Taxes February 6, 2026

IRS Issues Proposed Rules on Clean Fuel Tax Credit

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

Taxes February 6, 2026

The Treasury Department and the IRS released proposed regulations Feb. 3 on the clean fuel production credit under the One Big Beautiful Bill Act.

February 6, 2026

February 5, 2026

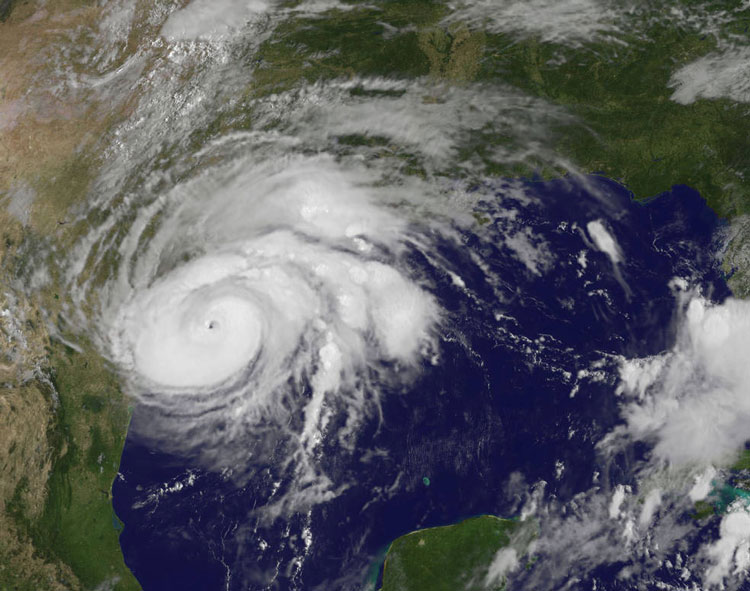

Taxes February 26, 2025

The Filing Relief for Natural Disasters Act would expedite the issuance of federal tax relief and provide the IRS with authority to grant tax relief once the governor of a state declares a disaster or state of emergency.

AICPA February 26, 2025

The AICPA’s recommendations were submitted to clarify the proposed revisions to the Treasury’s standards, as well as other rules that tax and valuation practitioners must follow.

IRS February 26, 2025

IRS chief operating officer Melanie Krause will be taking over as the agency's acting commissioner, a move that was announced by Treasury Secretary Scott Bessent on Monday after current IRS interim chief Douglas O'Donnell said he plans to retire on Feb. 28.

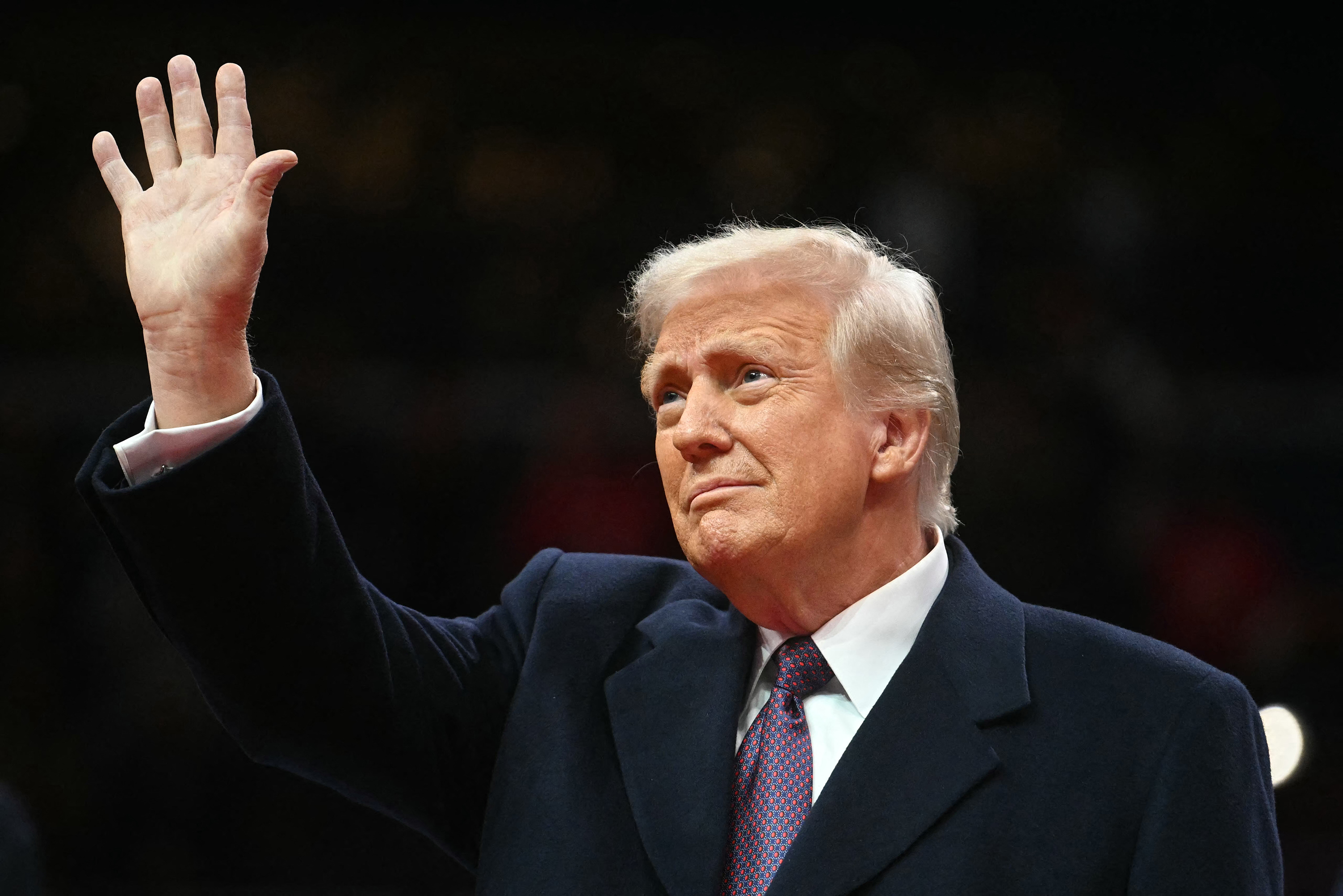

Taxes February 26, 2025

Chances for early action on Donald Trump's tax cut plans improved as House Republicans passed a budget blueprint Tuesday calling for deep cuts in safety-net programs such as Medicaid.

Taxes February 25, 2025

Governments can look to streamline tax administration to support transparent tax administration for constituents and businesses, while remaining budget conscious.

Taxes February 25, 2025

WalletHub released a new study of the states with the highest property tax rates to give prospective homebuyers a better understanding of how much they can expect to pay each year.

Taxes February 25, 2025

Curious what your paycheck would look like if President Trump actually does get rid of the federal income tax? Recently, GOBankingRates compiled data to determine what checks and income would look like, state by state.

Taxes February 25, 2025

Generally, self-employed individuals are required to pay annual self-employment tax, the equivalent of FICA tax for employees, on most business earnings.

![Fraud_Definition_iStock_4_11_13_1_.57a35565088db[1]](https://www.cpapracticeadvisor.com/wp-content/uploads/2020/03/Fraud_Definition_iStock_4_11_13_1_.57a35565088db_1_.5e5ffc60b7920.png)

Taxes February 25, 2025

In total, these claims sought refunds of over $98 million, of which the IRS paid approximately $33 million. McCoy personally received over $1.3 million in fraudulent refunds and was...

Small Business February 25, 2025

“The tariffs are going forward on time, on schedule,” Trump responded. The Commerce Department is currently calculating the rate it will impose on other countries, promising to incorporate both tariffs and other barriers on U.S. imports.

Taxes February 24, 2025

If you get paid through Venmo, PayPal, Cash App or another payment app, you may receive an IRS Form 1099-K this year. Here's what you need to know.

Taxes February 24, 2025

A quick glance at the latest 2025 tax refund numbers may be cause for concern for those who haven’t filed yet, but the IRS says there’s a good reason why certain numbers are down.