800-968-8900

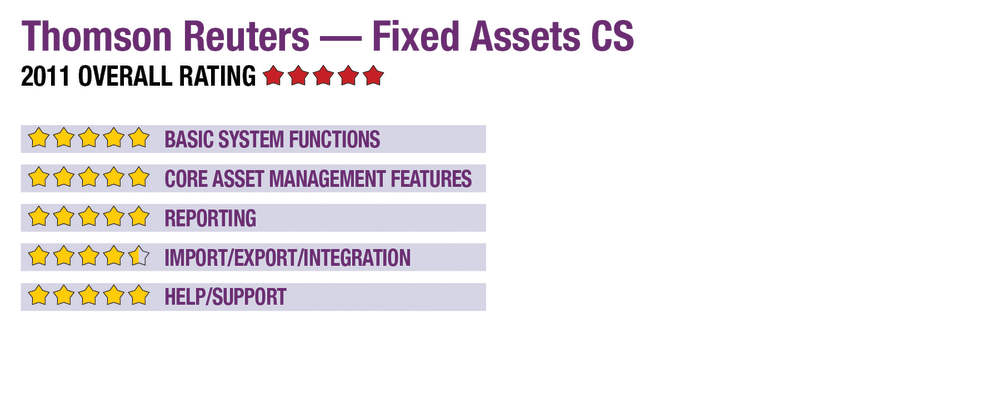

2011 Overall Rating 5

Best Fit

Firms serving multiple clients with moderate to complex asset bases and depreciation needs, particularly those firms using other programs in the CS Professional Suite.

Strengths

- Mass edits across groups, departments & global

- User-friendly wizards for many tasks

- Simplified splits, disposals & consolidations

- Good user customization

- Tight integration with tax & trial balance

Potential Limitations

- Not unlimited on assets or entities, but more than sufficient for most needs

Summary & Pricing

Fixed Assets CS offers a streamlined and intuitive asset management solution that can be used to manage virtually all asset and entity types, with extensive calculations and support for multiple books per client. The system is best suited to firms using other parts of the CS Professional Suite, particularly UltraTax CS, Trial Balance CS and Accounting CS, providing excellent integration and data sharing. Pricing starts at about $1,500 with renewals at about $300.

Product Delivery Methods

_X_ On-Premises

_X_ SaaS

_X_ Hosted by Vendor

Basic System Functions 5

Core Asset Management Features 5

Reporting 5

Import/Export/Integration 4.5

Help/Support 5

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs