888-999-1366

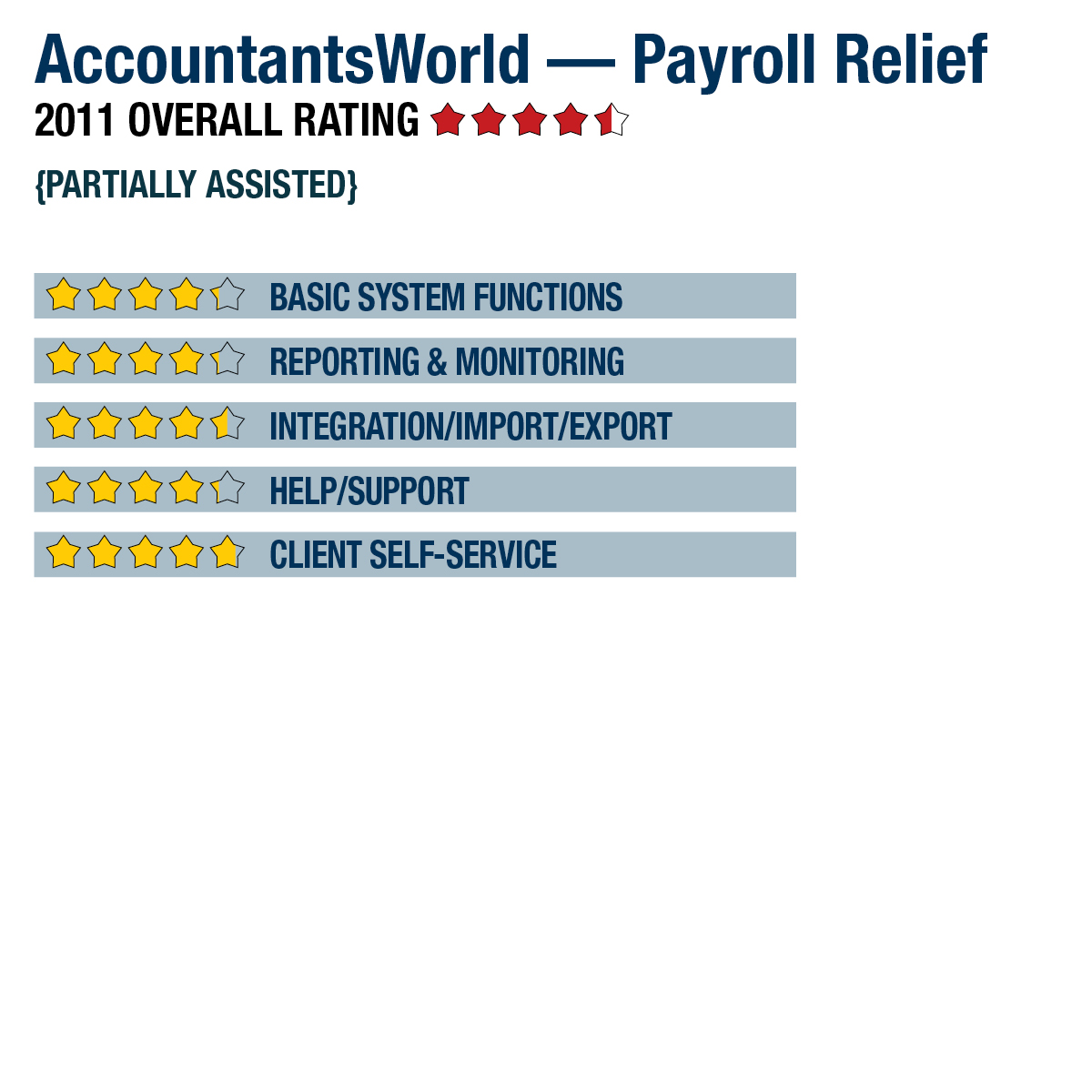

2011 Overall Rating 4.5

Best Fit

Any accounting firm that wants to offer payroll services directly to their clients. This cloud-based payroll service is private-labeled and can be configured to meet the needs of different clients. It is also a good fit for firms that would like to work with a web-based suite of tax & accounting firm tools.

Strengths

-

The product is all-inclusive with features such as direct deposit, federal & state electronic filing, & employee self-service portals at no additional charge.

-

Client-facing websites can be rebranded to show the Firm’s logo, as well as client company logo.

-

Control of tax filing & paying process, as well as the multi-client dashboard, protect the accountant & client against errors with tax payments.

-

Strong integration with the AccountantsWorld suite of applications.

Possible Limitations

-

AccountantsWorld only sells to practicing accountants, and does not offer a direct sales model where an accountant is not involved in a sale.

Summary & Pricing

AccountantsWorld prides itself in partnering with accounting professionals to offer payroll services through Payroll Relief. The product is specifically designed with accounting professionals in mind and offers features to aid firm profitability. First year pricing for accounting firms is set at a base price of $997 and includes the ability to process an unlimited number of payrolls. Subsequent years are dependent upon the number of payroll runs or paychecks that are processed on an annual basis. A firm processing 10 paychecks or less for a weekly payroll frequency starts at $5.95 per payroll. A per paycheck option is more beneficial for firms processing 1,500 or more paychecks annually, with 25,000 or more paychecks priced as low as $0.50 per paycheck.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4.25

Reporting & Monitoring 4.25

Integration/Import/Export 4.5

Help/Support 4.25

Client Self-Service Features 4.75

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs