800-Call ADP (225-5237)

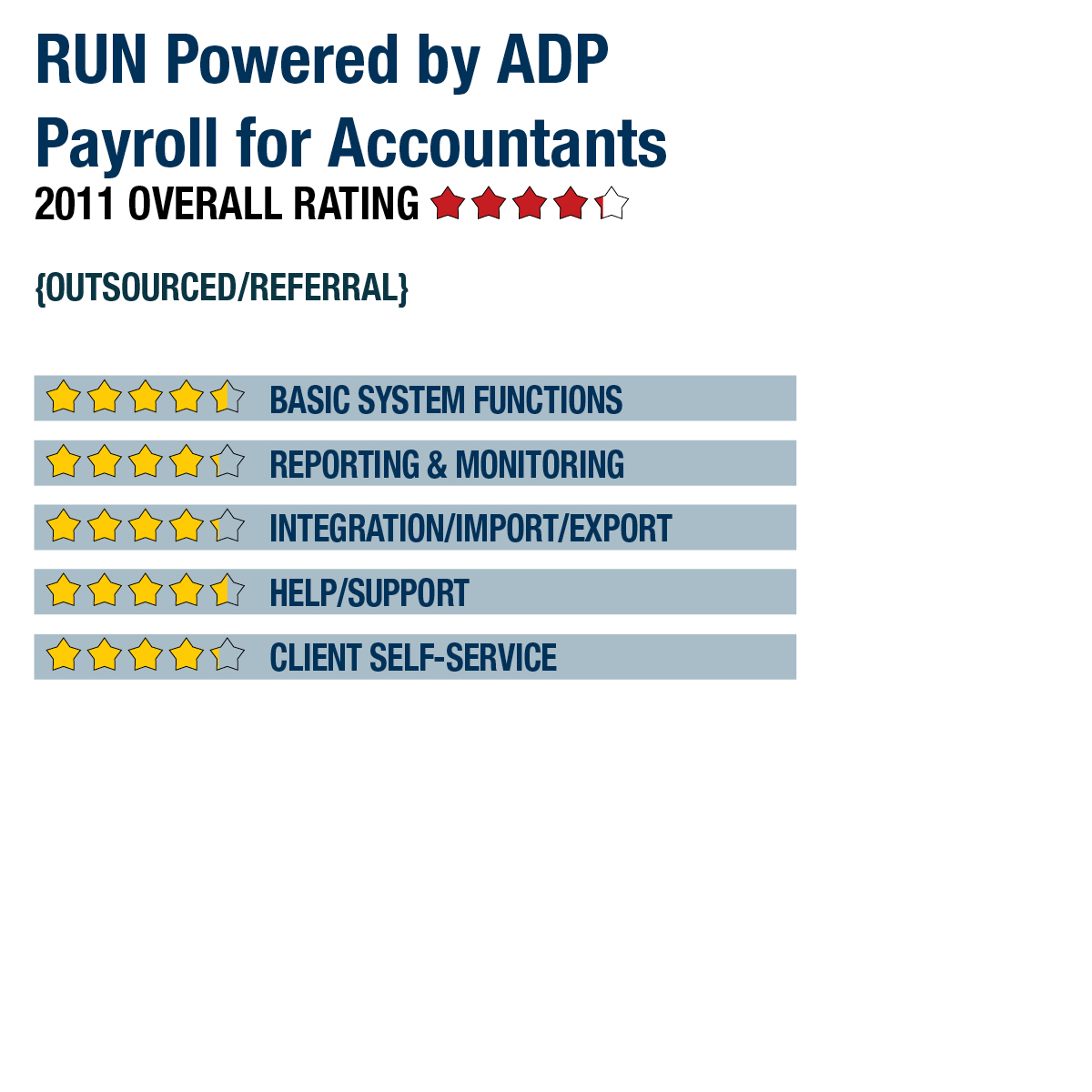

2011 Overall Rating 4.25

Best Fit

Firms who manage payroll and compliance needs for multiple client businesses, but who prefer most compliance work to be outsourced. It’s also a good fit for professionals who want to provide human resource tools and workers’ compensation premium payment solutions.

Strengths

- Available in full-service or do-it-yourself versions.

- Mobile app allows nearly full access to all program features, including processing payroll and viewing reports (currently not available in Accountants version).

- Offers add-on human resource and associated services.

- With full-service model, payment of all federal, state and local payroll tax liabilities and reporting are performed by ADP®. If ADP makes an error, it will pay the resulting fines and penalties in accordance with its contract terms.

- GL export function puts data into formats that can be imported by QuickBooks, Sage Peachtree and other accounting packages.

- Allows firms to provide client self-service portals with access to program features and functions, such as data and time entry, reporting, etc.

- Client side of system can be co-branded with the firm’s logo.

Potential Limitations

- Federal & State e-filing not available in Accountants version.

- Limited report customization.

- Employee self-service limited to accessing pay stubs, with no access to W-2s or HR information.

SUMMARY & PRICING

RUN Powered by ADP Payroll for Accountants offers comprehensive federal, state and local payroll management capabilities, with a simplified interface that streamlines and automates most functions. It also gives firms the ability to grant client access to input their own employee data. Different service levels allow firms to decide whether to manage payroll compliance and payment processes or have ADP handle those areas on a client-by-client basis. The system is offered to accountants at a discounted rate and billing is directed to the firm, allowing for markup for the firm’s services. Pricing is based on the number of businesses, how many employees they have, the frequency of payroll runs, and whether or not the payroll tax filing is managed by ADP or the firm. Standard pricing ranges from $22 a month for “do-it-yourself” solutions up to $60 a month, plus a per-employee processing charge, for full-service tax filing solutions. Additional volume pricing discounts are available for full-service tax clients.

Product Delivery Methods

___ On-Premises

_X_ SaaS

___ Hosted by Vendor

Basic System Functions 4.5

Reporting & Monitoring 4.25

Integration/Import/Export 4.25

Help/Support 4.5

Client Self-Service Features 4.25

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs