Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes June 17, 2025

Senate GOP released a bill that would end tax credits for wind and solar earlier than for other sources, and make only modest changes to most other incentives, dashing hopes of those seeking relief from major cuts passed by the House.

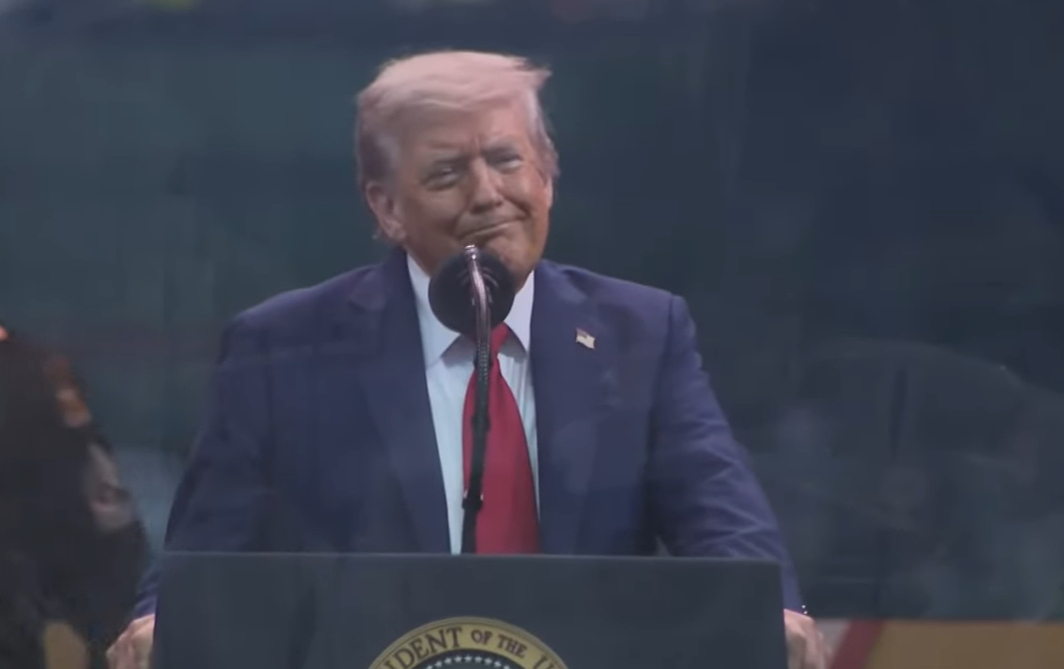

Taxes June 17, 2025

The Senate's version of President Donald Trump’s signature economic package expands some tax breaks while raising the debt ceiling by $5 trillion, instead of $4 trillion in the House-passed measure.

State and Local Taxes June 16, 2025

The Senate Finance Committee Monday rolled back the SALT deduction cap to $10,000 in its first draft of President Trump's sprawling budget bill, a dramatic reversal from the $40,000 that was negotiated in the House last month.

Taxes June 16, 2025

The “big, beautiful” tax bill that’s currently winding its way through Congress would, if it becomes law, lead to drastically different results for U.S. taxpayers, depending on where you fall on the income spectrum.

Taxes June 16, 2025

State CPA societies across the country are expressing their strong opposition to a provision in the One Big Beautiful Bill Act which would eliminate the ability of specified service trades or businesses (SSTBs) to deduct state and local taxes (SALT) at the entity level.

IRS June 16, 2025

Probationary employees' jobs were in limbo for weeks. Meanwhile, many IRS workers across the agency are looking to leave.

Technology June 16, 2025

TaxPlanIQ, a provider of tax planning software for tax and accounting firms, has launched several new features designed to make tax planning more efficient and scalable.

Technology June 16, 2025

Taxfyle on Monday introduced TXF Intelligence, a generative artificial intelligence tool built to automate and streamline tax return preparation for small tax and accounting firms in the U.S.

Small Business June 13, 2025

President Donald Trump’s trade war is affecting Americans from buying groceries to paying electric bills, with the cost of bananas, ground beef, and electricity surging to all-time highs.

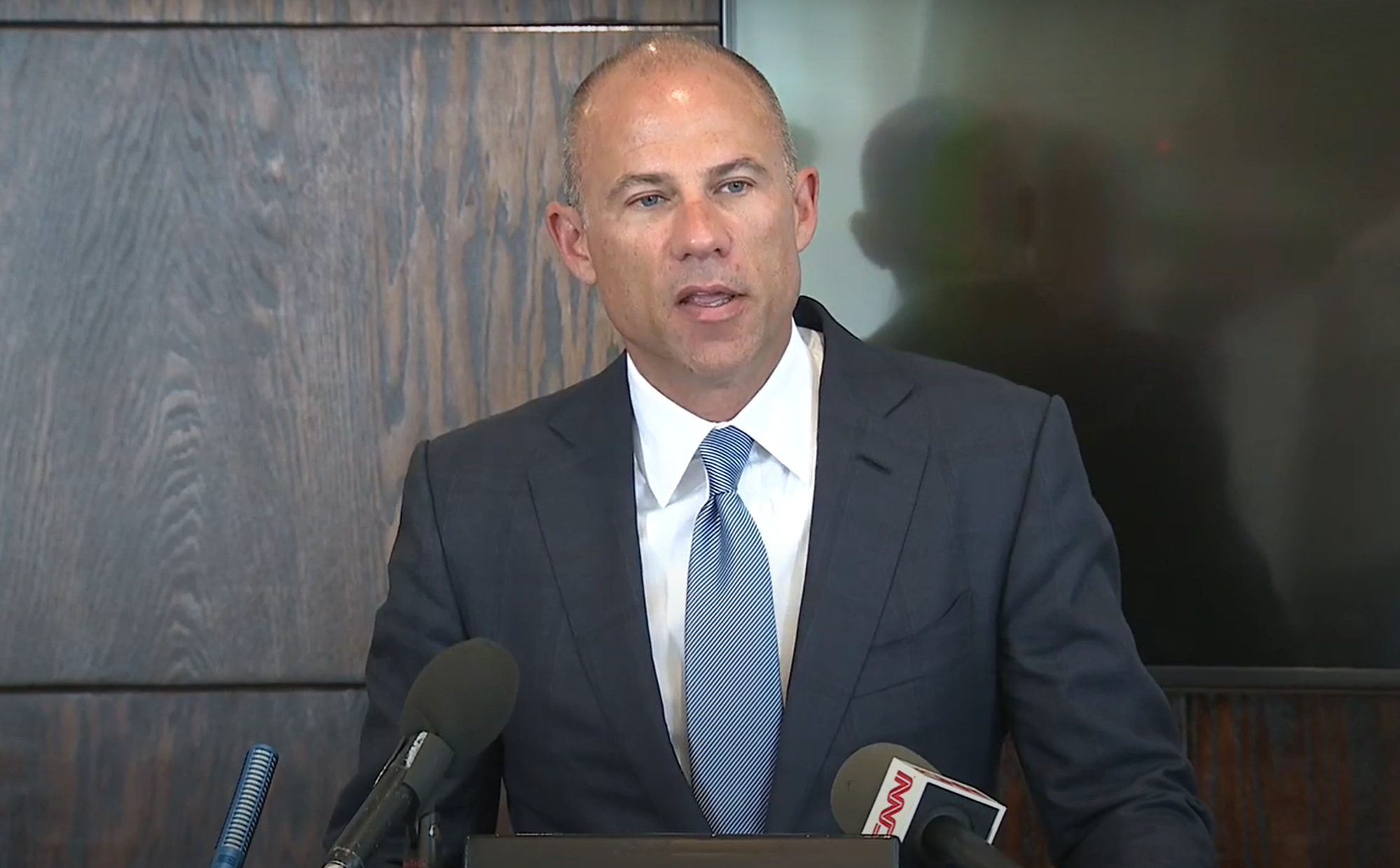

Taxes June 13, 2025

The lawyer who represented adult film star Stormy Daniels in her court battles against President Donald Trump, was resentenced June 12 to 11 years in prison for dodging taxes and stealing millions of dollars from clients.

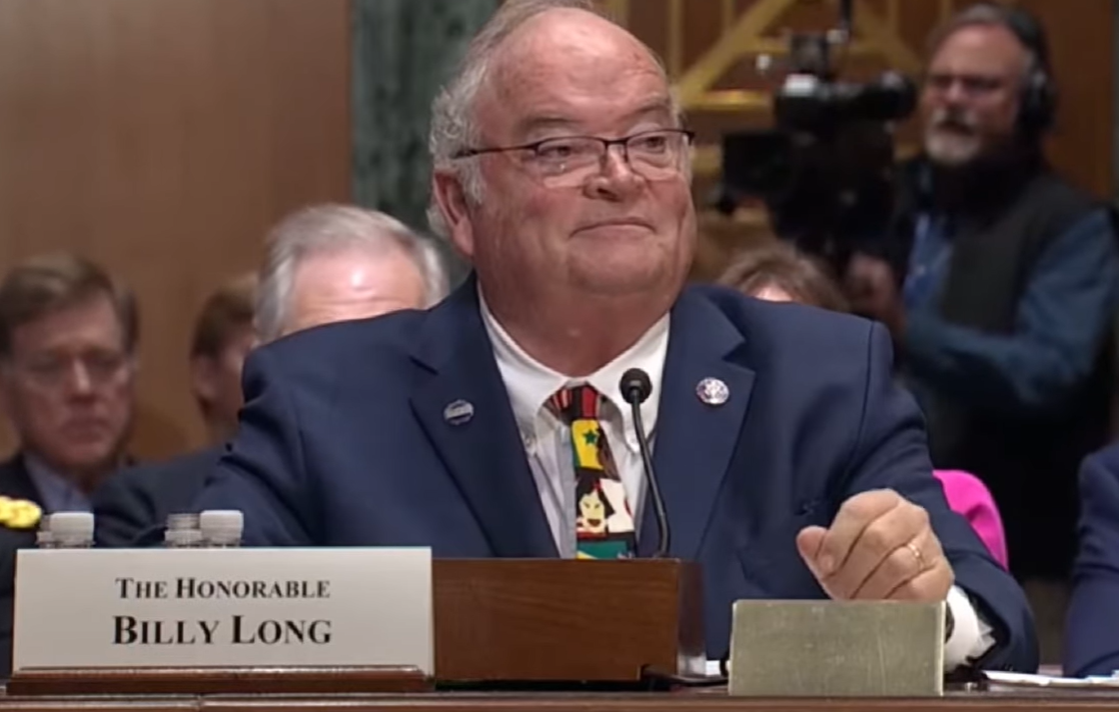

IRS June 12, 2025

The former Missouri lawmaker won confirmation on June 12 to be the next commissioner of the IRS, leading an agency that will play a key role in administering new tax breaks if Congress passes the “big, beautiful” reconciliation package.

Taxes June 12, 2025

The reconciliation bill passed by the House would most benefit high earners and reduce financial resources available to the lowest-income households, the Congressional Budget Office said on June 12.