– Automatic calculation of earnings. payroll taxes (federal and state), and deductions

– Prints checks, create tax deposit payments

– Prints W2 and 1099/1098 forms at year end

– Fill and print federal and state reports (generic format)

– Standard and Customizable Reports: Payroll Journal, Check Register

– Number of companies allowed: 6

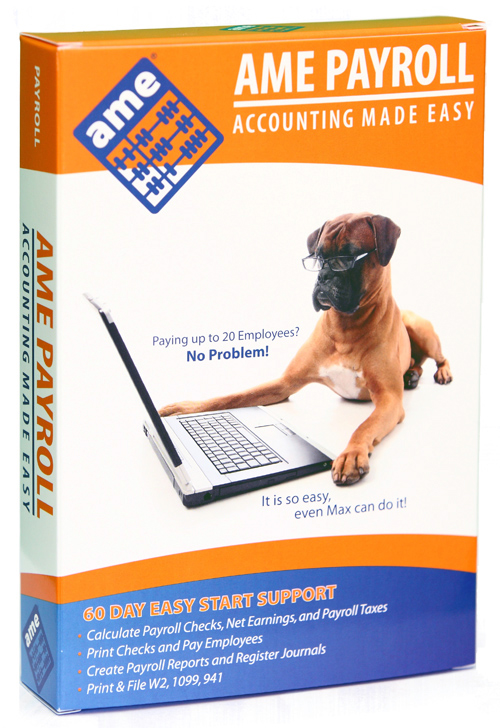

– Create payroll for up to 20 employees

– Create Direct Deposit file and e-file W2/1099 (optional add-ons)

– Backup/Restore utilities, Password protected data, online updates

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs