Consider the lesson for accounting firms that may be gleaned from Facebook’s announced acquisition of WhatsApp.

There is no shortage of insight and confusion surrounding the acquisition of the WhatsApp messaging application by Facebook for $4 billion in cash and up to $15 billion in stock. Some pundits claim the deal is yet another sign of impending stock market doom, as the “tech bubble” readies to burst for the third time in our lifetimes. Others see it as a bold move by Facebook to compete in the lucrative telecom messaging industry, bringing a valuable new level of service to the company's 450 million users.

The truth is that it is neither of these; it is a last-ditch effort to revitalize the product and extend its life cycle as Facebook itself moves past maturity and into decline. Consider a few random thoughts regarding the swirling speculation about Facebook's motives:

- This is not a deal for $19 billion. It is a deal for $4 billion in cash and 15 billion pieces of paper called Facebook shares, which could be worth less than cocktail napkins by this time next year.

- At this level, the deal is hardly outrageous — Facebook has the cash, and the price is not terribly out of line with similar acquisitions in the crazy environment of the new digital economy. There have been larger deals, and will be again before this year is out.

- It has virtually nothing to do with a move by Facebook into telecomm messaging services.

It has everything to do with the life cycle.

Every product line (or service, or industry) begins at introduction, when a handful of early adopters begin to use it. This stage requires a lot of investment with little profitability. If the product survives this stage – and most do not – sales and profits begin to pick up as the product grows in popularity and use. The product becomes self-sustaining as it enters maturity. Throwing off cash and profits, the product line that survives this long becomes financially successful, but is now beset by competitors and new technologies that must ultimately push it toward the end of its useful life – the decline stage. The product dies or is acquired by someone else.

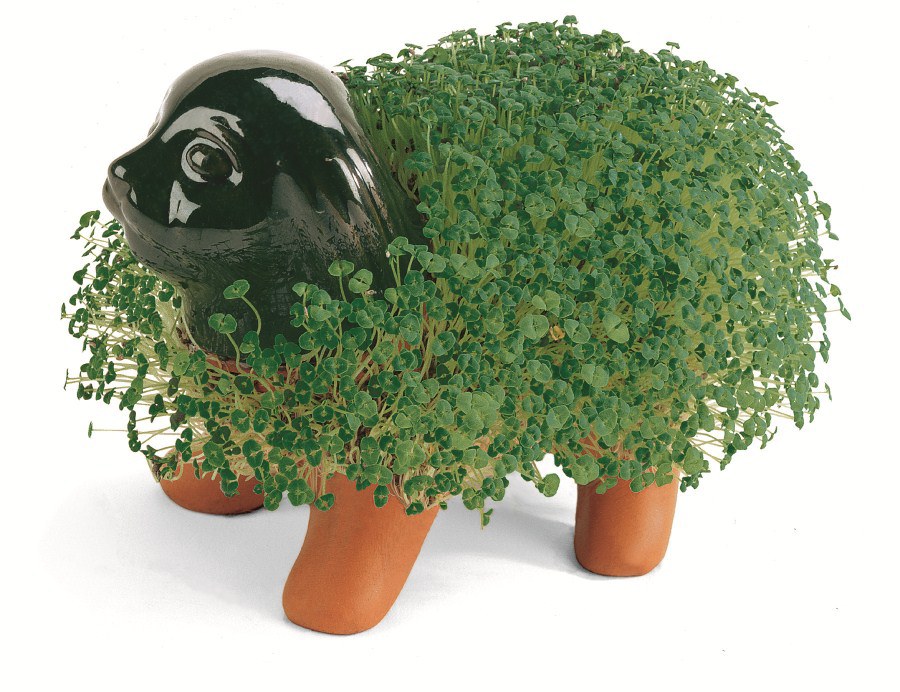

The entire life cycle can last for hundreds of years (think of a product like the simple clothes pin, which has been around in its present form since 1853). Or be as short as the life span of the chia pet, which was something on the order of 10 months back in 1982. The point is that every product has one, and this life cycle dictates many of the management decisions that must be made in order to deem the product successful at the end. If the company has only one major product, the company itself follows the same cycle.

Unless.

There is one brief window, as the company slides toward the end, when management can leverage the assets it has built over the life cycle to move the product or company back up the curve and into the growth stage again. Microsoft did it when DOS was dying, with the introduction of Windows. Apple did it with the iPad and iPhone. Google is constantly re-inventing itself with new applications and products, as when Google Earth and Street View re-vitalized the Google Maps product line.

Facebook has been in a dilemma throughout 2013. Its management team woke on the morning after its successful public offering to discover that all living things die, including really cool companies. At the time it went public, the public utterances would have had you believe the company was still in the early growth stage, when in fact it was already tipping into decline. The year since has been marked with declining use rates, low click-through rates on its advertising, falling stock values, and a since that the fickle young audience it attracts are moving to Pinterest and elsewhere.

Among tech pundits who slept through their management and marketing courses, this seems the harbinger of doom, though it is not. Enter the WhatsApp acquisition, which is Facebook CEO Mark Zuckerberg's effort to revitalize the line. Noting that the young are his target audience, and that people in that age bracket use messaging applications, he’s acquired a new and shiny bauble to attract new users to the fold.

Not in the US market. If anyone is still paying for a text/image messaging service in the US, they are not paying attention. The days of metered messaging ended years ago. But overseas, in countries where competition is stifled by government telecom monopolies. Places like China. The acquisition is a straight play to revitalize the company, attract a new generation of users and push both revenues and profits to more sustainable levels.

Will it work? The addition of a spring brought a host of new applications and life to the modest clothes pin. The introduction of the Obama Chia Pet has not done much for that product.

For accounting firms, though, the acquisition and the concept of the product life cycle carry critical lessons in management that fall into four categories:

- Accounting services have a product life cycle of their own, and part of the strategic planning process for a successful firm will be to assess what stage of the life cycle each major service line in is. If the answer is “Maturity tipping toward Decline,” management has best consider how to divest or re-vitalize that service. Combining the life stage analyses for all of the service lines likewise will give the partners an estimate of the life cycle of the firm overall.

- The move toward SaaS, cloud-based services was an effort by the industry to re-vitalize whole segments of accounting services through technology – bookkeeping, payroll, tax preparation, and even audit services. As a rough rule of thumb, any accounting service that is not moving to the cloud is likely in the Decline stage – engagement software is one category that comes to mind.

- The ability to interact with clients on an anytime/anywhere basis may be seen by some as an extension of cloud computing, but is in fact a revitalization move in itself. By increasing the convenience and security of interactions for the client, the accounting firm is providing a new, value-added service to help justify future growth and profitability. Any accounting firm that has not or is not adopting these services has automatically declared itself to be in Decline.

- Mergers and acquisitions in the accounting space must be as carefully assessed as the acquisition of a major new communications platform was for Facebook. Merging two firms in Decline will simply create a larger firm that is in Decline. It will be necessary to consider who the merger or acquisition can be used to leverage the assets of the two to create a re-vitalized new accounting firm.

The fundamental question: Is your accounting firm a Chia pet? And, if so, what is the best strategy to turn it into a clothes pin?

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs