Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

Taxes April 4, 2025

The Tax Blotter is a round-up of recent tax news and Tax Court rulings.

IRS April 3, 2025

Those who were casualties of the Trump administration's federal cost-cutting purge in February but later reinstated and put on paid leave last month after two court rulings have been told to come back to their jobs on April 14.

Taxes April 3, 2025

President Donald Trump, in the wake of his sweeping tariffs announcement on Wednesday, took a victory lap Thursday morning, posting on Truth Social that he had saved the American economy.

Taxes April 3, 2025

These are the nations, many of them staunch U.S. allies, that President Donald Trump has claimed take advantage of the U.S. through unfair trade practices.

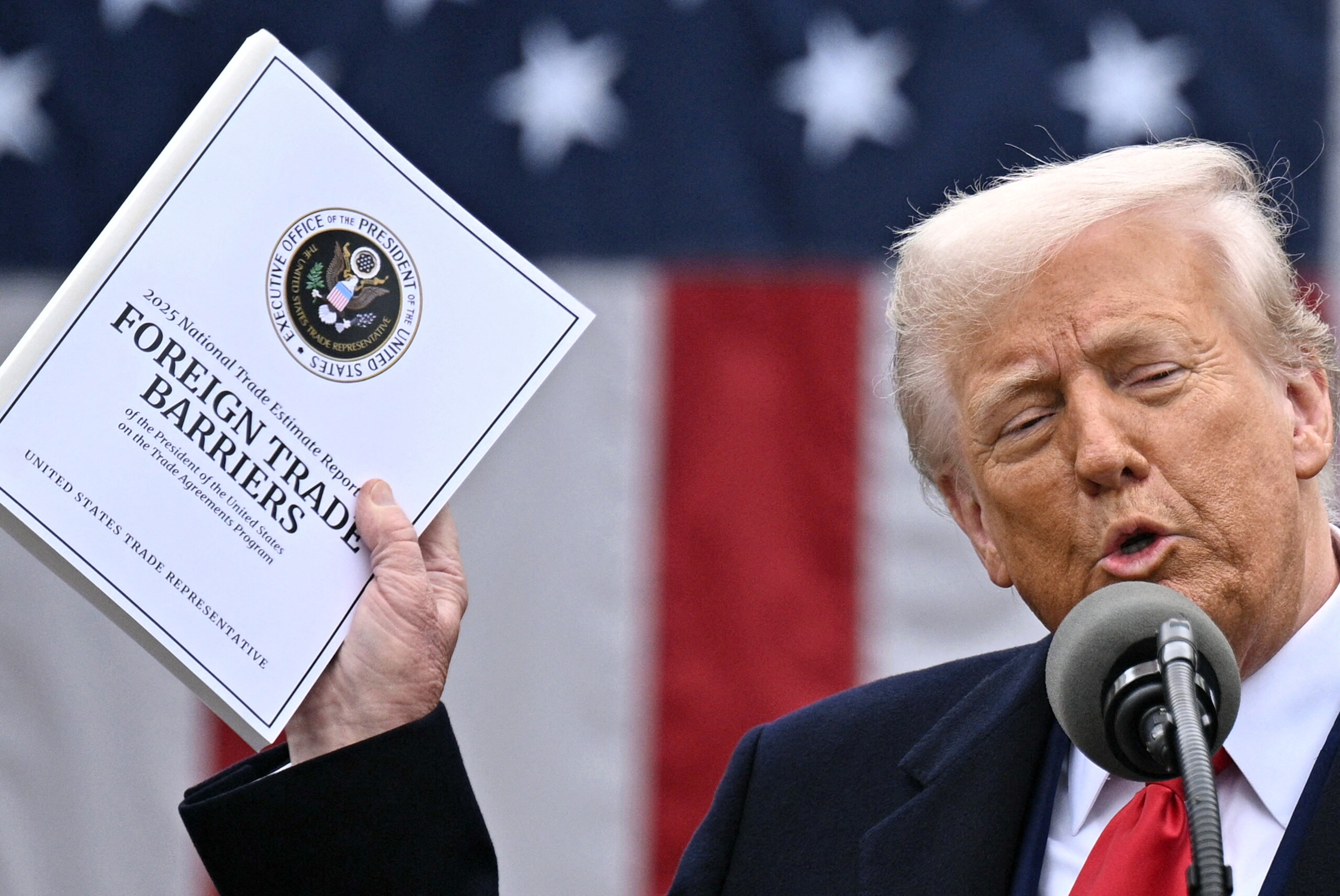

Taxes April 2, 2025

In a Rose Garden speech on April 2, Trump said the U.S. would begin applying a universal baseline tariff of 10% on imported goods from all foreign countries.

Mergers and Acquisitions April 2, 2025

As part of the deal, GTM and DMA have entered into a strategic alliance, and the acquisition complements GTM's existing income tax practice.

Mergers and Acquisitions April 2, 2025

The Dallas-based tax services firm has expanded its income tax practice after acquiring Brayn Consulting, a Houston-based tax firm that specializes in research and development, cost segregation, and green energy income tax incentives.

Taxes April 2, 2025

Washington Gov. Bob Ferguson on April 1 panned budget plans by legislative Democrats for relying on "far too much in taxes," including a new wealth tax he warned could be overturned by courts.

Small Business April 2, 2025

If you do business in Texas, you’ve probably heard of franchise tax. But you may not know exactly what the Texas franchise tax is — or if it applies to you. This blog post and Texas franchise tax FAQ will answer the following questions.

Taxes April 1, 2025

These anti-tariff messages have popped up on digital billboards in Georgia, Florida, and 10 other states, as well as around the nation’s capital, all paid for by the Canadian government.

Taxes April 1, 2025

These bills, which were also included in the recent Senate discussion draft, will improve transparency and fairness for taxpayers and are strongly supported by the AICPA.

Small Business April 1, 2025

Mississippi may implement a retail delivery fee as early as July 1, 2025. If it does, it will join Colorado and Minnesota, the only states with a fee on retail deliveries today.