The U.S. debt is weighing on business owners as they consider adding workers and making other investments, according to a new survey by Sageworks, a financial information company. In the survey, accounting and banking professionals were asked how the national debt affects businesses’ hiring and investment plans.

In Light of National Debt, Business Owners Less Likely To Hire, Less Likely to Invest

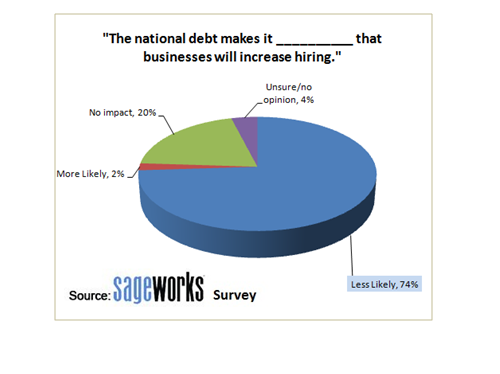

Among those surveyed, 74 percent said the national debt would make it “less likely” that businesses would increase hiring. Twenty percent said the debt has no impact on hiring plans, while two percent said the debt makes it more likely that businesses will increase hiring.

Sageworks CEO Brian Hamilton explained that this reaction from business owners is natural. “Businesses understand that the national debt is bound to result eventually in an increase in the cost of their own borrowing,” Hamilton said. “Why would they want to take on additional employees, equipment and infrastructure on our current debt load?”

Nearly three quarters, or 73 percent, of respondents also said the national debt would make it “less likely” for business owners to boost other investments in their company. About 1 in 6 respondents said the debt has no impact on businesses’ investment plans.

Sageworks Chief Operating Officer Nicole Wolfgang explained that smaller businesses, in particular, may be sensitive to concerns about the national debt because they may lack the rainy-day resources and cash reserves that a larger company may have available to ride out tough times. “It’s more of a general unease or a subtle sense that you want to be careful,” Wolfgang said. “You’re not quite sure what’s coming at you.”

Additionally, only 13 percent of respondents thought that their business clients would increase hiring in 2013, while 55 percent expected businesses to maintain their number of employees. The national debt coupled with a slowdown in private company sales growth seems to have created an uncertain hiring environment in 2013: “If companies weren’t hiring when sales growth was strong,” Hamilton asked, “what will they do now that sales are slowing down?”

Sageworks conducted the online survey between October 23rd and October 29th, collecting 150 responses from financial professionals. The poll’s respondents were all Sageworks customers who volunteered to answer the survey and were not randomly selected.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Small Business, Staffing