Approximately 74 percent of U.S. small business owners that use an outside accountant do so to receive assistance with understanding the complex tax regulations and code surrounding their business, according to the latest Sage Accountants Usage Study. The study, which looks at how small businesses use accountant services, was conducted among 373 small businesses in the U.S. and 300 in Canada.

Understanding and managing taxes continues to be a top concern for small businesses. In February 2012, the Sage Small Business Sentiment Survey found that 49 percent of SMBs listed high taxes as one of the top three issues that could potentially hinder growth and 43 percent listed too many regulations as a potential factor. As many businesses gear up for the changes in tax codes and regulations due to provisions of the Affordable Care Act going into effect in 2014, understanding the changes and staying compliant will continue to be main concerns. This will lead many to either start or continue working with an outside accountant.

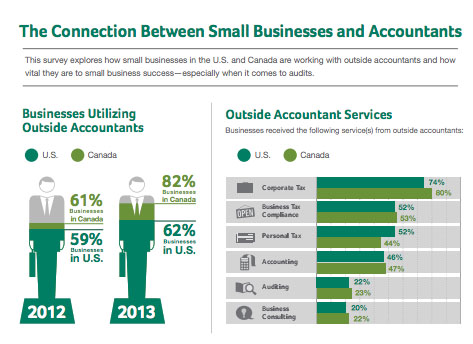

According to the survey, 74 percent of U.S. SMBs already receive corporate tax services from an outside accountant, with 52 percent receiving business tax compliance services. In addition, 62 percent of SMB owners maintain an active relationship with their accounting, regularly utilizing their services. This is up from 60 percent last year.

In addition to the survey, Sage also released an infographic and video featuring Jennifer Warawa, Sage VP of partner programs and channel sales, which share other findings of the survey, as well as the importance of using an outside accountant as a business consultant. Sage provides business management software and services for small and mid-sized businesses.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Small Business