The Affordable Care Act, aka ObamaCare, is decreasing the likelihood that businesses will hire new employees, according to a new survey by Sageworks, a financial information company.

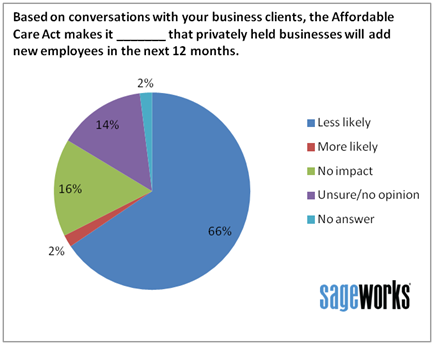

Sageworks surveyed 300 accounting professionals who work closely with these firms and found that 66 percent expect the new health care changes will make it less likely that businesses will add new employees in the next year. Sixteen percent said it would have “no impact,” and 14 percent of respondents said they were “unsure” about the ultimate impact. Only 2 percent said the Act makes it “more likely” that businesses will add new employees.

Recent data from Sageworks shows that privately held companies have been generating average annual sales growth of about 10 percent as of May 31. The average private company had a 6.6 percent net profit margin, based on financial statements from the six months ended May 31, compared with 4.5 percent a year earlier.

“Private companies are performing well, but they’re simply not hiring with the same volume and consistency that we’d expect from them at this point in the economic recovery,” noted Sageworks Chairman Brian Hamilton.

“The recent delay in the implementation of the Affordable Care Act, and the uncertainty that accompanies such a delay, won’t help the employment situation,” Hamilton added. “Private businesses are trying to map out their hiring and investment plans for the next twelve months, and a last minute delay like this will increase the likelihood that companies remain on the fence about hiring.”

Separately, Sageworks asked more generally about the hiring picture for CPAs’ business clients, and the outlook seems less optimistic than it was in March. More than 60 percent of respondents in the latest survey said that businesses are planning to maintain their current number of employees over the next 12 months.

Thirteen percent said that, based on conversations with their business clients, they expect companies will increase their number of employees in the next year. Twelve percent predict companies will reduce their number of employees, and 12 percent said they are unsure about their business clients’ hiring plans.

A similar survey of CPAs in March by Sageworks found that 50 percent expected staffing levels to remain largely unchanged; 20 percent expected staffing increases and 6.5 percent predicted staffing reductions over the coming 12 months.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs

Tags: Accounting, Benefits, Legislation, Small Business, Staffing