(Note from Isaac: If this is too short, I can provide a portal image.)

As I evaluate the previous tax season, I honestly feel that it was one of the best ever for my firm—despite a few curve balls like the IRS allowing brokerage firms to delay delivery of 1099’s for nearly a month (talk about workload compression). What made all the difference this year is having a highly efficient, standardized tax workflow process in place.

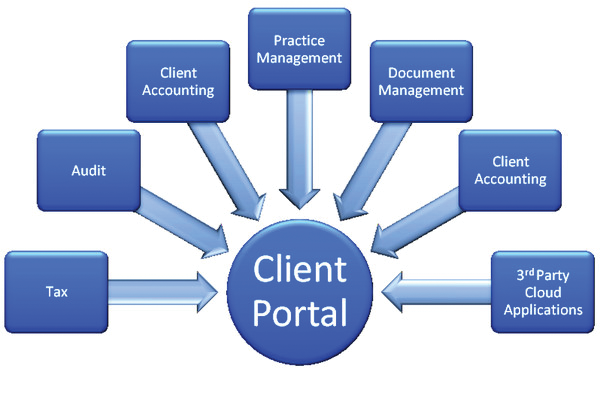

With all the challenges that inevitably arise during busy season, it is important that firms have an efficient and uniform tax workflow in place. The curve balls are out of our control…our internal work processes are not. A core element of my firm’s tax workflow is portals. However, portals are not a stand-alone solution, but rather are an integrated part of the overall process.

So, how do portals make the tax workflow more efficient? First, they must be part of a larger, standardized process. It’s also critical that you educate your clients on the value of portals to ensure appropriate and regular use on the client side. Consider an example from my firm.

Starting on January 5th, my firm delivered 91% of client organizers electronically via client portals. In conjunction with organizer delivery, we also sent a thoughtful and well designed communication to all clients, explaining how to access their portal and complete their organizer. Within this communication, we also highlighted the value propositions of using portals (convenience, 24/7 access, ease of use, etc.) and encouraged clients to scan and upload source documents electronically to the portal for a completely paperless process.

The results were great. About 25% of clients scanned and uploaded source documents to their portals, and the remaining 75% dropped documents off at our office. Internally, we used an advanced scan and organize workflow tool to quickly compile paper documents in digital format prior to preparation. We then transferred electronic data to our tax preparation software for processing and review—which allowed us to perform all work on-screen through to e-filing the return.

To finalize, our practice management solution notified administrative staff to send a copy of the return and a bookmarked PDF of the client’s source documents to clients via their secure portal. Administrative staff was also alerted to send clients a notification email that the return was ready for review and signature. The client invoice was attached within this email. Finally, we provided clients with the ability pay invoices electronically through our website or to send a check. Once we receive the completed e-file forms, they were submitted and the process was complete.

Compared to our old manual process of distributing paper organizers, printing client copies of returns, processing paper copies (often times having to reprint), and waiting for clients to pick up return copies and return signed e-file forms to us, our new process is far more efficient. And portals are an invaluable component!

The use of portals is instrumental in serving today’s clients more effectively. It’s my opinion that if you select a good portal solution (one that integrates well your current applications and website) and you educate staff and clients on proper use you will clearly see that the proof is in the portal!

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Cloud Technology, Software