Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

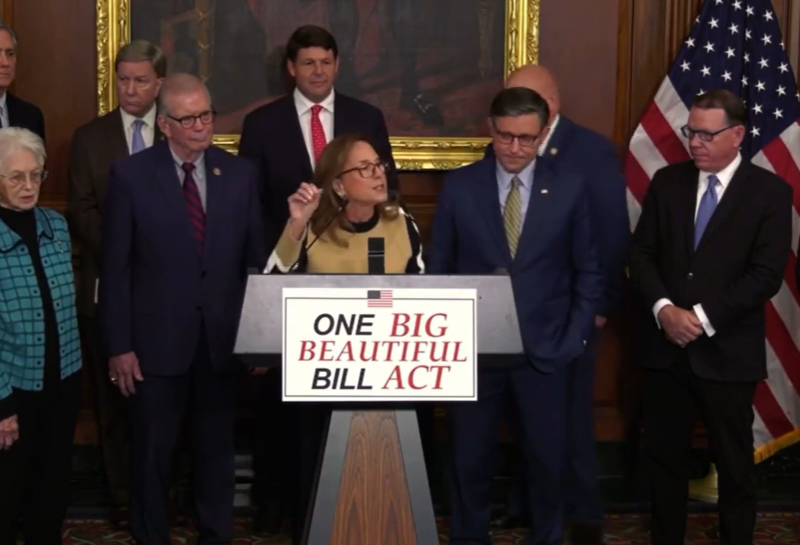

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes June 9, 2025

The 1,037-page bill is chock full of increased spending for border security and the military, but the biggest ticket items are sweeping tax cuts that Republicans say will boost the economy.

Technology June 9, 2025

The tax management platform announced on June 9 the launch of its artificial intelligence-driven tax reports, designed to enhance how business owners and individuals make tax decisions and maximize tax savings.

Taxes June 6, 2025

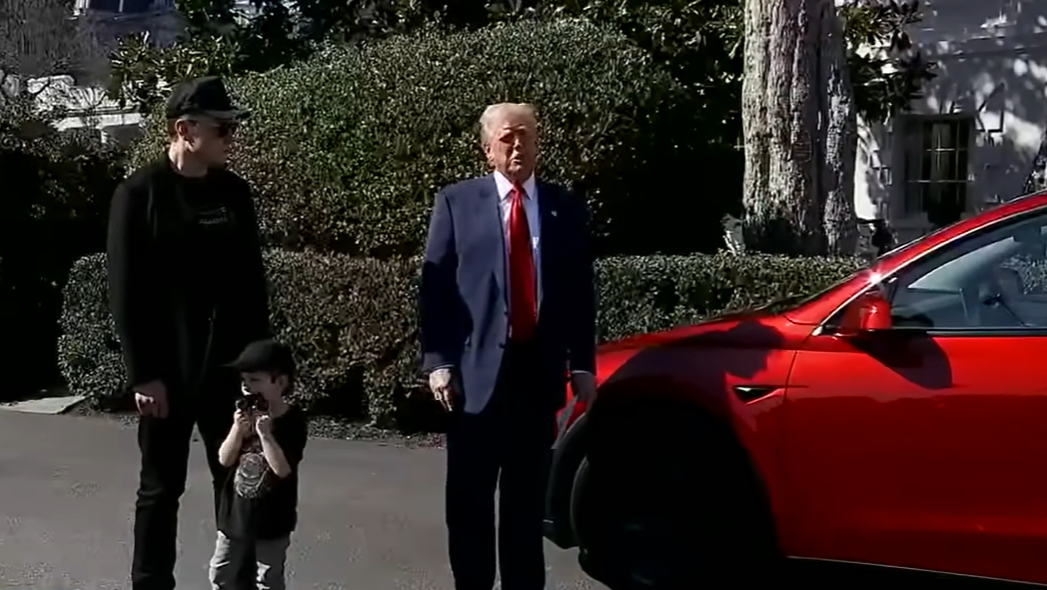

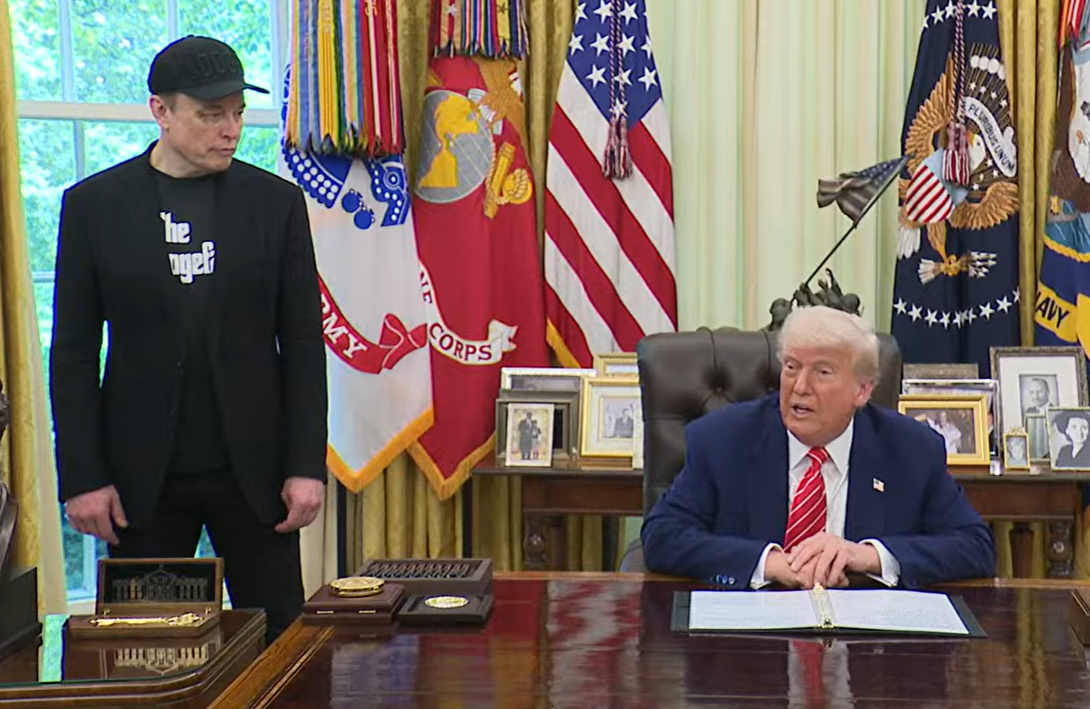

The current feud between President Donald Trump and Elon Musk is increasing pressure on the White House over its signature legislation known as the “One Big Beautiful Bill Act”—a bill under intense scrutiny in the Senate.

State and Local Taxes June 6, 2025

Senate Majority Leader John Thune (R-SD) has suggested the upper chamber will have to make some changes to the massive tax breaks and spending package passed by the House—including to the SALT cap.

Taxes June 5, 2025

The president hit back at the Tesla CEO over his criticism of Republicans' massive budget proposal, suggesting the tech mogul is primarily upset over provisions that slash government support for electric vehicles.

Taxes June 5, 2025

The IRS just released its annual “Data Book” providing vital information about the agency’s activities for its 2024 fiscal year (FY2024) spanning October 1, 2023, through September 30, 2024 .

Taxes June 4, 2025

The former presidential advisor stepped up his fight against the One Big Beautiful Bill Act on June 4, calling on Americans to pressure their representatives in Washington to “kill” the legislation.

Taxes June 4, 2025

If President Donald Trump’s “big, beautiful bill” passes, taxes will be cut by roughly $3.75 trillion but it will add $2.4 trillion to the overall deficit over the next decade, according to a new report from the Congressional Budget Office.

Taxes June 4, 2025

Republican congressional leaders pushed back Wednesday on Elon Musk’s harsh criticism of President Trump’s signature budget bill as a fiscally dangerous “disgusting abomination.”

Taxes June 4, 2025

The House kept some tax credit incentives for new nuclear projects in its tax break and immigration megabill because the industry would die out without them, said U.S. Rep. Chuck Fleischmann (R-TN).

Taxes June 4, 2025

There has been a lot of talk in hockey circles recently how a select group of teams possibly have an upper hand in the NHL because they play in states without an income tax.

Taxes June 4, 2025

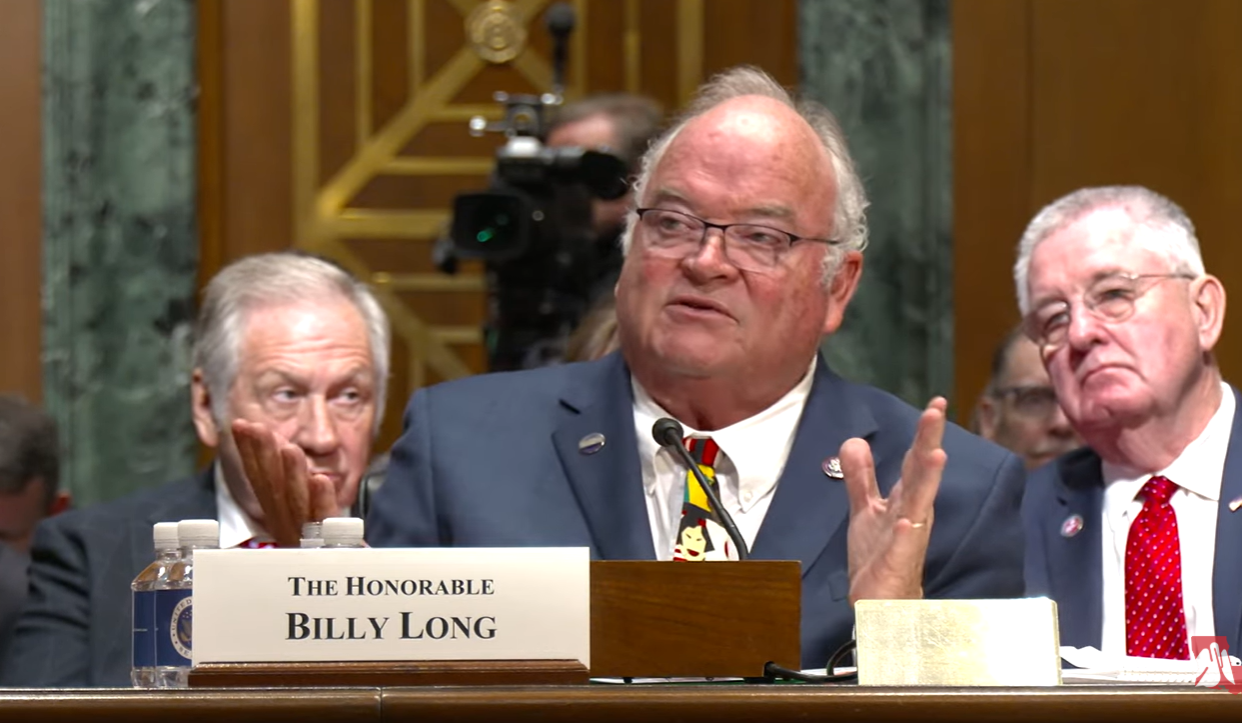

The Senate Finance Committee voted along party lines on June 3 to approve President Donald Trump’s nomination of former Missouri Rep. Billy Long to lead the IRS over the objections of Democrats.