Bill.com, provider of integrated bill payment, invoicing and cash management solutions, announced the launch of the latest feature for their Cash Flow Command and Control system today.

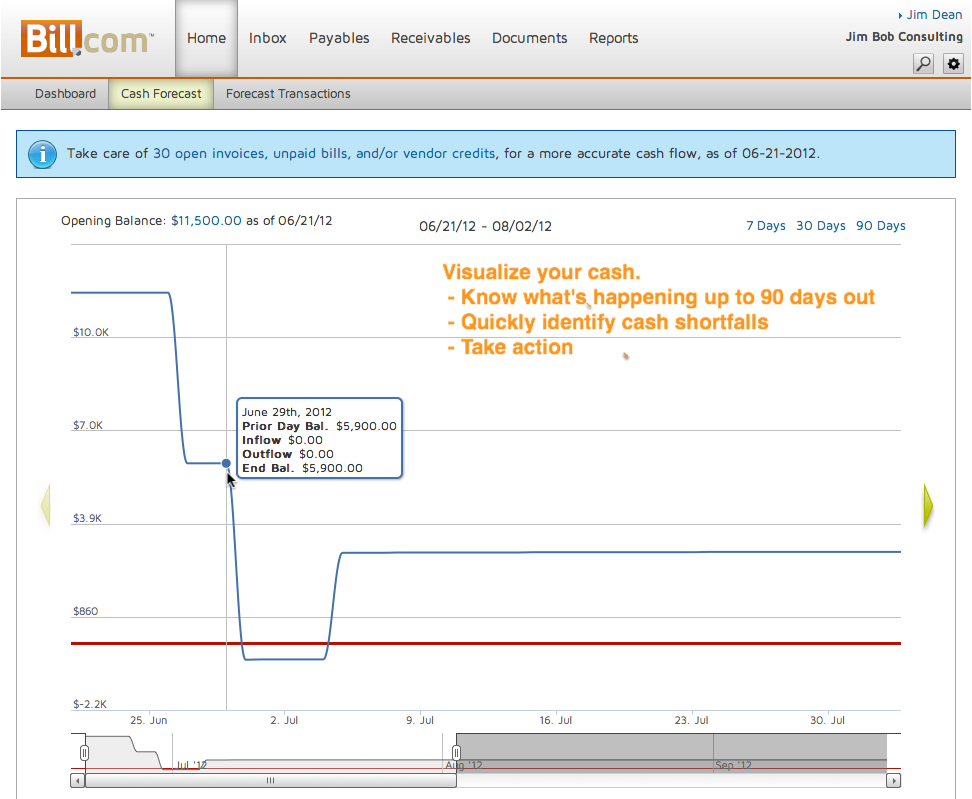

Bill.com’s new cash management feature gives customers a complete look at their cash flow and control over their cash forecasting. With the Cash Flow Command and Control System, firms now have a better view of cash flow cycles with the ability to manage accounts payable and accounts receivables using one cloud-based solution. Bill.com’s solution connects to users’ banks, allowing for more efficient management of transactions.

“Our new cash flow management is changing the game in how businesses make financial decisions by arming them with streamlined, clear data rather than complicated, cumbersome spreadsheets,” said René Lacerte, founder and CEO of Bill.com. “As our beta users’ success has shown, real-time cash flow management helps businesses not just control their bottom line, but make the investments and decisions needed to manage and grow their businesses as aggressively and easily as possible.”

The new Cash Flow Command and Control System offers a more streamlined workflow and automatically collects data from users’ financial institutions and accounting systems. With a comprehensive view of their cash flow, professionals are able to identify potential issues, like late invoices, and take the appropriate action. Bill.com’s cash flow system also automatically enters accounts payable and accounts receivable information, adjusting the cash flow forecast to reflect the expected date of payment. Users will also receive alerts if the cash view not been updated recently.

The new system also allows users to drill down into invoices, bills, contracts and notes when forecasting and create various “what-if” scenarios. The system lets users move transactions across accounts and create charts and tables using the forecasted scenario data. Information that is managed in other systems can be easily entered into the forecast. Users can also send reminders to clients for payments due.

This latest feature has been a “long time coming” as Bill.com has strived from the beginning to give customers the right tools to drill down accurately into their cash flow, says Lacerte. Being able to know his company’s cash flow position at all times is very important for Mac Frampton who is the co-owner, CFO and artist of Alkahest Artists and Attractions. Frampton’s concert business books and tracks 40 artists as they perform countrywide and requires that he keeps accurate records of client payments, which was difficult with Frampton’s previous cash flow management process.

“Before Bill.com, there was a lot of human error involved in my books so cash flow was hard to track. Bill.com’s cash flow system has given me immediate precision control over my cash flow. It has been miraculous,” said Frampton. “Not only do I have far superior knowledge of when I have enough money to make investments and when I need to tighten my belt, I can do this from my mobile device in real time, which is essential for someone who travels as much as I do.”

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs