Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes April 25, 2025

President Donald Trump has said he's open to the idea of raising taxes, particularly on America's top earners; however, a recent poll shows voters are concerned about the prospect of tax hikes and would like to see Trump's 2017 tax cuts kept in place.

Taxes April 24, 2025

Accountants can play a crucial role in helping their clients take full advantage of the Inflation Reduction Act's clean energy tax credits through strategic planning.

Taxes April 24, 2025

The president said imposing a higher tax rate on millionaires would spur the country’s richest to leave the U.S., downplaying an idea that is under discussion in some Republican circles as a way to pay for an economic package.

Taxes April 24, 2025

A dozen states filed a federal lawsuit on April 23 challenging the Trump administration’s imposition of sweeping tariffs, arguing the president trampled on Congress’ powers to raise taxes.

Taxes April 24, 2025

There were more than 300 new lobbying registrations—disclosures firms file when they acquire new clients—citing tax policy issues, up more than 200% compared to the first quarter last year and more than 260% compared to the previous quarter.

Taxes April 23, 2025

Lawrence Summers said that the Trump administration’s moves to downsize the IRS, along with other changes, are likely to incentivize reduced tax-payment compliance.

Taxes April 22, 2025

A Republican proposal to tax income over $1 million at a 40% rate could generate around $400 billion over a decade, according to estimates from the Budget Lab at Yale and the Tax Foundation.

Taxes April 22, 2025

Sacramento Assemblywoman Stephanie Nguyen, D-Elk Grove, highlighted a new bill this week that would give a tax credit to business owners who say they have to spend money cleaning up after people who camp out on or near their properties.

Taxes April 22, 2025

By checking tax withholding, individuals can prevent having to owe additional money and any potential penalties at tax time.

Taxes April 21, 2025

After the feds froze more than $2 billion in grants to the Cambridge campus and threatened its tax-exempt status, Harvard University has filed a lawsuit against the Trump administration in Massachusetts federal court.

Payroll April 21, 2025

A study by GoBankingRates found that nationally the average person needed to earn $130,000 to take home $100,000 after factoring in federal and state income taxes.

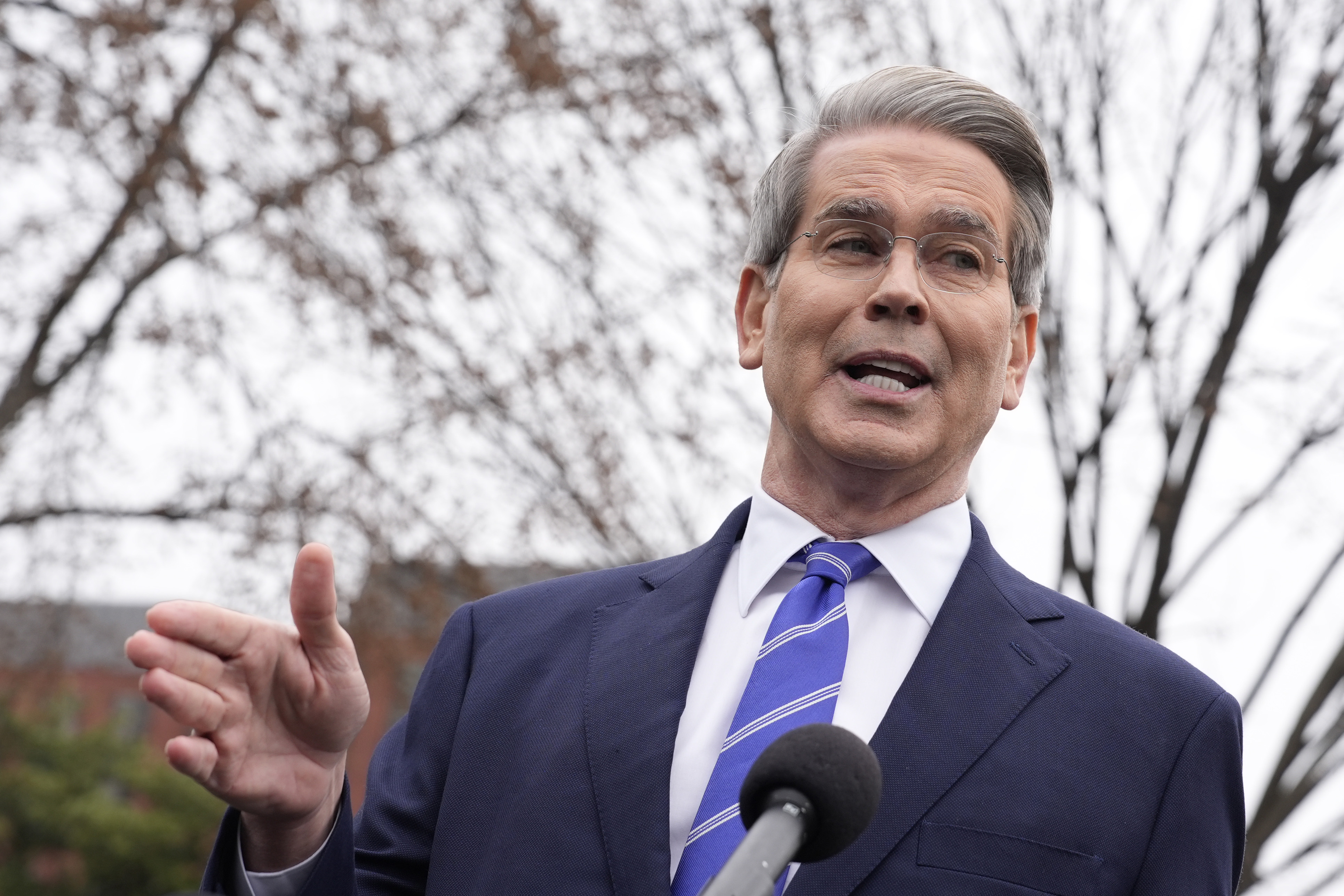

IRS April 19, 2025

Treasury Secretary Scott Bessent appointed his deputy, Michael Faulkender, as the next acting chief of the IRS after reports the current leader of the agency, Gary Shapley, had been installed at the urging of Elon Musk without Bessent’s knowledge.