From the Nov. 2007 Review of Client

Write-Up Systems

Accounting Relief is a web-based unified write-up/trial balance system. It

is accessed via Accountant’s Office Online, which is the hub for all AccountantsWorld

services. In addition to Accounting Relief, modules are available for web-based

live and ATF payroll, sales tax preparation, document management, time and billing,

website creation, and practice management. Accounting Relief is also at the

forefront of a trend toward total integration between a client’s bookkeeping

program and the professional accounting program. This new model for professional/client

accounting eliminates the need to transfer data — it’s already in

the same system as the professional uses.

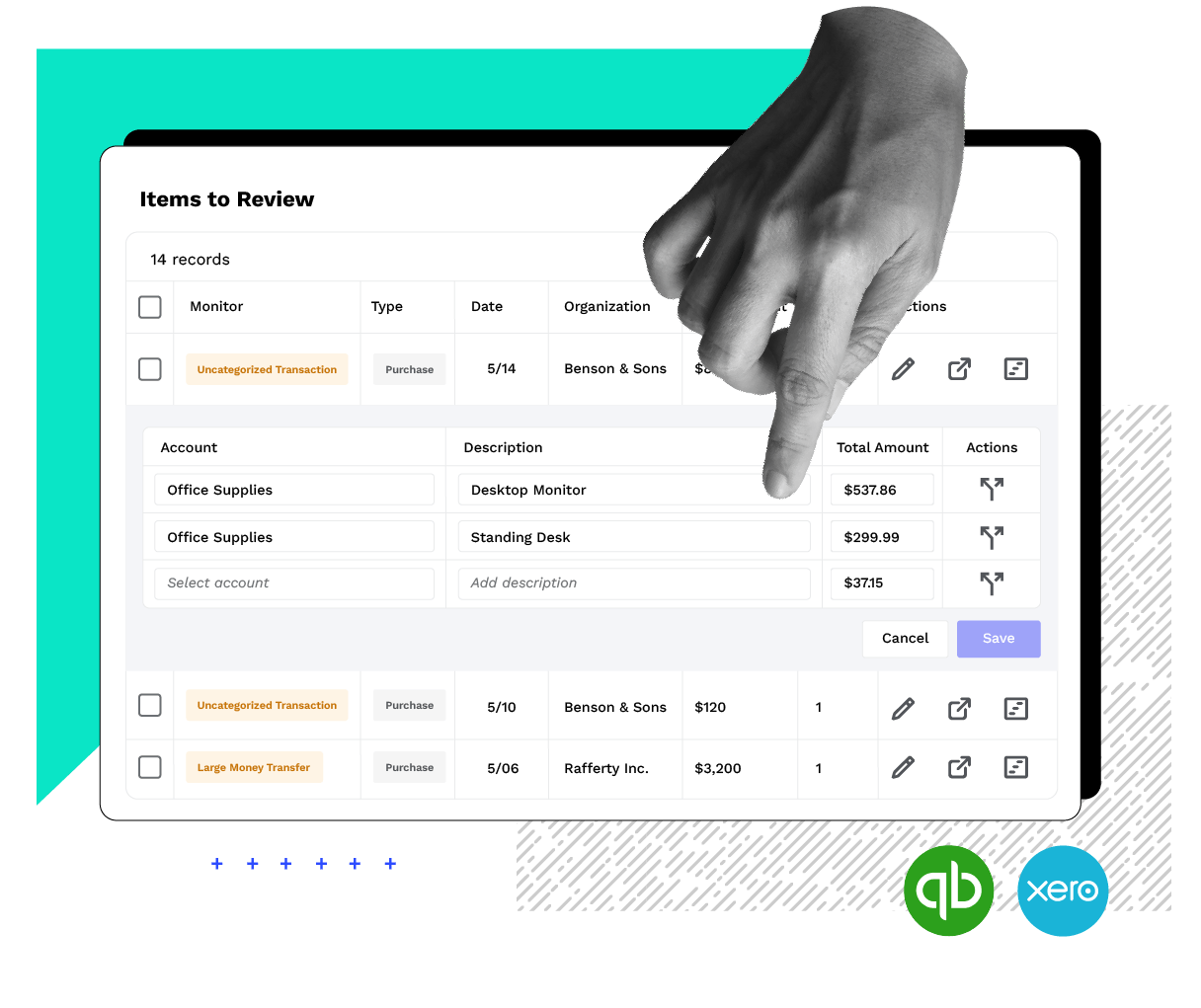

Essentially, clients use and enter their transactional data into the same

system as their accountant uses to provide professional services, with the client

area tailored to the needs of non-professionals and allowing them access only

to areas they need. Meanwhile, the professional’s side of the online accounting

suite provides advanced financial reporting capabilities, strong security features,

user-level customization, and the ability to manage any number of clients and

subsidiary entities. The core Accounting Relief AC system costs $995 per year

or $99 per month for full use, including use of the client bookkeeping functions

by any number of clients, which results in client data flowing directly into

the accounting system for review without the need for data transfer. Smaller

practices can also utilize the system at a cost of $99 per client per year.

LEARNING CURVE & EASE OF USE — 5 Stars

Accounting Relief AC is a fully web-based program that is logged into through

a secure online portal — Accountant’s Office Online (AOO). Whether

in the office, at home or on the road, professional staff and clients log into

their section of the program from the accounting firm’s website (AccountantsWorld

also offers a website development tool). This keeps the accounting firm’s

brand in front of the client. The client interface is different than the professional’s,

providing a simple, graphically appealing flowchart of functions that enables

them to access customers, vendors, banking, invoicing and other traditional

functions in a user-friendly environment that is comparable to off-the-shelf

SMB programs. But since the accounting firm manages the program, clients have

access to only the functions and areas specifically allowed by the accounting

firm. Once within the program, the professional’s interface is customizable

to give access to system features and available modules, and can be set to include

firm news and announcements, as well as news headlines, program tips, a scheduler/calendar

and various webinars, seminars and options in the Learning Center.

Accounting Relief AC opens within a separate window from the AOO desktop,

initially displaying a client selection screen that includes search and filtering

functions. After selecting a company in which to work, the Activity Center opens

and provides an exceptional dashboard view of various key business indicators.

The data shown can be customized to include cash balance, financial summaries,

pending/overdue AR and AP, unprinted checks, and even expenses analysis and

sales comparisons with full-color charts and graphs that are automatically updated

by the system. An icon navigation menu at the top provides easy access to Transactions,

Adjustments, GL, Trial Balance, Journals, Financials, Bank Reconciliation and

a transaction search tool. A text link menu provides additional methods of getting

around the system, allowing users to jump to screens for Company, Banking, Customers,

Vendors, Trial Balance, Utilities, Reports and Financials.

Data-entry tasks are simple, with selection lists for choosing accounts and

other data, along with simple creation of adjustments, whether normal, reversing

or recurring. Bank reconciliation functions are very easy to use, providing

a dual view of the client check register and the bank statement, with simple

check-off boxes, while balances are displayed and constantly updated.

REPORTING & FINANCIAL STATEMENTS — 5 Stars

Accounting Relief AC includes a great selection of customizable financials (balance

sheets, income statements, cash flow, retained earnings) and trial balance reports,

as well as engagement workpapers, leadsheets and cover letters for compilations,

reviews and audits. It also has analysis and review tools, includes 30 financial

ratios and can perform industry comparisons. The program has a built-in editing

system, but also enables the generation of reports and financials into Excel,

PDF and *.RTF formats.

INTEGRATION, IMPORT/EXPORT — 5 Stars

Accounting Relief AC is truly a unified accounting system that gets rid of the

need to import, transfer or bridge client data into the system — the data

is already there because the client is using a different arm of the same base

program. For those clients who aren’t on the system, however, it can import

from QuickBooks and other programs that can export to common file formats. Accounting

Relief AC can also export financials and write-up data to spreadsheets, Excel,

*.RTF and ASCII files, and can export to most professional tax preparation systems,

including Lacerte, ProSeries, UltraTax CS and ProSystem fx Tax.

SUPPORT, TRAINING & HELP SYSTEM — 5 Stars

Acounting Relief AC includes good built-in support functions, as well as links

from the Accountant’s Office Online desktop to online training webinars,

tutorials and other educational resources. The vendor includes tech support

with program pricing.

RELATIVE VALUE — 5 Stars

Accounting Relief AC is an outstanding innovation in the way professional accountants

interact with their clients for write-up functions. With both sides using the

same online program (with very different interfaces and access rights), the

data is always in the hands of the accountant, where it belongs. The online

nature of the program also provides great collaboration tools. The system is

perfectly geared toward firms who can get their small business clients to use

the system, too. Larger and more complex clients will still need to have data

transferred in, but for small clients (who are more likely to make many more

mistakes, anyway), putting more control back into the hands of their accountant

is brilliant!

2007 Overall Rating: 5 Stars

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs