowering professionals across the firm."

IRS June 23, 2025

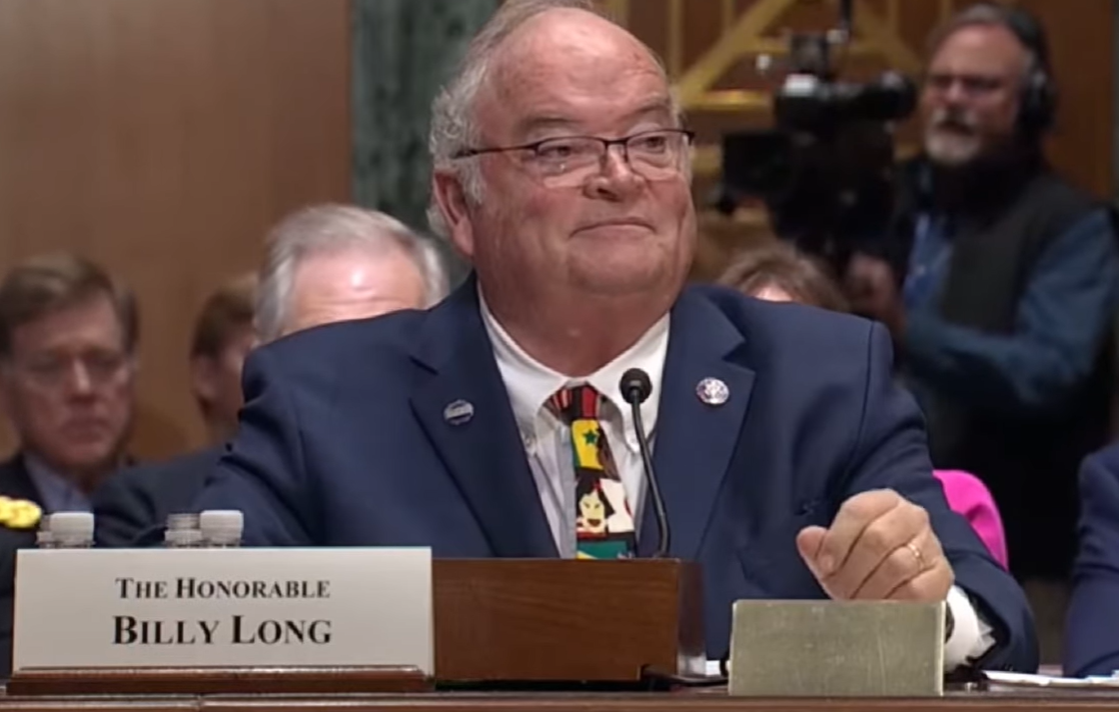

The former Missouri lawmaker, who was sworn in on June 16, said transforming the culture at the tax agency is at the top of his to-do list.

Taxes June 23, 2025

Victims of severe storms that produced flooding and damaging winds in areas of Texas and Mississippi in mid- to late March have more time to file various federal individual and business tax returns and make tax payments, the IRS said.