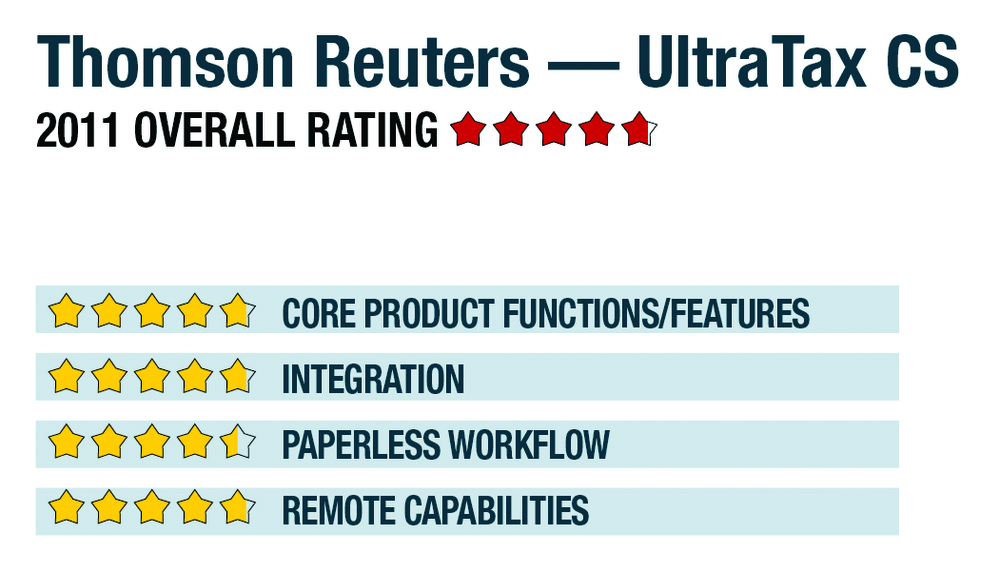

OVERALL RATING 4.75

800-968-8900

CS.ThomsonReuters.com

Product delivery methods:

__x___ On-Premises

_____ SaaS

__x___ Hosted by Vendor

BEST FIRM FIT:

Small to mid-sized firms that need advanced workflow functionality. Excellent fit for most full-service tax and accounting firms.

STRENGTHS:

- Integration with other Thomson Reuters CS Suite products, as well as the CheckPoint research suite & many write-up applications

- Hosted & leased versions available as part of Virtual Office CS

- Barcode scanning imports information from W-2s & K-1s for lower complexity returns while supporting complex features requiring manual entry like K-1s with special allocations at the same time

- New for 2010, UltraTax can automatically e-mail clients when returns are accepted for e-filing with tax authorities

- Highest electronic filing acceptance rates for 2008 & 2009 tax years of all products reviewed

POTENTIAL LIMITATIONS:

- Scan & organize tools in the Thomson Reuters suite require users to also license FileCabinet CS or GoFileRoom

- Limited support for multi-office firms without using Virtual Office or Citrix/Terminal Services.

EXECUTIVE SUMMARY & PRICING:

UltraTax CS is a good fit for tax practices of all sizes and volumes. Several software delivery options are available to users. Users may elect to receive a traditional disc to load on a PC or server, may download the software directly from Thomson Reuters or, as previously noted, select a hosted solution. Pricing for the traditional CD/download-based option starts at $2,375 for unlimited federal 1040 returns. Other federal and state modules are available on a per-return or unlimited basis. The hosted solutions are available through purchase or lease and are available at a set monthly fee.

4.75 – CORE PRODUCT FUNCTIONS/FEATURES

- · Product depth/multi-state

- · Navigation/ease of use

- · Support for special situations

- · Analytical review

- · Electronic filing

4.75 – INTEGRATION

- · w/in publisher’s own suite

- · w/tax research tools & guidance

- · w/other or external programs

- · w/practice management

- · w/external services

4.5 – PAPERLESS WORKFLOW

- · paperless creation

- · paperless open items

- · paperless review

- · access control for limiting access into returns

- · digital document storage/mgmt.

- · data import/output

4.75 – REMOTE CAPABILITIES

- portal

- remotes access

- 1099 depot

- Outsourced document prep

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs