Accounting

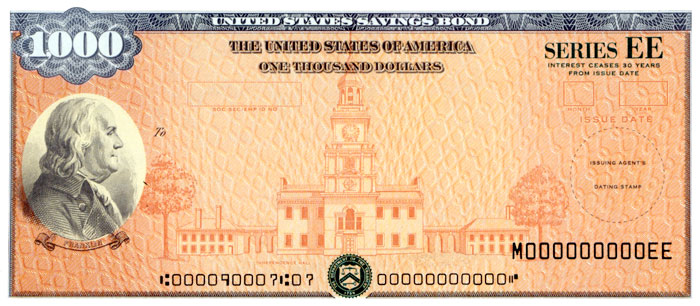

Tax Angles to U.S. Series EE Savings Bonds

For investors looking for safety and a definitive return on their money, U.S. Savings Bonds are a tried-and-true option. Although they aren’t as glamorous as many other investments, you know exactly what you’re getting. Plus, you have more tax leeway ...

Apr. 07, 2022

For investors looking for safety and a definitive return on their money, U.S. Savings Bonds are a tried-and-true option. Although they aren’t as glamorous as many other investments, you know exactly what you’re getting. Plus, you have more tax leeway than usual.

The most common type of U.S. Savings Bond, the Series EE Bond, can trace its roots back to the E Bonds that were first issued during World War II. These bonds have traditionally been given as gifts on birthdays and other occasions like christenings and bar and bat mitzvahs. They may also be used to help finance a private school or college education.

Series EE Bonds provide a fixed rate of interest for 20 years. After that period, the EE Bond is guaranteed to double due to a one-time payment from the U.S. Treasury that effectively increases the rate to 3.5% for ten years. Thus, EE Bonds pay out interest for a total period of 30 years.

You can buy EE Bonds online through the government’s Treasury Direct website at www.treasurydirect.com. You can no longer acquire EE Bonds in paper form.

There are a number of denominations available, but the minimum purchase is $25. The cost of the bond is its face value. For example, you must pay $25 to acquire a $25 Series EE Bond. There’s an annual limit of $10,000.

Notably, U.S. Savings Bonds are backed by the full faith and credit of the U.S. government. That makes them one of the safest investments around.

What about taxes? Generally, EE bonds are subject to federal income tax when you cash in the bonds or they mature, whichever comes first. This provides tax deferral for investors and potentially enables you to pay tax when you’re in a lower tax bracket (e.g., in retirement).

However, you can elect to pay tax annually instead of deferring the tax. Why would you do that? This may make sense if you expect your tax bracket to decrease in the next few years. Or it may be an option for a child who is currently in a low tax bracket.

Caution: This tax election applies to all future Series EE Bonds you purchase. So think things over carefully before you volunteer to pay tax sooner rather than later.

Furthermore, the interest income from U.S. Series E Bonds is completely exempt from federal income tax if the following requirements are met:

- The funds are used for qualified educational expenses. This includes tuition and fees for courses that count toward a degree or certificate program, but not books or room and board.

- The expense is incurred in the same tax year in which the EE Bonds are redeemed.

- Both the principal and the interest from the bonds are used.

- The qualified education expenses have not already been covered by financial aid and scholarships, Section 529 plans, Coverdell Education Savings Accounts (CESAs) or other tax breaks.

- Your filing status is not married filing separately.

Finally, be aware that Series EE Bond interest is exempt from any state income tax. The only tax repercussions are on the federal level.