888-236-9501

www.accountant.intuit.com/payroll

Best Fit

Accounting professionals who do client bookkeeping/write-up or payroll preparation in QuickBooks for Windows, as well as those who need support for payroll integration with job costing in QuickBooks.

Strengths

- Tightly integrated with the Windows version of QuickBooks; however, there is no support for QuickBooks Online, QuickBooks for Mac or third-party accounting software other than Excel file import/export.

- Supports after-the-fact payroll & and allows payroll processing for up to 50 companies/EINs for a single price (with significant discounts for ProAdvisors).

- Employee self-service portals included at no additional charge through ViewMyPaycheck.com.

- Excel-based reporting is particularly good for ad hoc reports or reconciling data, but some customizations require PivotTable skills.

- Certified Payroll reporting for government contractors now available.

- Large number of time tracking tools & other add-ons available through the Intuit Marketplace, including an Outlook add-in and mobile solutions.

Potential Limitations

- Service requires local installation of a supported version of QuickBooks for Windows, or the use of a QuickBooks hosting provider.

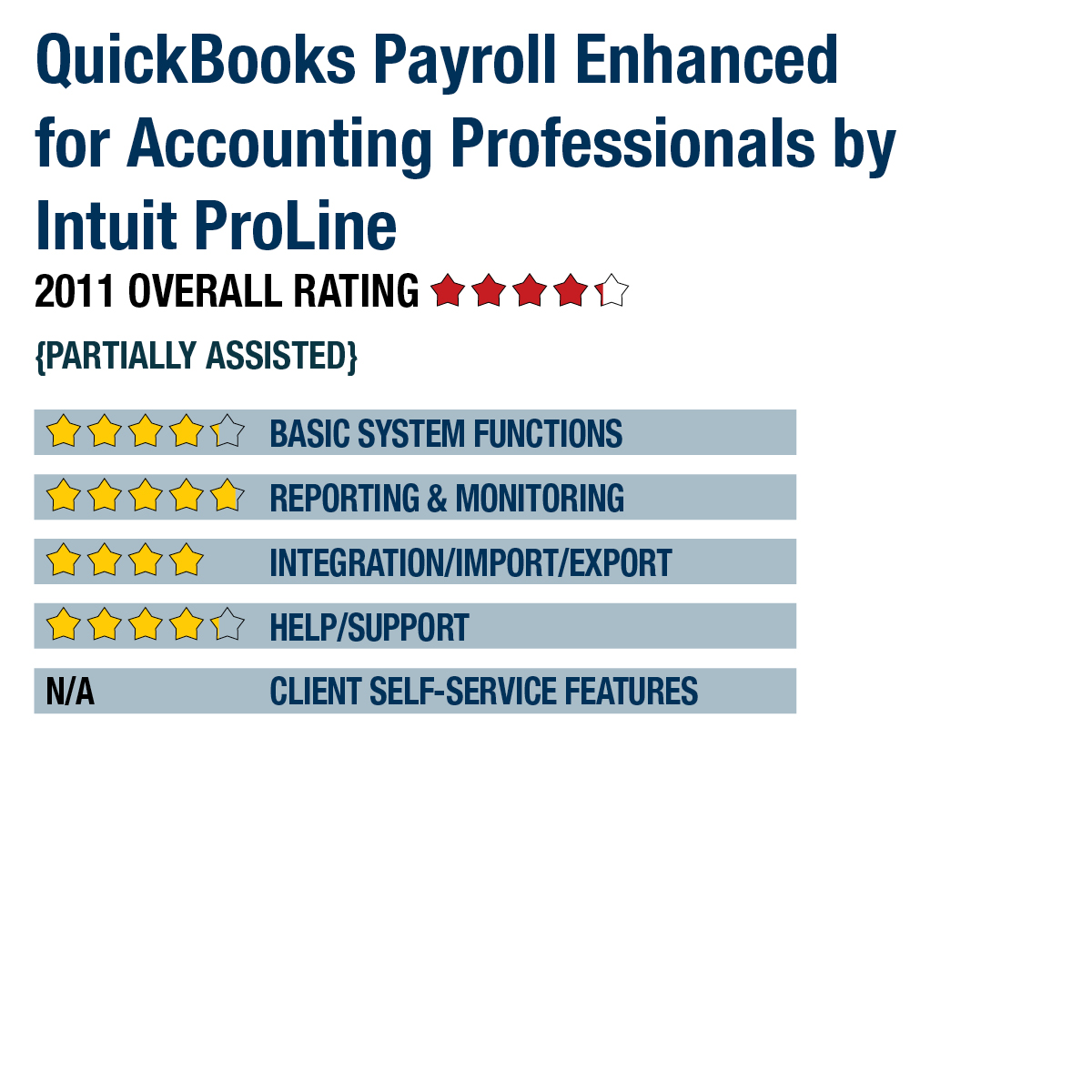

QuickBooks Payroll Enhanced is an on-premises payroll solution from Intuit and directly integrates with QuickBooks accounting software. Intuit provides two tiers of service through QuickBooks Payroll Enhanced: one tier for small businesses and another tier for accounting professionals. Although both products are similar in function, this article will focus on the product tier designed for accounting professionals, QuickBooks Payroll Enhanced for Accountants. This service has a number of features designed to assist accounting professionals who manage payroll for their clients and has a strong after-the-fact payroll feature set.

BASIC SYSTEM FUNCTIONS

Intuit QuickBooks Payroll Enhanced for Accountants is designed to work within and directly integrates with the QuickBooks application. The payroll module is integrated into the QuickBooks menu and includes two payroll management dashboards: Employee Center and Payroll Center. The Employee Center allows full management of employees, including adding/removing employees and reviewing history. The Payroll Center is a dashboard showing scheduled payroll related tasks, such as upcoming payroll runs and scheduled liability payments.

The Intuit QuickBooks Payroll Enhanced for Accountants subscription includes payroll processing for up to 50 client EINs. The subscription service is intended for small business employers and is optimized for small to mid-sized businesses with 100 or fewer employees within each client file. Due to direct integration with QuickBooks, job costing and other allocations may be processed with each employee paycheck. Employees may be paid on different payroll schedules with different intervals (e.g. hourly employees paid weekly, salaried employees paid monthly). Direct deposit is available as a per-transaction charge and supports up to two bank and investment accounts. Employees without direct deposit capabilities may be issued a traditional check, or employers may choose to offer a prepaid debit card. The company noted that there are no fees to the employer for setting up or loading money onto the prepaid debit cards through payroll. There are only nominal fees for the employee who uses the card, normally only if the employee uses an ATM to get cash. There are no fees for normal purchases you might make with any Visa. See https://paycard.intuit.com/support/fl_paycard.html for the fee schedule.

A key feature of Intuit QuickBooks Payroll Enhanced for Accountants is the ability to process after-the-fact payroll. Data entry is accomplished through a spreadsheet-style format with each column customizable to match client earnings and deduction items. Previous payroll data may also be automatically carried forward to reduce data entry. After entering appropriate information, QuickBooks will perform adjustments to ensure each net paycheck is correct. Any further adjustments necessary can be made by the accounting professional. 4.25

REPORTING & MONITORING

Intuit QuickBooks Payroll Enhanced for Accountants automatically populates all forms and related schedules. All federal forms and currently more than 20 state forms may be submitted electronically without additional fees. All forms not submitted electronically are available for paper filing. A new feature available to users of QuickBooks 2011 is the ability to automatically archive all filed quarterly forms. All tax forms are automatically saved to a local or network location and are then accessible at any time as PDF files..

Eight predefined payroll reports show details of payroll expense items and taxes paid or accrued for a given time period. Several other reports may be exported to Excel for further manipulation and analysis. The Excel-based reports include a Certified Payroll Report for government contractors, and tax form worksheets. A sophisticated pivot table report with most payroll and HR information is included, and can be modified to meet most custom reporting needs. Custom reports can be built based on existing reports from within QuickBooks, and can be “memorized” or saved. Compliance and due date monitoring is available through the Payroll Center feature within QuickBooks. The Payroll Center has a dashboard view of upcoming payroll runs for the current company, a schedule of liability payments, and lists upcoming tax form due dates. 4.75

INTEGRATION/IMPORT & EXPORT

Intuit QuickBooks Payroll Enhanced for Accountants is designed specifically for integration with QuickBooks software. The integration runs throughout QuickBooks and ties directly to each individual module. Intuit requires payroll service subscribers to have a relatively current version of QuickBooks. Currently, users will need to be using QuickBooks Pro/Premier 2009 or greater. Employee time information can be entered through the timekeeping functions within QuickBooks or through a third-party add-on available in the Intuit Marketplace. QuickBooks allows importing and exporting of Excel files for integration with other products. Any year-to-date payroll processed outside of QuickBooks is unable to be imported and will need to be manually entered. 4

HELP & SUPPORT

Since the payroll service is fully contained within QuickBooks, the Help and support options are provided through the native QuickBooks product support options. Once subscribers activate their service, payroll-specific support is offered through the Payroll Center feature within QuickBooks. This section features several how-to guides, tax and online resources, and a direct link to the online community knowledgebase, which allows for peer-to-peer assistance. Support is also available through live chat and U.S.-based phone support during weekday operational hours. 4.25

CLIENT SELF-SERVICE FEATURES

Intuit QuickBooks Payroll Enhanced for Accountants includes an employee portal through the subsidiary website, ViewMyPaycheck.com. After each payroll run, users are prompted to upload the appropriate data to the subsidiary website. Through ViewMyPaycheck.com, employees may access current and previous pay stubs, vacation and other time off accruals, and annual reporting documents. At this time, the portal is read-only and does not offer any timekeeping entry by employees. This service is included at no charge with the payroll subscription. N/A

SUMMARY & PRICING

Intuit QuickBooks Payroll Enhanced for Accountants is a solid payroll solution for accounting professionals who manage client bookkeeping and payroll within QuickBooks. The service offering may be custom tailored to fit the service level desired for each client, allowing full or specific access to some clients and read-only access to others. Pricing is currently set at $374 per year and includes payroll capabilities for up to 50 client EINs. The payroll service may also be bundled with the Intuit ProAdvisor membership at a discounted rate. Pricing for direct deposit transactions are set at $1.25 per pay period and is only charged for those employees paid by direct deposit.

2011 Overall Rating 4.25

Product Delivery Methods

_X_ On-Premises

___ SaaS

_X_ Hosted by Vendor

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs