Taxes February 13, 2026

Tax Court Slams Brakes on Charitable Deduction

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

Taxes February 13, 2026

The Tax Court immediately nixed the deduction because of the inadequate substantiation and the lack of any appraisal for high-income items.

February 12, 2026

February 12, 2026

February 12, 2026

Taxes June 19, 2025

Mexican-made packs of popular U.S. cigarette brands are flooding the market as a result of a loophole in U.S. trade law.

Taxes June 18, 2025

Following the release of the reconciliation bill by the Senate, the AICPA has identified several provisions it supports.

Small Business June 18, 2025

The request filed by two family-owned toy companies on June 17 seeks to put the case on an expedited track with the possibility of a definitive Supreme Court ruling by the end of the year.

Taxes June 17, 2025

Despite changes from the Tax Cuts and Jobs Act (TCJA), military personnel may still claim a deduction for job-related moving expenses. But simply working for the armed forces doesn’t command a deduction.

Taxes June 17, 2025

The proposal, which follows the House’s narrow passage of its own version in May, includes sweeping changes to the tax code.

Taxes June 17, 2025

Senate Republicans’ tax bill would eliminate federal taxes and regulations on short-barreled rifles, short-barreled shotguns, and silencers as well as preempt state or local licensing requirements in a win for gun-rights advocates.

Taxes June 17, 2025

Senate GOP released a bill that would end tax credits for wind and solar earlier than for other sources, and make only modest changes to most other incentives, dashing hopes of those seeking relief from major cuts passed by the House.

Taxes June 17, 2025

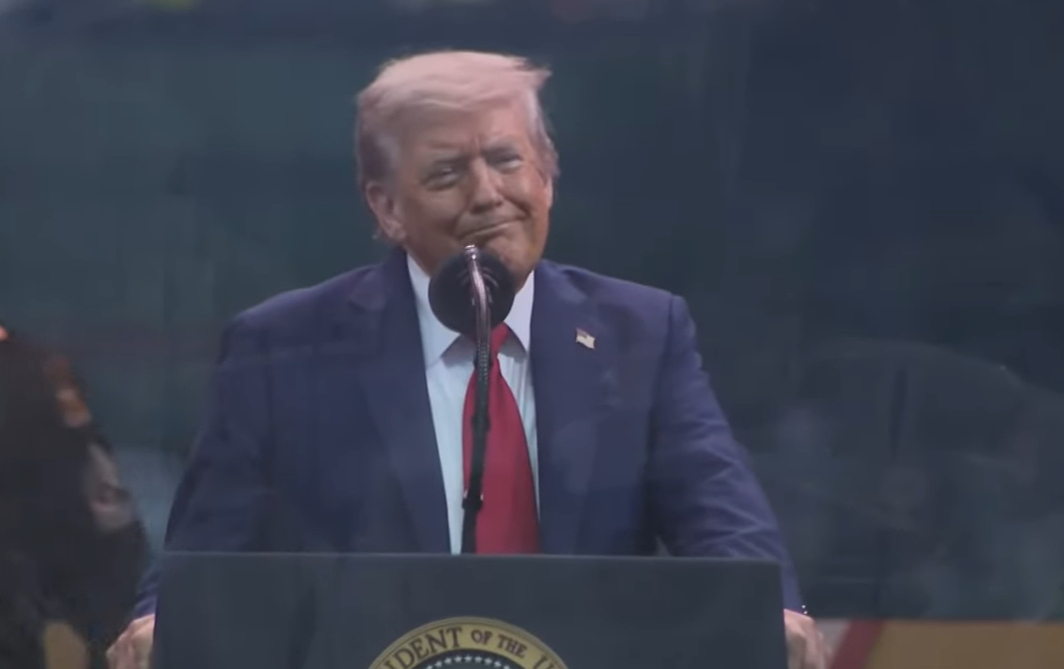

The Senate's version of President Donald Trump’s signature economic package expands some tax breaks while raising the debt ceiling by $5 trillion, instead of $4 trillion in the House-passed measure.

State and Local Taxes June 16, 2025

The Senate Finance Committee Monday rolled back the SALT deduction cap to $10,000 in its first draft of President Trump's sprawling budget bill, a dramatic reversal from the $40,000 that was negotiated in the House last month.

Taxes June 16, 2025

The “big, beautiful” tax bill that’s currently winding its way through Congress would, if it becomes law, lead to drastically different results for U.S. taxpayers, depending on where you fall on the income spectrum.

Taxes June 16, 2025

State CPA societies across the country are expressing their strong opposition to a provision in the One Big Beautiful Bill Act which would eliminate the ability of specified service trades or businesses (SSTBs) to deduct state and local taxes (SALT) at the entity level.

IRS June 16, 2025

Probationary employees' jobs were in limbo for weeks. Meanwhile, many IRS workers across the agency are looking to leave.